Wealth Building Account

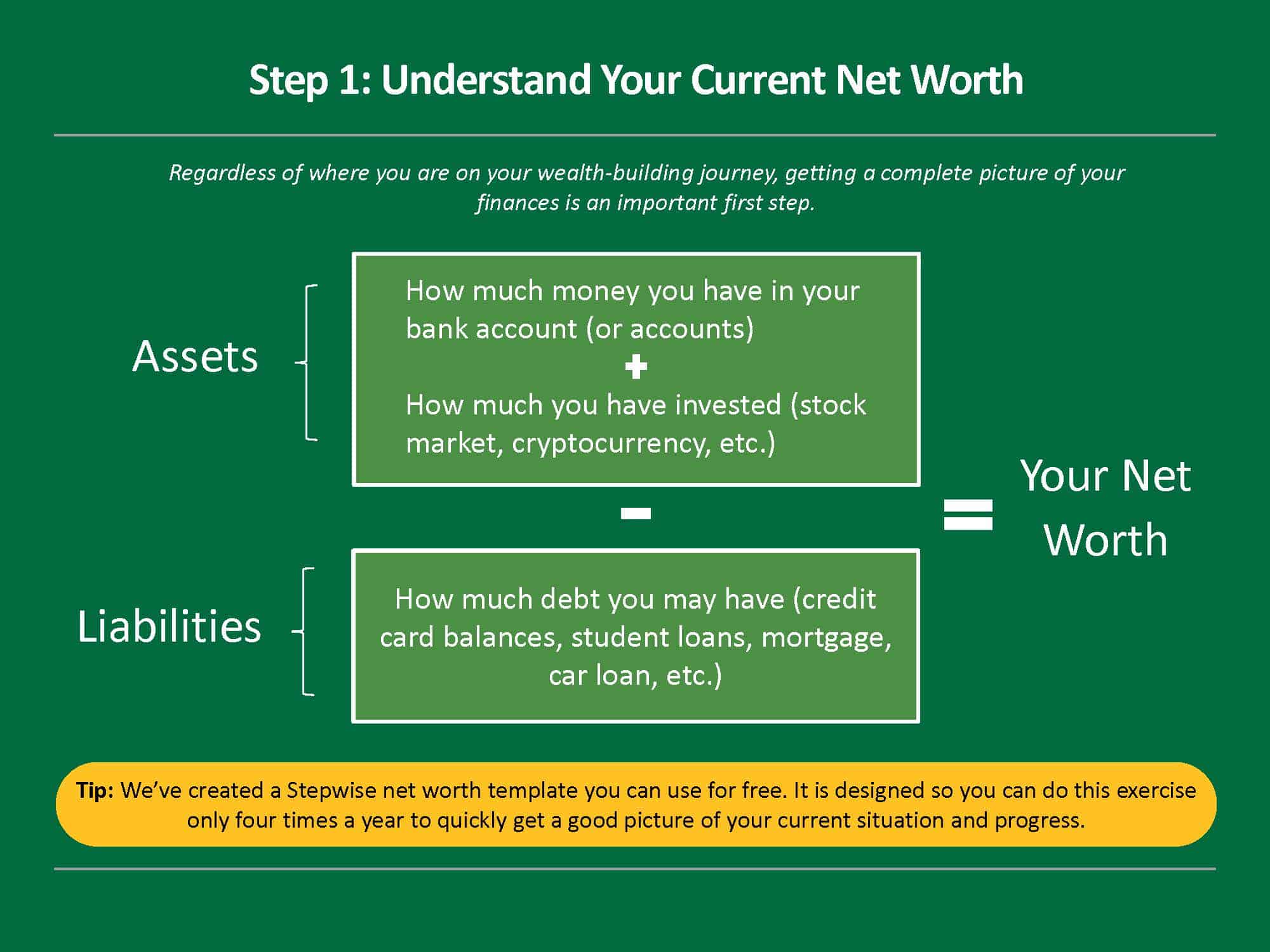

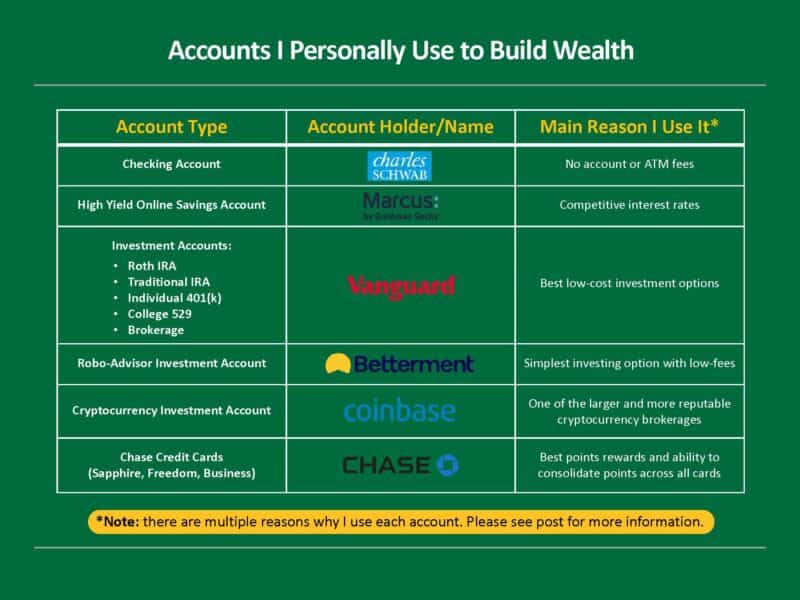

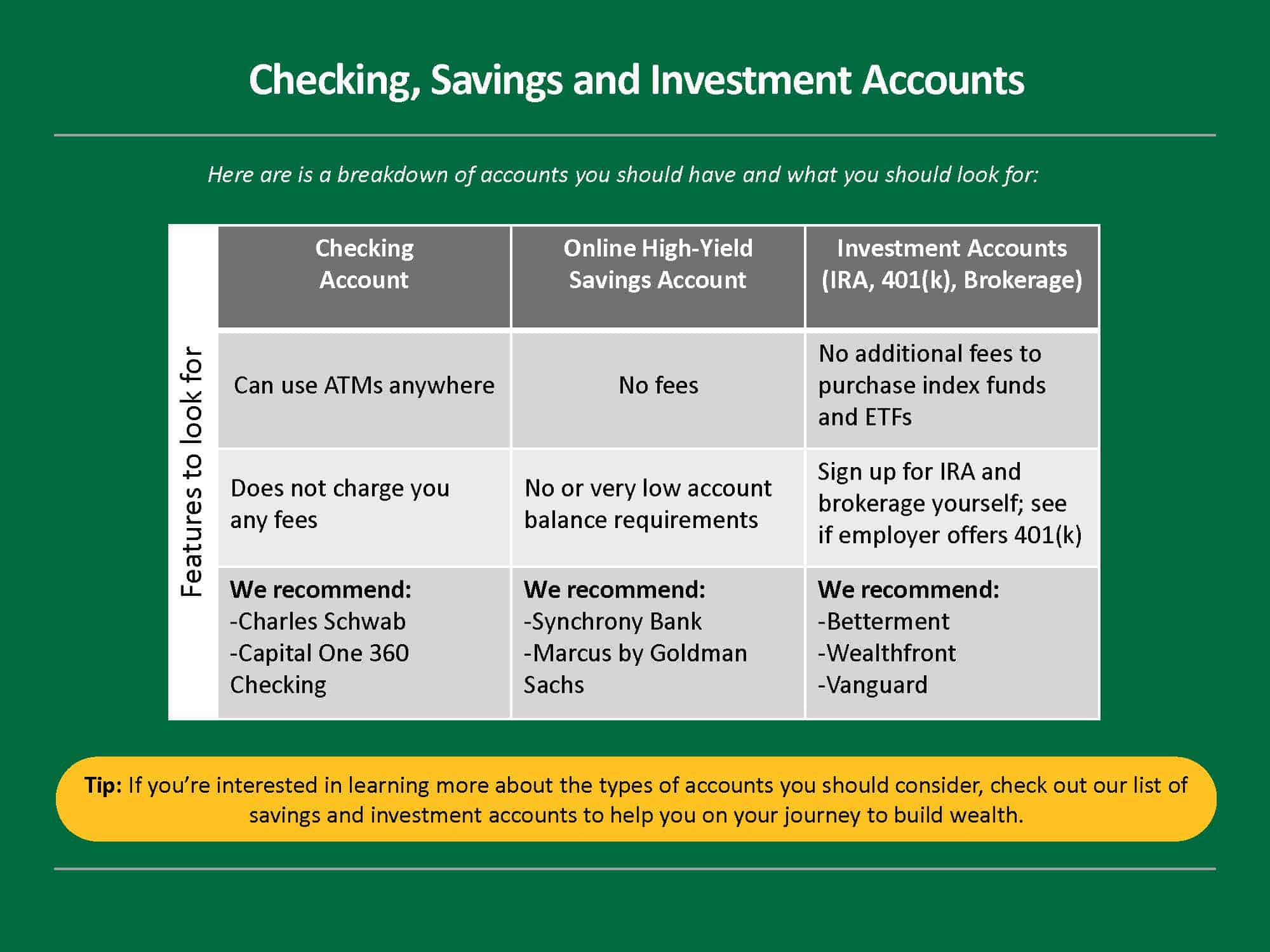

Wealth Building Account - If you’re just starting to dip your toes into real estate investing, the magic question is how long it will take to begin building wealth. Wealth management accounts are types of investment accounts that are managed by a professional, who coordinates the rebalancing and reallocation of assets in a portfolio. Budgeting/saving) with just enough information to get you started. Universal early wealth building accounts have the potential to transform household wealth in the u.s.—and they have bipartisan support. In addition to offering different potential returns, some financial accounts come with. Wealth isn’t built on luck or shortcuts. A roth ira is at the top of the list. You probably use your account to receive your paycheck, cover your living expenses or stash some cash for a rainy day. 8 ways to use your bank’s products and services to. Know your total wealth at a glance, monitor your rbc wealthplan progress, stay up to date on the markets, move your money and more—securely on your computer, tablet or mobile device,. Universal early wealth building accounts have the potential to transform household wealth in the u.s.—and they have bipartisan support. To build and maintain good credit, it is important to pay bills on time, keep credit card balances low and avoid unnecessary new accounts. Most financial literacy books focus on a single topic (e.g. When building wealth, you shouldn’t just keep all your money in one type of account. Building wealth is about small, regular investments into your financial security. Your choices here include a taxable brokerage account, an ira (individual retirement account), or a 401(k) plan if your employer offers one. Singh says one of the simplest ways he grows his wealth is by setting up his bank accounts to help do it for him. Here's how to build and maintain your wealth over time. Budgeting/saving) with just enough information to get you started. Community wealth building (cwb) promotes community ownership and democratic community control of local businesses, housing, land, and commercial corridors. Need expert guidance when it comes to managing your investments or. In this guide, we’ll explore some key wealth building strategies to help you grow your money over time. You probably use your account to receive your paycheck, cover your living expenses or stash some cash for a rainy day. The purpose of building your wealth bridge is to. 8. Universal early wealth building accounts have the potential to transform household wealth in the u.s.—and they have bipartisan support. Below, we outline key principles for building wealth, including setting goals, managing debt, saving, investing, understanding taxes, and building strong credit. It’s a result of consistent habits and deliberate actions repeated over time. If you’re just starting to dip your toes. If you’re just starting to dip your toes into real estate investing, the magic question is how long it will take to begin building wealth. To build and maintain good credit, it is important to pay bills on time, keep credit card balances low and avoid unnecessary new accounts. Building wealth is about small, regular investments into your financial security.. When building wealth, you shouldn’t just keep all your money in one type of account. Community wealth building (cwb) promotes community ownership and democratic community control of local businesses, housing, land, and commercial corridors. Building wealth is about small, regular investments into your financial security. Need expert guidance when it comes to managing your investments or. In this guide, we’ll. When building wealth, you shouldn’t just keep all your money in one type of account. Singh says one of the simplest ways he grows his wealth is by setting up his bank accounts to help do it for him. If you’re just starting to dip your toes into real estate investing, the magic question is how long it will take. Know your total wealth at a glance, monitor your rbc wealthplan progress, stay up to date on the markets, move your money and more—securely on your computer, tablet or mobile device,. Investopedia highlights that 401(k) plans are the most popular form of employer. Wealth management accounts are types of investment accounts that are managed by a professional, who coordinates the. Know your total wealth at a glance, monitor your rbc wealthplan progress, stay up to date on the markets, move your money and more—securely on your computer, tablet or mobile device,. 8 ways to use your bank’s products and services to. Here's how to build and maintain your wealth over time. You can get rich in real estate. In addition. In addition to offering different potential returns, some financial accounts come with. Need expert guidance when it comes to managing your investments or. Building wealth is about small, regular investments into your financial security. Community wealth building (cwb) promotes community ownership and democratic community control of local businesses, housing, land, and commercial corridors. A roth ira is at the top. You can get rich in real estate. Building wealth is about small, regular investments into your financial security. Know your total wealth at a glance, monitor your rbc wealthplan progress, stay up to date on the markets, move your money and more—securely on your computer, tablet or mobile device,. Your choices here include a taxable brokerage account, an ira (individual. Singh says one of the simplest ways he grows his wealth is by setting up his bank accounts to help do it for him. Wealth management accounts are types of investment accounts that are managed by a professional, who coordinates the rebalancing and reallocation of assets in a portfolio. The purpose of building your wealth bridge is to. Know your. Building wealth is about small, regular investments into your financial security. To build and maintain good credit, it is important to pay bills on time, keep credit card balances low and avoid unnecessary new accounts. When building wealth, you shouldn’t just keep all your money in one type of account. Universal early wealth building accounts have the potential to transform household wealth in the u.s.—and they have bipartisan support. In addition to offering different potential returns, some financial accounts come with. Need expert guidance when it comes to managing your investments or. You can get rich in real estate. 8 ways to use your bank’s products and services to. Below, we outline key principles for building wealth, including setting goals, managing debt, saving, investing, understanding taxes, and building strong credit. Most financial literacy books focus on a single topic (e.g. Budgeting/saving) with just enough information to get you started. The purpose of building your wealth bridge is to. A roth ira is at the top of the list. Wealth management accounts are types of investment accounts that are managed by a professional, who coordinates the rebalancing and reallocation of assets in a portfolio. Your choices here include a taxable brokerage account, an ira (individual retirement account), or a 401(k) plan if your employer offers one. Investopedia highlights that 401(k) plans are the most popular form of employer.6Step Guide How To Save, Invest, And Build Wealth Stepwise

5 Types of Bank Accounts That Most People Need to Build Wealth

WEALTH BUILDING

5 Accounts to Build Wealth

Top 3 Wealth Building Accounts

5 Accounts to Build Wealth

Wealth Building 101 Tutorial Guide Articles and Resources

Fair Neobank Announces Dividends up to 4 on their Wealth Building

6Step Guide How To Save, Invest, And Build Wealth Stepwise

6Step Guide How To Save, Invest, And Build Wealth Stepwise

You Probably Use Your Account To Receive Your Paycheck, Cover Your Living Expenses Or Stash Some Cash For A Rainy Day.

If You’re Just Starting To Dip Your Toes Into Real Estate Investing, The Magic Question Is How Long It Will Take To Begin Building Wealth.

Singh Says One Of The Simplest Ways He Grows His Wealth Is By Setting Up His Bank Accounts To Help Do It For Him.

It’s A Result Of Consistent Habits And Deliberate Actions Repeated Over Time.

Related Post: