Unsecured Credit Builder Loan

Unsecured Credit Builder Loan - Credit builder loans are really not “loans” so much as they are savings accounts that help you build a credit history. Credit builder loans can place an installment loan on your credit record with little cost and no credit check. Similar to a credit card, a personal line of credit is an unsecured loan. Need help building your credit? These loans are geared toward borrowers who are seeking to build their credit and who might not get approved for traditional loans from banks and other lenders. They are offered by credit unions, community banks and. Perks of a personal loan with hacu: Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? There's also a savings boost — you get. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. This traditional personal loan offers you the flexibility to borrow money for unexpected expenses, debt consolidation, financial goals, and more—all. Credit builder loans can place an installment loan on your credit record with little cost and no credit check. Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Use this loan to build credit history and as an. Unsecured credit builder loans help people build credit even if they aren’t in good standing. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. Credit builder loans are really not “loans” so much as they are savings accounts that help you build a credit history. Unlike a traditional business loan, where the borrower receives. The financial product’s viability doesn’t necessarily suggest that it’s the right choice. Instead, you’ll make fixed monthly payments to the lender over the course of the. Unsecured credit builder loans help people build credit even if they aren’t in good standing. View details, map and photos of this condo property with 3 bedrooms and 2 total baths. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. They are offered by credit unions, community banks. They are offered by credit unions, community banks and. These loans are geared toward borrowers who are seeking to build their credit and who might not get approved for traditional loans from banks and other lenders. There's also a savings boost — you get. Manages assigned customers and proactively meets with them, both in person and over the phone, to. Unsecured credit builder loans help people build credit even if they aren’t in good standing. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Credit builder loans are really not “loans” so much as they are savings accounts that help you build a credit history. Perks of. Credit builder loans can place an installment loan on your credit record with little cost and no credit check. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. Manages assigned customers and proactively meets with them, both in person and over the phone, to build lasting relationships, discover. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Unsecured credit builder loans help people build credit even if they aren’t in good standing. View details, map and. Perks of a personal loan with hacu: Similar to a credit card, a personal line of credit is an unsecured loan. Manages assigned customers and proactively meets with them, both in person and over the phone, to build lasting relationships, discover financial needs, and tailor product and. View details, map and photos of this condo property with 3 bedrooms and. Need help building your credit? They are offered by credit unions, community banks and. Instead, you’ll make fixed monthly payments to the lender over the course of the. The financial product’s viability doesn’t necessarily suggest that it’s the right choice. Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Unlike a traditional business loan, where the borrower receives. Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? If you have fair or bad credit, you’ll likely pay an origination fee of 1% to 10% of your loan amount — that's $500 to $5,000 on a $50,000 loan. Unlike traditional. Credit builder loans can place an installment loan on your credit record with little cost and no credit check. That can help you build credit, especially if you have a thin credit file. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Manages assigned customers and proactively. Credit builder loans can place an installment loan on your credit record with little cost and no credit check. Sba loans are offered by banks and other lenders but come with a partial guarantee from the u.s. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. Instead, you’ll. Review this list of the 9 best credit builder loans. This traditional personal loan offers you the flexibility to borrow money for unexpected expenses, debt consolidation, financial goals, and more—all. Credit builder loans are really not “loans” so much as they are savings accounts that help you build a credit history. Need help building your credit? These loans are geared toward borrowers who are seeking to build their credit and who might not get approved for traditional loans from banks and other lenders. The financial product’s viability doesn’t necessarily suggest that it’s the right choice. They are offered by credit unions, community banks and. Use this loan to build credit history and as an. Unsecured credit builder loans help people build credit even if they aren’t in good standing. That can help you build credit, especially if you have a thin credit file. A business line of credit is a flexible financing option that allows businesses to borrow money up to a predetermined credit limit. Savings and credit builder loans are a great way to build your credit history with less liability than a credit card. Unlike traditional loans, which provide you with a lump sum upfront, a. Sba loans are offered by banks and other lenders but come with a partial guarantee from the u.s. Unlike a traditional business loan, where the borrower receives. Similar to a credit card, a personal line of credit is an unsecured loan.Secured Loans vs. Unsecured Loans The Key Differences Self. Credit

Best Unsecured Credit Cards For Building Credit Flik Eco

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

Chime 5,000 Credit Builder Loan (Primary) UNSECURED Tradeline Loans

Top 10 unsecured credit builder loan in 2022 Blog Hồng

6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]

Secured Loans vs. Unsecured Loans The Key Differences Self. Credit

Self Credit Builder Loan Review 2023 No Credit Check

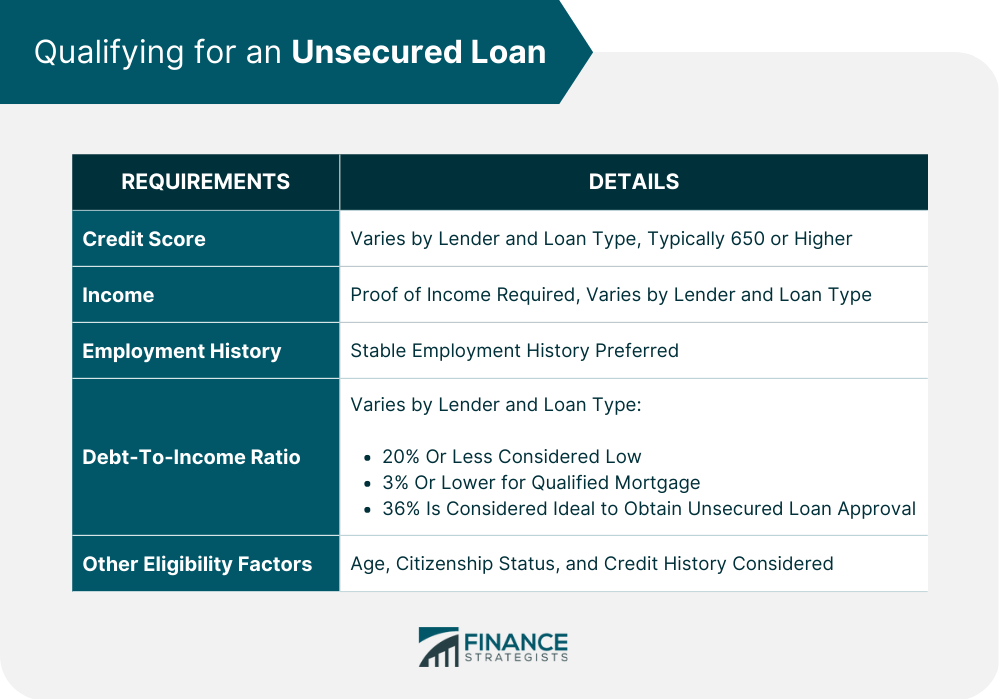

Unsecured Loan Definition, Qualifications, & How to Apply

Self Credit Builder Loan Review for 2022 No Credit Check

Credit Builder Loans Can Place An Installment Loan On Your Credit Record With Little Cost And No Credit Check.

There's Also A Savings Boost — You Get.

Perks Of A Personal Loan With Hacu:

Looking To Boost Your Credit Score And Build Thousands Of Dollars In Savings — All With No Credit Check?

Related Post:

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-1-1024x727.png)

![6 Best Credit Builder Loans for 2022 [No Credit Check, Online, Unsecured]](https://digitalhoney.money/wp-content/uploads/2021/08/image-6.png)