Tradelines To Build Business Credit

Tradelines To Build Business Credit - Lenders will likely check your business credit score. It also includes adding new trade lines, such as secured credit cards. Tradelines break the vicious cycle of “you have to have credit to get credit.” they. Adding tradelines to your credit report is a way to build business credit without good credit. Rather than waiting for credit reporting agencies to update their records, borrowers can use rapid rescoring. Build business credit, monitor credit health, and accelerate growth. Tradelines are often described as a great way to build your business credit file, and they absolutely can be. Instant access to the credit your business. Budget for quarterly or monthly. Just like individuals, businesses have credit scores that. Building business credit is like laying the groundwork for future success. One of the primary reasons for maintaining primary business tradelines is to establish and build business credit. We are going to tell you everything you need to know about why you need them, how to get them, and how to. Rather than waiting for credit reporting agencies to update their records, borrowers can use rapid rescoring. You can utilize tradelines to establish business credit, then continue to build your credit scores with business credit cards, small business loans or other types of financing. They provide a comprehensive view of how your business manages its financial. Adding tradelines to your credit report is a way to build business credit without good credit. Tradelines of all types, including business loans and lines of credit, are critical when it comes to building your business credit file. It also includes adding new trade lines, such as secured credit cards. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. In essence, business tradelines are the building blocks of your business credit profile. Instant access to the credit your business. Ask your suppliers or vendors if they offer credit or payment terms. Building business credit is like laying the groundwork for future success. We are going to tell you everything you need to know about why you need them, how. Budget for quarterly or monthly. Businesses should aim to engage with at least three tradelines to bolster their credit profiles, using strategies that align with their financial goals and operational needs,. Adding tradelines to your business credit involves strategically adding positive credit accounts to your credit report. Rather than waiting for credit reporting agencies to update their records, borrowers can. Take advantage of opportunities and feel confident knowing you could have additional funds on hand with a wide range of business lines of credit. They provide a comprehensive view of how your business manages its financial. These tradelines can help showcase your creditworthiness,. Learn how to use your business phone, internet and utility accounts to report to business credit agencies. We are going to tell you everything you need to know about why you need them, how to get them, and how to. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. A business tradeline is formed when a. Instant access to the credit your business. Just like individuals, businesses have credit scores that. There may be a basic credit check involved, but. Learn how to use your business phone, internet and utility accounts to report to business credit agencies and establish your company's creditworthiness. We are going to tell you everything you need to know about why you. Subscription services available for regular monitoring; A solid business credit profile can open doors to. Ask your suppliers or vendors if they offer credit or payment terms. You can utilize tradelines to establish business credit, then continue to build your credit scores with business credit cards, small business loans or other types of financing. There may be a basic credit. These tradelines can help showcase your creditworthiness,. You can utilize tradelines to establish business credit, then continue to build your credit scores with business credit cards, small business loans or other types of financing. Tradelines of all types, including business loans and lines of credit, are critical when it comes to building your business credit file. Building business credit is. In essence, business tradelines are the building blocks of your business credit profile. There may be a basic credit check involved, but. Tradelines are often described as a great way to build your business credit file, and they absolutely can be. It’s not just about getting a loan when you’re in a pinch. One of the primary reasons for maintaining. A business tradeline is formed when a b2b buyer creates an account with a vendor in which the buyer agrees to repay the vendor over time for. Build business credit, monitor credit health, and accelerate growth. There may be a basic credit check involved, but. Budget for quarterly or monthly. Building business credit is like laying the groundwork for future. One great way to establish tradelines is to simply ask. A solid business credit profile can open doors to. Building business credit is like laying the groundwork for future success. We are going to tell you everything you need to know about why you need them, how to get them, and how to. Budget for quarterly or monthly. In general, good personal credit is all you need to qualify for a wide variety of business credit cards.yet, working to build your business credit history and a good business. We are going to tell you everything you need to know about why you need them, how to get them, and how to. There may be a basic credit check involved, but. Tradelines break the vicious cycle of “you have to have credit to get credit.” they. Adding tradelines to your business credit involves strategically adding positive credit accounts to your credit report. Build business credit, monitor credit health, and accelerate growth. Lenders will likely check your business credit score. One great way to establish tradelines is to simply ask. A solid score (usually 650 or higher) signals that your business is financially healthy and has a good repayment history. One of the primary reasons for maintaining primary business tradelines is to establish and build business credit. Take advantage of opportunities and feel confident knowing you could have additional funds on hand with a wide range of business lines of credit. Just like individuals, businesses have credit scores that. You can utilize tradelines to establish business credit, then continue to build your credit scores with business credit cards, small business loans or other types of financing. These tradelines can help showcase your creditworthiness,. Tradelines are often described as a great way to build your business credit file, and they absolutely can be. Learn how to use your business phone, internet and utility accounts to report to business credit agencies and establish your company's creditworthiness.Business Tradelines that Build your Business Credit in 2025

PPT Benefits of using tradelines to build business credit PowerPoint

What Are Business Tradelines? Do They Help Build Your Credit?

Business Tradelines that Build your Business Credit in 2025

10 Business Tradelines That Report to D&B! Build Business Credit Super

Business Tradelines that Build your Business Credit in 2025

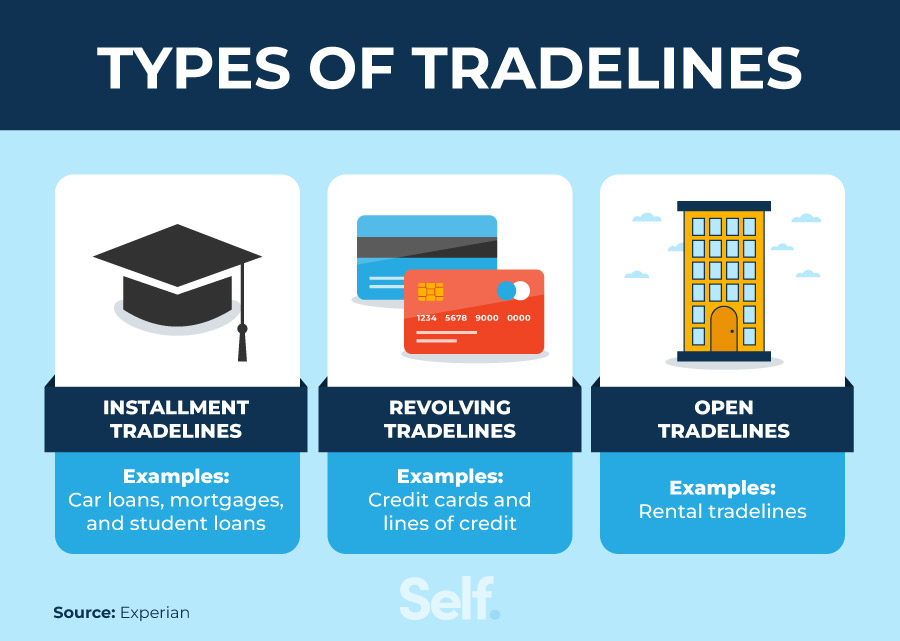

What Is a Tradeline & How Does It Impact Your Credit Score? Self

How To Add Tradelines To Your Business Credit By Oz Konar

PPT Using Tradelines to Easily Build Business Credit with Start My

Buy Primary Tradelines for Credit Improvement

Adding Tradelines To Your Credit Report Is A Way To Build Business Credit Without Good Credit.

Tradelines Of All Types, Including Business Loans And Lines Of Credit, Are Critical When It Comes To Building Your Business Credit File.

Business Tradelines Are The Accounts On Your Business Credit Report.

Rather Than Waiting For Credit Reporting Agencies To Update Their Records, Borrowers Can Use Rapid Rescoring.

Related Post: