Using 1031 Funds To Build On Property You Already Own

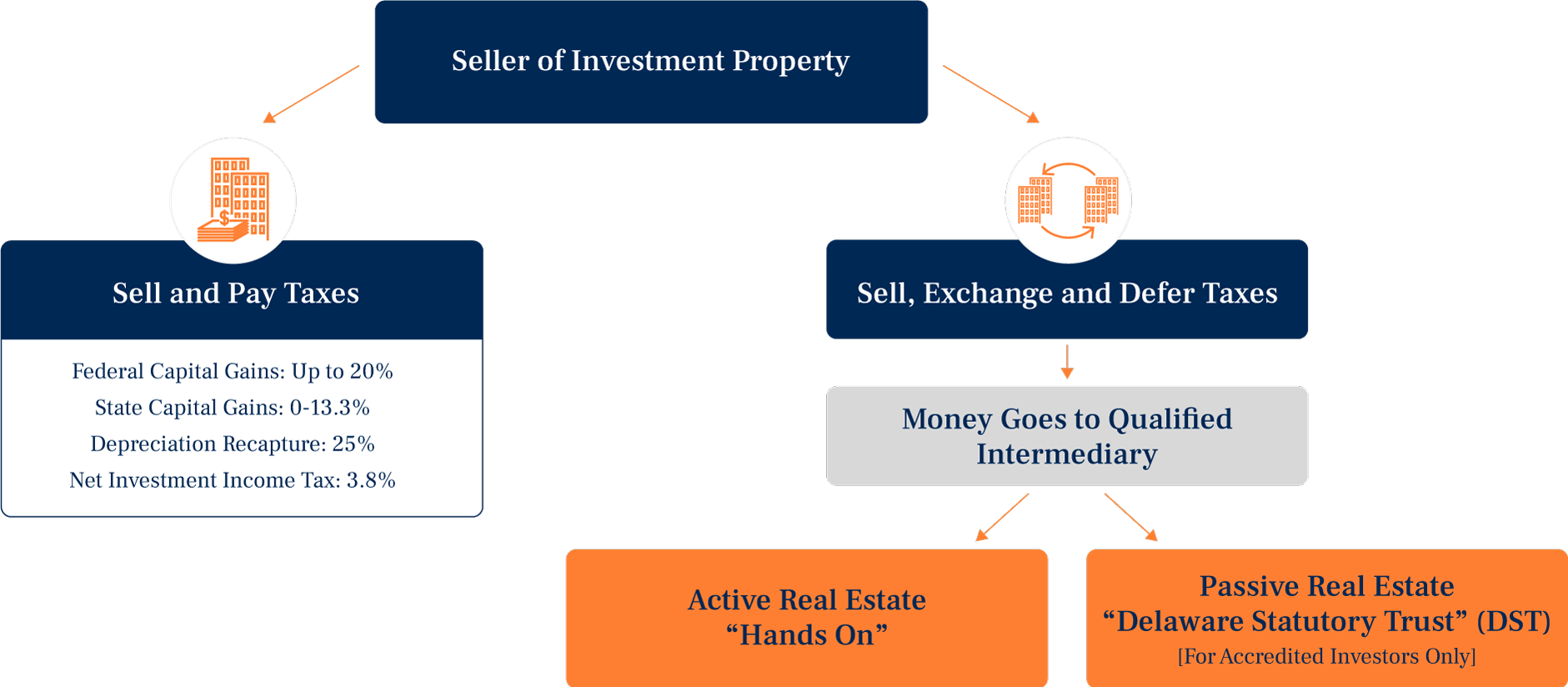

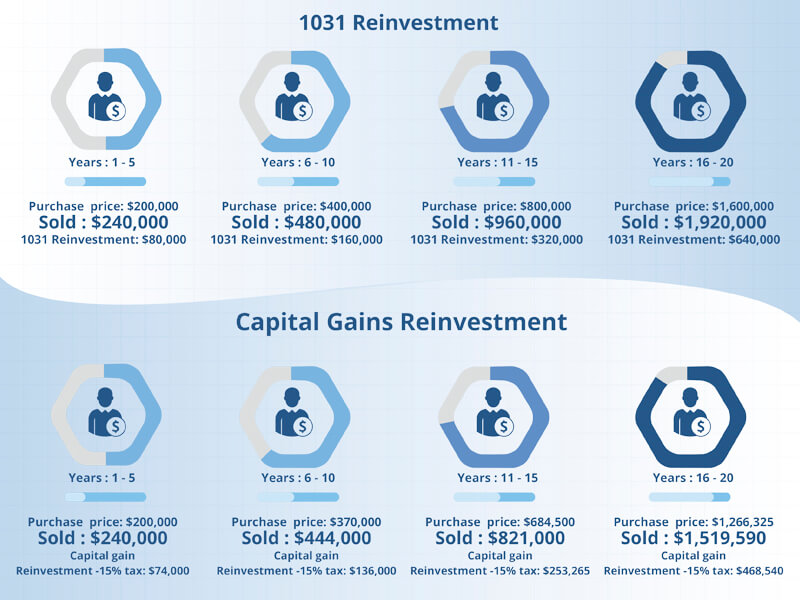

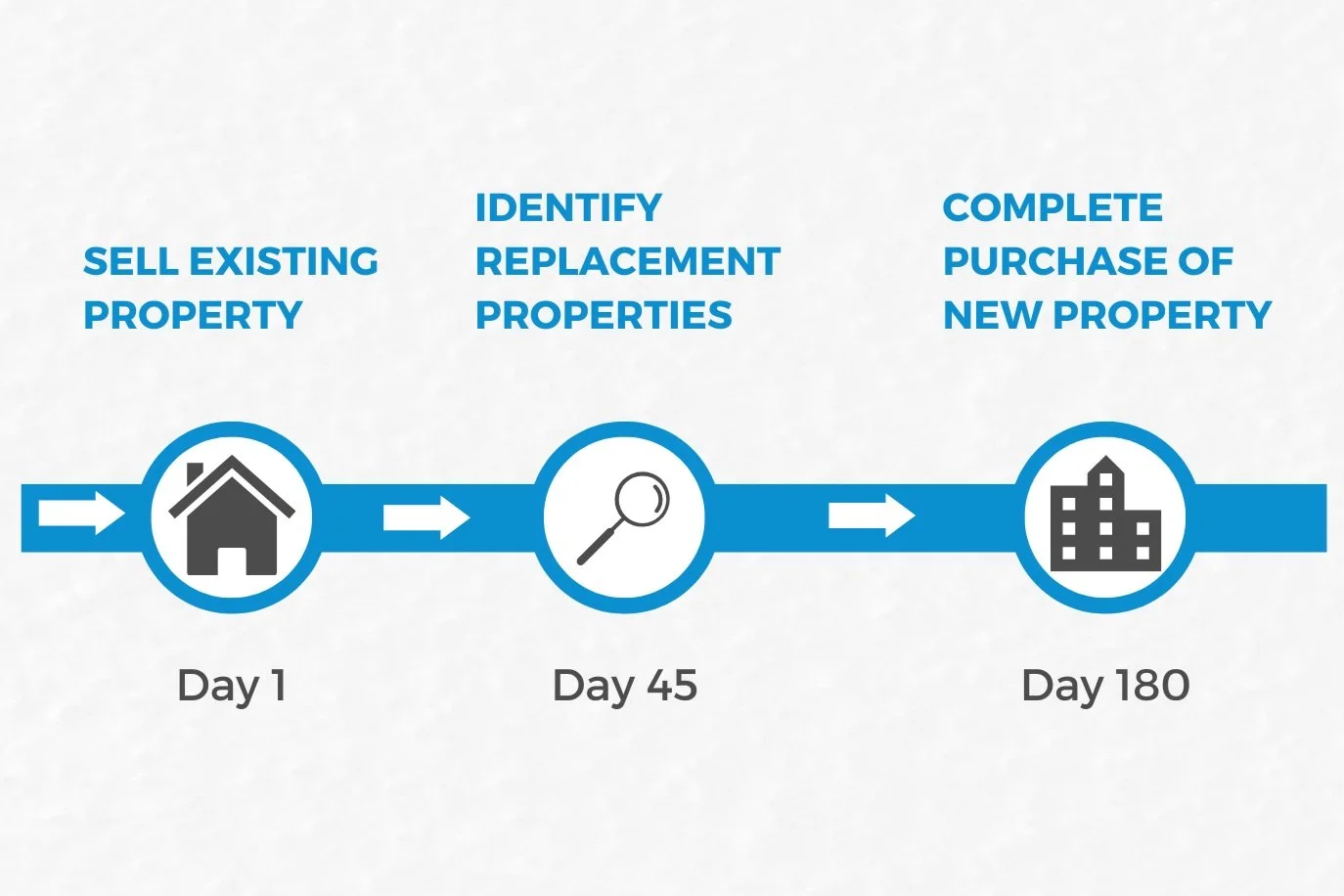

Using 1031 Funds To Build On Property You Already Own - I would like to 1031 out of an investment building that i have owned for several years and exchange into new construction buildings on raw land that i already own (paid cash. Conditions for a successful exchange. Can you improve your replacement property with 1031 exchange funds? You would sell one or more properties (“relinquished property”) and subsequently build or make improvements on land that you already own (“replacement property”). Your primary residence or vacation property doesn’t qualify under 1031 exchange rules. First, if the replacement property, before any improvements is equal in value to the relinquished. Navigating a internal revenue code section 1031 states that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for. Generally, no, you can not sell real property (relinquished property) and defer the payment of your depreciation recapture and capital gain income taxes by structuring a 1031 exchange by. Using a 1031 exchange can be like a powerful “reset button” for. First exchange explains irs guidelines for permitted upgrades. There are ways to use a 1031 exchange to build on the replacement property. You would sell one or more properties (“relinquished property”) and subsequently build or make improvements on land that you already own (“replacement property”). You must complete both transactions within a prescribed timetable, dowdy says. Land a taxpayer already owns cannot be acquired by them in an exchange, so some taxpayers may attempt to transfer their property to another party, have improvements built on the. Can you improve your replacement property with 1031 exchange funds? To do a 1031 exchange into a property you already own, you need to satisfy the napkin test and get further assistance from qualified tax or legal counsel. Conditions for a successful exchange. This mechanism allows investors to not only defer. Generally, no, you can not sell real property (relinquished property) and defer the payment of your depreciation recapture and capital gain income taxes by structuring a 1031 exchange by. Such a process is aptly named. When using a 1031 exchange to pay for a property you already own, ensure you conduct the napkin test, or better still, seek professional assistance from a qualified intermediary. An easier way to go about a using 1031 exchange on a new build is to invest in a nnn lease property that is ready to break ground or already being. Generally, no, you can not sell real property (relinquished property) and defer the payment of your depreciation recapture and capital gain income taxes by structuring a 1031 exchange by. Ensuring a successful exchange means. To avoid missteps, ensure you understand the core requirements of a 1031 exchange, including: Land a taxpayer already owns cannot be acquired by them in an. On occasion, an investor may want to use available funds to construct improvements to the replacement property. Using a 1031 exchange can be like a powerful “reset button” for. But the clock is ticking: A way to satisfy the test is through a leasehold improvement 1031 exchange. When using a 1031 exchange to pay for a property you already own,. On occasion, an investor may want to use available funds to construct improvements to the replacement property. To avoid missteps, ensure you understand the core requirements of a 1031 exchange, including: To do a 1031 exchange into a property you already own, you need to satisfy the napkin test and get further assistance from qualified tax or legal counsel. A. An easier way to go about a using 1031 exchange on a new build is to invest in a nnn lease property that is ready to break ground or already being built. Conditions for a successful exchange. You must complete both transactions within a prescribed timetable, dowdy says. First exchange explains irs guidelines for permitted upgrades. Can you improve your. There are ways to use a 1031 exchange to build on the replacement property. To avoid missteps, ensure you understand the core requirements of a 1031 exchange, including: You must complete both transactions within a prescribed timetable, dowdy says. Conditions for a successful exchange. On occasion, an investor may want to use available funds to construct improvements to the replacement. I would like to 1031 out of an investment building that i have owned for several years and exchange into new construction buildings on raw land that i already own (paid cash. Can you improve your replacement property with 1031 exchange funds? Using a 1031 exchange can be like a powerful “reset button” for. There are ways to use a. I would like to 1031 out of an investment building that i have owned for several years and exchange into new construction buildings on raw land that i already own (paid cash. To do a 1031 exchange into a property you already own, you need to satisfy the napkin test and get further assistance from qualified tax or legal counsel.. Generally, no, you can not sell real property (relinquished property) and defer the payment of your depreciation recapture and capital gain income taxes by structuring a 1031 exchange by. You must complete both transactions within a prescribed timetable, dowdy says. There are ways to use a 1031 exchange to build on the replacement property. A way to satisfy the test. To avoid missteps, ensure you understand the core requirements of a 1031 exchange, including: I would like to 1031 out of an investment building that i have owned for several years and exchange into new construction buildings on raw land that i already own (paid cash. Can you improve your replacement property with 1031 exchange funds? There are ways to. Such a process is aptly named. A qualified intermediary plays a critical role,. Using a 1031 exchange can be like a powerful “reset button” for. To do a 1031 exchange into a property you already own, you need to satisfy the napkin test and get further assistance from qualified tax or legal counsel. Your primary residence or vacation property doesn’t qualify under 1031 exchange rules. Generally, no, you can not sell real property (relinquished property) and defer the payment of your depreciation recapture and capital gain income taxes by structuring a 1031 exchange by. On occasion, an investor may want to use available funds to construct improvements to the replacement property. Conditions for a successful exchange. I would like to 1031 out of an investment building that i have owned for several years and exchange into new construction buildings on raw land that i already own (paid cash. The lack of 1031 to capital in this space due to transaction slowdown across commercial real estate, the lack of private capital due to elevated rates, that's both at the. Navigating a internal revenue code section 1031 states that no gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for. First exchange explains irs guidelines for permitted upgrades. You would sell one or more properties (“relinquished property”) and subsequently build or make improvements on land that you already own (“replacement property”). This mechanism allows investors to not only defer. You must complete both transactions within a prescribed timetable, dowdy says. Land a taxpayer already owns cannot be acquired by them in an exchange, so some taxpayers may attempt to transfer their property to another party, have improvements built on the.Elevating Your Investment The Strategy Behind Using 1031 Exchanges for

1031 Exchange Investment Properties Marcus & Millichap

Using the 1031 Exchange

The ULTIMATE Guide to Understanding 1031 Exchange Rules

What Is A 1031 Exchange? (in Real Estate) — The Cauble Group

The 1031 Exchange Rules You Need to Know 1031 Crowdfunding

HOW TO BUILD A REAL ESTATE EMPIRE USING 1031 EXCHANGES COMERCIAL

Using a 1031 Exchange For a LowerPriced Property What You Need to

1031 Exchange Real Estate Law Mekhtiyev Law

How to Use 1031 Exchange Funds to Improve Your Replacement Property

First, If The Replacement Property, Before Any Improvements Is Equal In Value To The Relinquished.

Can You Improve Your Replacement Property With 1031 Exchange Funds?

Ensuring A Successful Exchange Means.

There Are Ways To Use A 1031 Exchange To Build On The Replacement Property.

Related Post:

.jpg)