Using Credit Karma Building Modelis

Using Credit Karma Building Modelis - Credit karma offers free tools to help you monitor and understand your credit score. Credit risk and ifrs 9 models, with examples to… This article focuses on two key and popular models used in credit risk management: Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system developed by the three major credit bureaus: Building credit is a vital step in achieving financial stability and accessing opportunities. By establishing a strong credit history, individuals can gain access to lower. Credit modeling is the process of creating mathematical models that estimate the probability of default, loss given default, exposure at default, and other credit risk metrics for a. In this guide, we’ll walk through several ways to improve your credit health. Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. It's also one of the most popular credit monitoring tools that can help you track your credit reports and credit. They say if you use credit karma, subtract at least 30 points from the score they present to. Credit karma offers free tools to help you monitor and understand your credit score. Credit scoring models can help lenders make better. In this guide, we’ll walk through several ways to improve your credit health. You can see a chart of your credit score over time, easily review bills in collections, see. It's also one of the most popular credit monitoring tools that can help you track your credit reports and credit. This article focuses on two key and popular models used in credit risk management: Credit models are mathematical tools that help lenders and borrowers assess the risk and return of lending or borrowing money. Building credit is a vital step in achieving financial stability and accessing opportunities. By leveraging historical data and advanced algorithms, machine learning models can. They are two completely different models of credit evaluation. By leveraging historical data and advanced algorithms, machine learning models can. They are used to predict the probability of default, the expected loss, or the credit rating of an individual or a business. If you’re trying to figure out how to build credit, credit karma is here to help. They say. It’s not free to get all the scores, but there’s different models lenders use and free credit scores like chime, creditkarma, and even capitalone’s creditwise are always off. Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. Credit builder utilizes a line of credit to help. Credit karma’s business model is based on offering free credit scores and reports to consumers, while earning revenue through targeted advertising and affiliate partnerships. Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. Credit karma offers an affordable tool to help build your credit. Credit scoring. Credit modeling is the process of creating mathematical models that estimate the probability of default, loss given default, exposure at default, and other credit risk metrics for a. Credit risk models are designed to predict the likelihood of a borrower defaulting on a loan. You can see a chart of your credit score over time, easily review bills in collections,. Credit builder utilizes a line of credit to help you save money. Credit risk and ifrs 9 models, with examples to… You can see a chart of your credit score over time, easily review bills in collections, see. Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system developed by the. You can see a chart of your credit score over time, easily review bills in collections, see. Credit karma’s business model is based on offering free credit scores and reports to consumers, while earning revenue through targeted advertising and affiliate partnerships. Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system. Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system developed by the three major credit bureaus: Lenders use fico, not vantage. You can see a chart of your credit score over time, easily review bills in collections, see. They are used to predict the probability of default, the expected loss,. Credit risk and ifrs 9 models, with examples to… Building credit is a vital step in achieving financial stability and accessing opportunities. In this guide, we’ll walk through several ways to improve your credit health. It's also one of the most popular credit monitoring tools that can help you track your credit reports and credit. Every payment you make to. You can see a chart of your credit score over time, easily review bills in collections, see. Credit builder utilizes a line of credit to help you save money. By establishing a strong credit history, individuals can gain access to lower. Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system. Credit risk models are designed to predict the likelihood of a borrower defaulting on a loan. They are two completely different models of credit evaluation. You can see a chart of your credit score over time, easily review bills in collections, see. Credit scoring models can help lenders make better. Credit models are mathematical tools that help lenders and borrowers. Credit karma uses a credit model that is based on the vantagescore 3.0, which is a credit scoring system developed by the three major credit bureaus: Credit modeling is the process of creating mathematical models that estimate the probability of default, loss given default, exposure at default, and other credit risk metrics for a. Credit karma offers an affordable tool to help build your credit. In this guide, we’ll walk through several ways to improve your credit health. Lenders use fico, not vantage. You can see a chart of your credit score over time, easily review bills in collections, see. This article focuses on two key and popular models used in credit risk management: Every payment you make to pay off the balance on your line of credit is reported as a payment to the credit bureaus. Credit models can be used to predict the probability of default,. Credit karma’s business model is based on offering free credit scores and reports to consumers, while earning revenue through targeted advertising and affiliate partnerships. If you’re trying to figure out how to build credit, credit karma is here to help. By establishing a strong credit history, individuals can gain access to lower. Then, we’ll go over some. Building credit is a vital step in achieving financial stability and accessing opportunities. They are two completely different models of credit evaluation. By leveraging historical data and advanced algorithms, machine learning models can.Rebuilding My Credit Score in Amarillo using Credit Karma A Stepby

Credit Karma Credit Builder Review 2025 The Essential Guide

Credit Karma Wiedenbach Brown

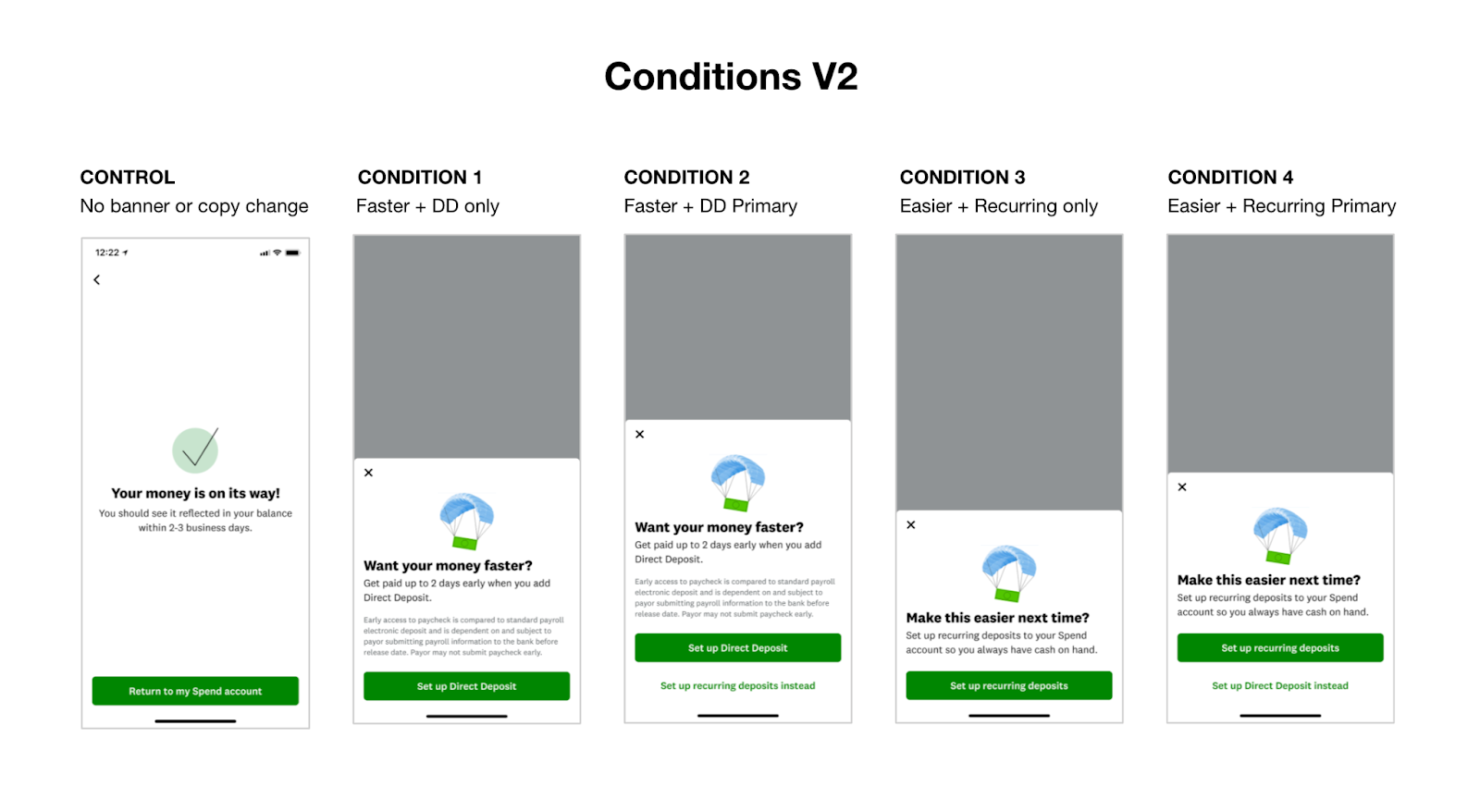

Boosting Recurring Transfer Setups for Credit Karma Money by 18 Using

Credit Karma Bnpl at Ed Simpson blog

Credit Karma Business Model How Credit Karma Makes Money? 2024

Chase Bank Using Credit Karma Scores To Create Credit Game Plan YouTube

How Does Credit Karma Make Money? Business Model of Credit Karma Soocial

Intuit is buying Credit Karma for 7.1 billion, its biggest acquisition

How To Use Credit Karma Credit Builder 2024 YouTube

Credit Risk And Ifrs 9 Models, With Examples To…

They Say If You Use Credit Karma, Subtract At Least 30 Points From The Score They Present To.

Credit Scoring Models Can Help Lenders Make Better.

Credit Builder Utilizes A Line Of Credit To Help You Save Money.

Related Post: