Usda Loan For Building A House

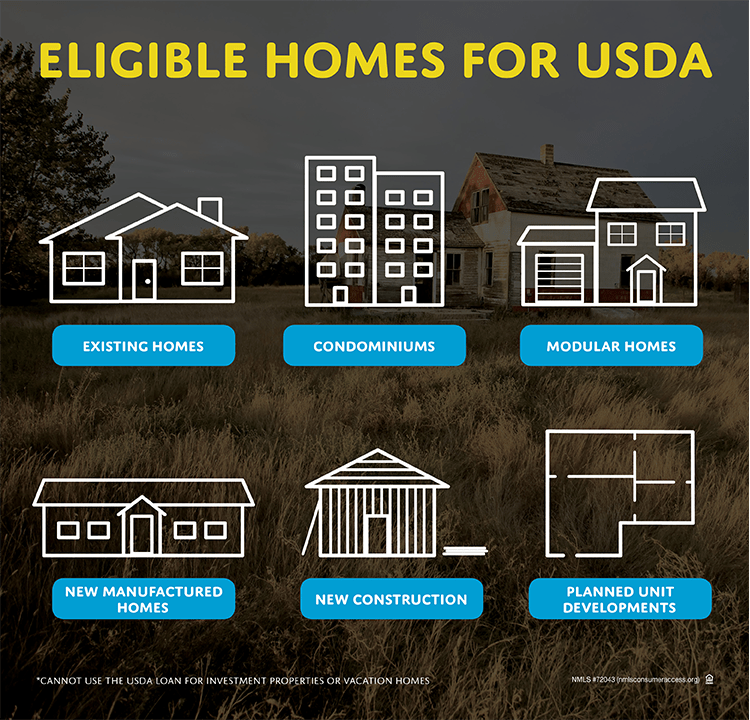

Usda Loan For Building A House - Unlike a traditional construction loan, which. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way to finance your dream. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. Some of the key benefits include: The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. If the loan applicant's house is not located on the farm, then the agency looks to the data for the county in which the largest portion of the farm is located. There are a number of benefits to using a usda construction loan for your new home. A new dwelling is defined as one that is less. You must purchase property in a rural area. There are a number of benefits to using a usda construction loan for your new home. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way to finance your dream. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. Some of the key benefits include: Usda considers a property new. If the loan applicant's house is not located on the farm, then the agency looks to the data for the county in which the largest portion of the farm is located. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. The usda has a loan program for those looking to build their homes. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way to finance your dream. While a. Typically with a population below 20,000. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. You. Loan applicants must contribute a. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. Usda considers a property new. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. There are a number of benefits to. Some of the key benefits include: While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. If the loan applicant's house is not located on the farm, then the agency looks to the data for the county in which the largest portion of the farm is. Usda considers a property new. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. Unlike a traditional construction loan, which. A new dwelling is defined as one that is less. Typically with a population below 20,000. Some of the key benefits include: There are a number of benefits to using a usda construction loan for your new home. Typically with a population below 20,000. Usda considers a property new. The usda has a loan program for those looking to build their homes. The usda has a loan program for those looking to build their homes. Typically with a population below 20,000. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. A new dwelling is defined as one that. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. Typically with a population below 20,000. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way. Typically with a population below 20,000. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. The usda has a loan program for those looking to build their homes. You must purchase property in a rural area. A new dwelling is defined as one that is. While a regular usda loan lets you buy a house that’s already built, a usda construction loan lets you build a new one instead. Typically with a population below 20,000. With no down payment requirement and a seamless transition from a construction loan to a permanent loan, a usda construction loan is a great way to finance your dream. Usda construction loans combine the purchase of land — usually five acres or more — with the cost of constructing a house on that land in a designated area. Unlike a traditional construction loan, which. Usda considers a property new. The ultimate guide to usda loans by realtor.com® | everything you need to know about the usda’s $0 down payment option loan and how to determine if it’s the right fit for you. The usda has a loan program for those looking to build their homes. A new dwelling is defined as one that is less. There are a number of benefits to using a usda construction loan for your new home. Newly constructed homes may be financed with usda’s single family housing guaranteed loan program when they meet program requirements. Some of the key benefits include:USDA Construction Loans for New Homes Construction loans, Usda, Usda loan

USDA Loans, Part 1 What is a USDA Home Loan? Moreira Team Mortgage

Part 2 USDA Construction Loans What costs can be included within a

USDA Eligibility To Build A Home In Rural Area

Part 1 USDA Construction Loans How do you qualify for a USDA

USDA Home Building Loan Can you purchase land separately with a USDA

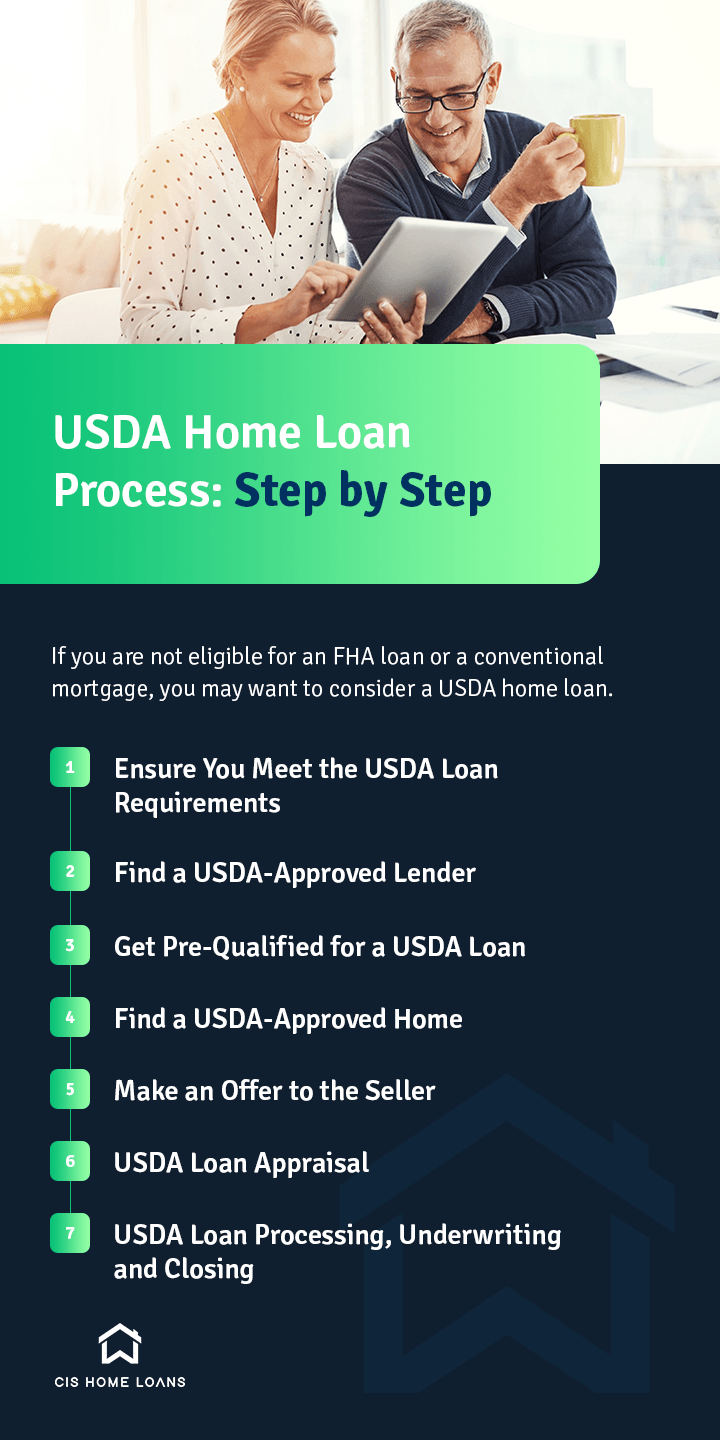

USDA Home Loan Process Step by Step CIS Home Loans

Can You Use A Usda Loan For New Construction Loan Walls

USDA New Construction Loans USDA Rural Mortgage

USDA One Time Close Construction Loan Get FHA, VA, USDA Mortgage

If The Loan Applicant's House Is Not Located On The Farm, Then The Agency Looks To The Data For The County In Which The Largest Portion Of The Farm Is Located.

You Must Purchase Property In A Rural Area.

Loan Applicants Must Contribute A.

Related Post: