Tradelines To Build Personal Credit

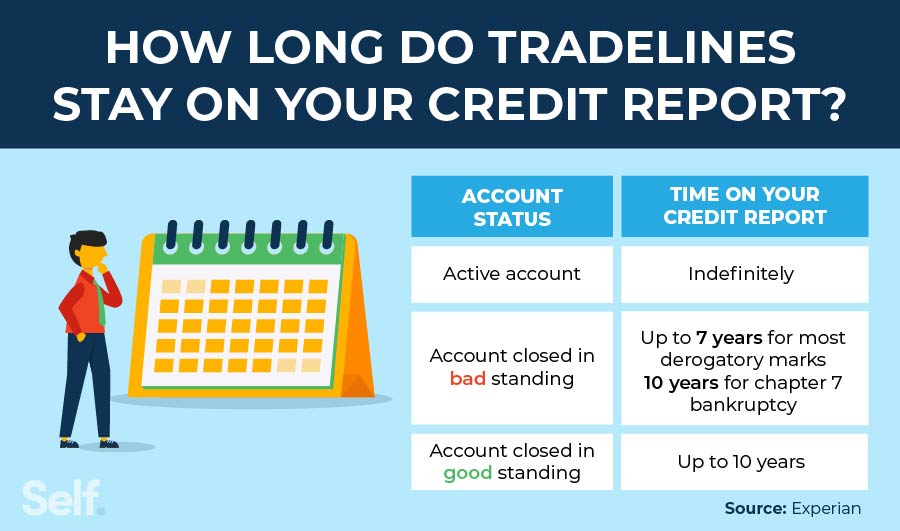

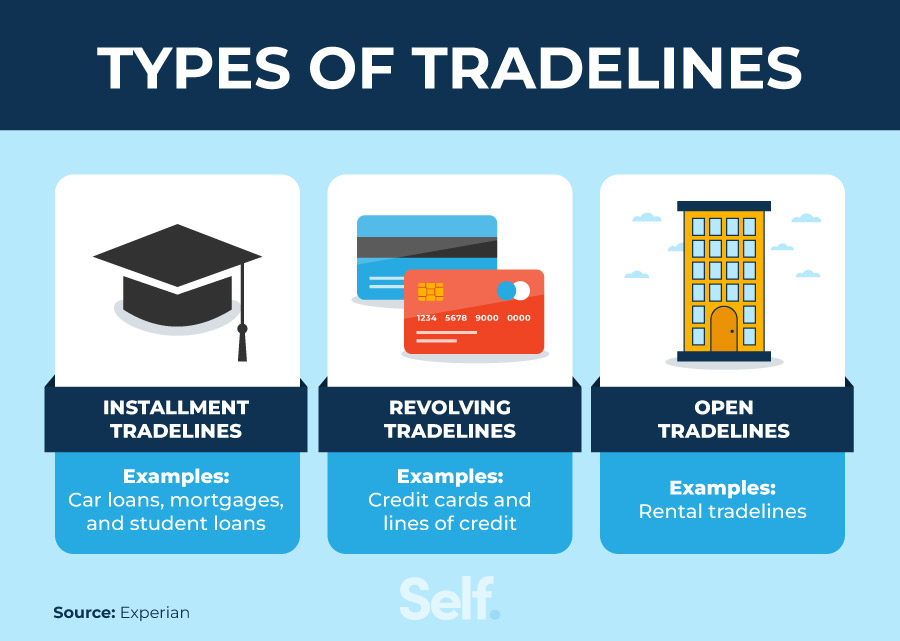

Tradelines To Build Personal Credit - Including tradelines in your credit report helps build a credit profile, allowing potential lenders and creditors to assess your creditworthiness. Key accounts on your credit report, such as credit cards, auto loans, and vendor credit, vital for assessing creditworthiness. These tradelines can include credit cards, auto loans, home loans or student. However, choosing the wrong tradeline can cost you more than just money. Tradelines and the information they send to a credit reporting agency make up your credit score. When you are looking to improve bad credit, credit repair companies are one option, but building good credit on your own is just as easy. These accounts, typically held by lenders or financial institutions,. These accounts include credit cards, loans, and mortgages. Your credit score determines your ability to obtain loans, credit cards, and other. The information consists of the. Buying tradelines is an arrangement where someone pays to be added to someone else’s account (usually a credit card account) as an authorized user. When you are looking to improve bad credit, credit repair companies are one option, but building good credit on your own is just as easy. Here, we’ll break down what a tradeline is and. The information consists of the. Tradelines refer to the accounts listed on your credit report. Grow credit, and experian boost™ provides free tradelines to help you build credit. We’ll also explore related topics like. Tradelines are the records of your credit accounts on your credit report. When it comes to managing your personal finances, having a good credit score is crucial. In 2024, tradelines remain a powerful tool for managing and improving your credit score, but they should be used wisely. Here, we’ll break down what a tradeline is and. Tradelines and the information they send to a credit reporting agency make up your credit score. Over time, many secured cards have transitioned to unsecured credit cards. Credit tradelines are the accounts that appear on your credit report, along with important information about those accounts. Your credit score determines your ability. They include a wealth of information about how you manage credit. Business tradelines can help you build business credit, while personal tradelines can help build personal credit. These tradelines are key to your financial reputation, reflecting your creditworthiness and playing a crucial role in securing everything from personal loans to business financing. By adding positive tradelines, you can give your. Your tradelines show how much you first. This post will detail everything about tradelines, including what. It helps you build a positive credit history. By adding positive tradelines, you can give your credit score an instant boost. Key accounts on your credit report, such as credit cards, auto loans, and vendor credit, vital for assessing creditworthiness. Buying tradelines is an arrangement where someone pays to be added to someone else’s account (usually a credit card account) as an authorized user. Your credit score determines your ability to obtain loans, credit cards, and other. This post will detail everything about tradelines, including what. However, choosing the wrong tradeline can cost you more than just money. We’ll also. Whether you’re building credit from scratch or. These accounts include credit cards, loans, and mortgages. Here, we’ll break down what a tradeline is and. They include a wealth of information about how you manage credit. Credit tradelines are the accounts that appear on your credit report, along with important information about those accounts. However, choosing the wrong tradeline can cost you more than just money. Tradelines refer to the accounts listed on your credit report. Business tradelines can help you build business credit, while personal tradelines can help build personal credit. Credit tradelines, and the information contained in them, are what make up your credit history. When you are looking to improve bad. However, choosing the wrong tradeline can cost you more than just money. Here, we’ll break down what a tradeline is and. Add authorized user tradelines to help improve your credit scores. This comprehensive guide will delve into how to purchase a tradeline, the benefits they offer, and the best tradelines for personal credit. Over time, many secured cards have transitioned. By adding positive tradelines, you can give your credit score an instant boost. This post will detail everything about tradelines, including what. It helps you build a positive credit history. Grow credit, and experian boost™ provides free tradelines to help you build credit. Whether you’re building credit from scratch or. Over time, many secured cards have transitioned to unsecured credit cards. Credit tradelines are the accounts that appear on your credit report, along with important information about those accounts. Your credit score determines your ability to obtain loans, credit cards, and other. Tradelines are credit accounts that appear on your credit report and can positively impact your credit score. The. Add authorized user tradelines to help improve your credit scores. The information consists of the. Tradelines refer to the accounts listed on your credit report. Grow credit, and experian boost™ provides free tradelines to help you build credit. Including tradelines in your credit report helps build a credit profile, allowing potential lenders and creditors to assess your creditworthiness. Tradelines are the records of your credit accounts on your credit report. Business tradelines can help you build business credit, while personal tradelines can help build personal credit. Here, we’ll break down what a tradeline is and. Tradelines and the information they send to a credit reporting agency make up your credit score. These tradelines can include credit cards, auto loans, home loans or student. Key accounts on your credit report, such as credit cards, auto loans, and vendor credit, vital for assessing creditworthiness. Whether you’re building credit from scratch or. When you are looking to improve bad credit, credit repair companies are one option, but building good credit on your own is just as easy. A tradeline is a credit account on your credit report. Add authorized user tradelines to help improve your credit scores. However, choosing the wrong tradeline can cost you more than just money. We’ll also explore related topics like. You can get a free tradeline to build your credit by signing up for experian boost, grow credit, and credit cards with no annual fees. The good news is that you can improve your credit score in several easy ways, including buying a tradeline. Your credit score determines your ability to obtain loans, credit cards, and other. Credit repair services can provide.Credit Expert Can Authorized User Tradelines Be Used to Build Credit

Best Tradelines To Build Credit [2022] Debt Game Over

Personal and Business Tradelines Sovereign Filing Solutions

What are examples of tradelines? Leia aqui What counts as a credit

The Ultimate Guide To Finding The Best Tradelines For Personal Credit

How To Build Your Credit Score With Tradelines

Using Tradelines To Build Credit Blog Boost Credit

What Is a Tradeline & How Does It Impact Your Credit Score? Self

The Ultimate Guide to Tradelines Building Your Personal and Business

Credit Expert Can Authorized User Tradelines Be Used to Build Credit

Including Tradelines In Your Credit Report Helps Build A Credit Profile, Allowing Potential Lenders And Creditors To Assess Your Creditworthiness.

By Adding Positive Tradelines, You Can Give Your Credit Score An Instant Boost.

This Comprehensive Guide Will Delve Into How To Purchase A Tradeline, The Benefits They Offer, And The Best Tradelines For Personal Credit.

These Tradelines Are Key To Your Financial Reputation, Reflecting Your Creditworthiness And Playing A Crucial Role In Securing Everything From Personal Loans To Business Financing.

Related Post:

![Best Tradelines To Build Credit [2022] Debt Game Over](https://debtgameover.com/wp-content/uploads/2022/04/Best-Tradelines-To-Build-Credit4.jpg)