What Credit Score Is Needed To Build A House

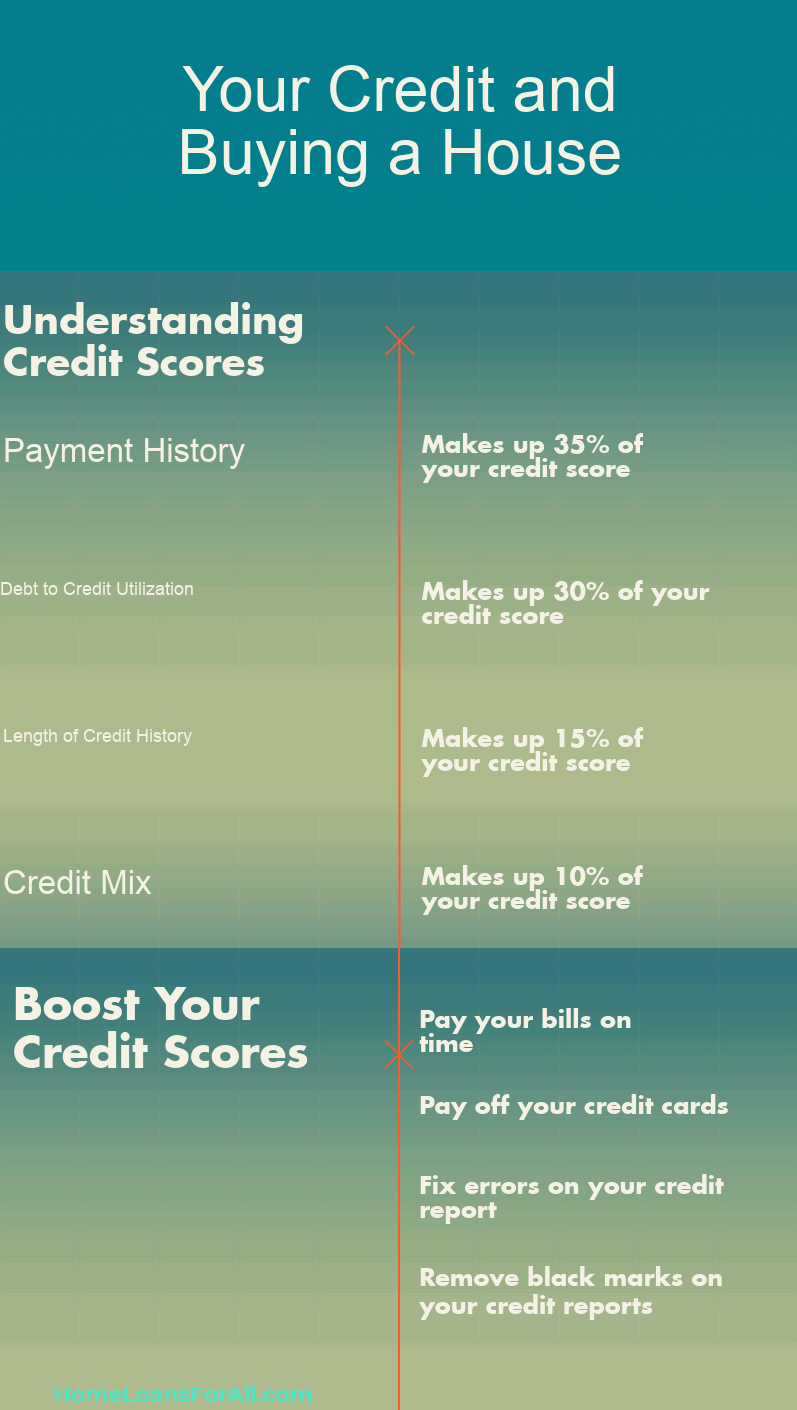

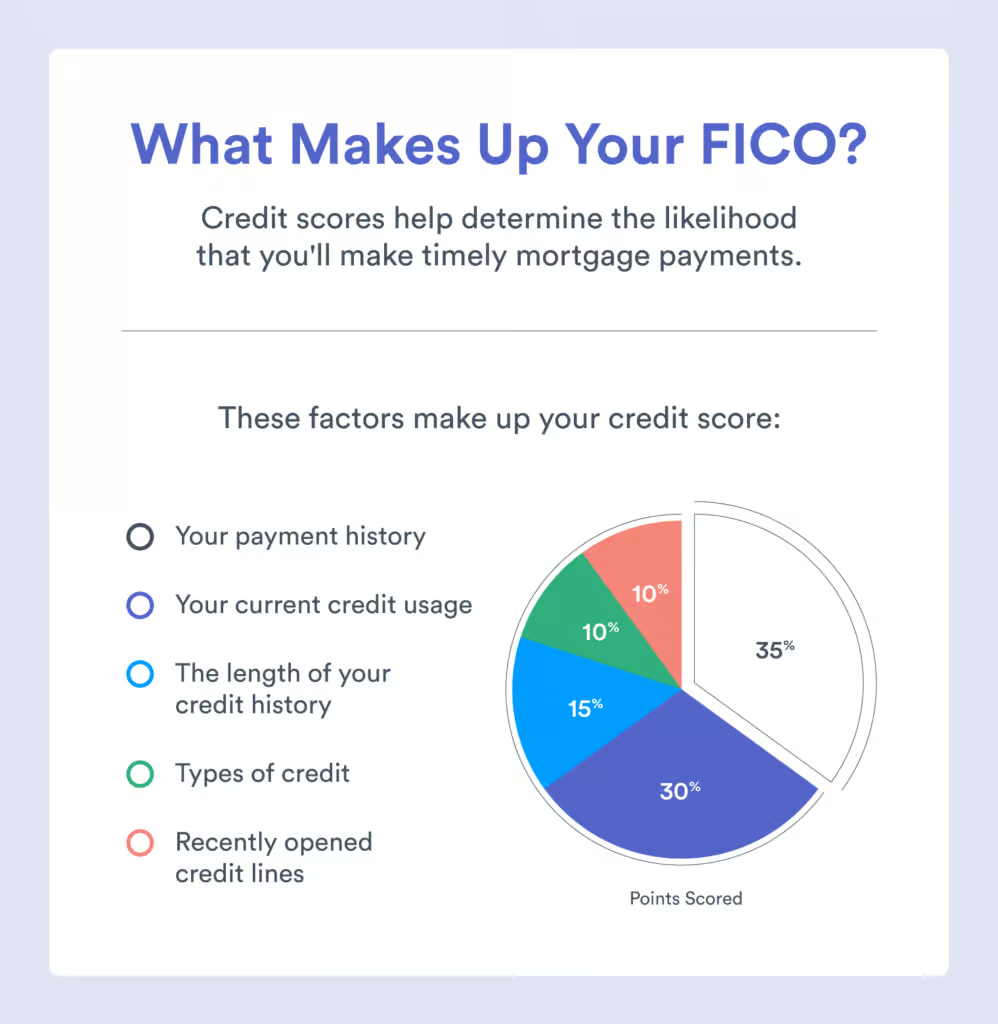

What Credit Score Is Needed To Build A House - West virginia has the most affordable housing, where homebuyers need to earn around $64,000 per year to afford the median house. Explore the requirements and guidelines to secure financing for your construction project. Its estimated market value and its. Find out the necessary credit score for a construction loan in the finance industry. With this unique financing option, you can buy land and build a home with a usda construction loan—rolling the cost of the land, construction, and permanent mortgage into one. With a federal housing administration (fha). Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. A good credit score to buy a house is 720 or higher. Generally speaking, you’ll likely need a score of at least 620 — what’s classified as a “fair” rating — to qualify with most lenders. Most lenders typically want a minimal credit score of 680 for the loan to be considered, some want the score to be 720 or better. With a federal housing administration (fha). Going into 2022, the minimum credit score needed to get approved for a mortgage is 640, though it would be more accurate to say that anywhere between 620 and 680 would be considered a. Find out the necessary credit score for a construction loan in the finance industry. Its estimated market value and its. Explore the requirements and guidelines to secure financing for your construction project. What is a good credit score to buy a house? These loans aren't insured by a government agency and. With this unique financing option, you can buy land and build a home with a usda construction loan—rolling the cost of the land, construction, and permanent mortgage into one. Learn how to rent out your house in 12 easy steps and how to manage your rental properties with specialized landlord software, like avail. This official evaluation of the home determines two things: Since the average credit score in canada is around 650, the requirements for construction financing. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. Conventional loans typically require a minimum credit. Most lenders generally prefer applicants for a construction loan to have a minimum fico score for construction loan of 700. A lot goes into preparing a site to be turned into a home, from engineering and. Conventional loans typically require a minimum credit score of 620, though some may require a score of 660 or higher. West virginia has the. With a solid history of good credit and a promising. There are a few nuances to. Most lenders typically want a minimal credit score of 680 for the loan to be considered, some want the score to be 720 or better. When you use an fha loan to buy a house, it first has to pass an fha appraisal. Find. When you use an fha loan to buy a house, it first has to pass an fha appraisal. Find out the necessary credit score for a construction loan in the finance industry. This official evaluation of the home determines two things: A credit score of 800 or higher is ideal, as it unlocks the very best loan rates. The answer. Still, there isn’t a set minimum score. Conventional loans typically require a minimum credit score of 620, though some may require a score of 660 or higher. A lot goes into preparing a site to be turned into a home, from engineering and. With this unique financing option, you can buy land and build a home with a usda construction. Some construction loans can be converted to mortgages after your home is finished. Find out how your building construction project can be financed with the right credit score. Fha construction loans need a minimum credit score of 580. Its estimated market value and its. To qualify for a home construction loan, you need a credit score of at least 680. But, in practice, you usually need at least a 640 score. Your credit report and your credit score are two different things. Some construction loans can be converted to mortgages after your home is finished. Most lenders typically want a minimal credit score of 680 for the loan to be considered, some want the score to be 720 or better.. With a federal housing administration (fha). Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. Since the average credit score in canada is around 650, the requirements for construction financing. To get a construction loan, you need to meet certain criteria. When you use an fha loan to buy a house, it first. There are a few nuances to. But, in practice, you usually need at least a 640 score. Learn how to rent out your house in 12 easy steps and how to manage your rental properties with specialized landlord software, like avail. Explore the requirements and guidelines to secure financing for your construction project. These loans aren't insured by a government. With a solid history of good credit and a promising. Your credit report and your credit score are two different things. Find out how your building construction project can be financed with the right credit score. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. With a federal housing administration (fha). Most lenders generally prefer applicants for a construction loan to have a minimum fico score for construction loan of 700. There are a few nuances to. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. Construction loans let you finance the materials and labor to build a house from scratch — as opposed to a traditional mortgage loan, which is only for completed homes. To get a construction loan, you need to meet certain criteria. In 2024, site work contributed an average of $32,719 to the cost of building a new home. Generally speaking, you’ll likely need a score of at least 620 — what’s classified as a “fair” rating — to qualify with most lenders. Since the average credit score in canada is around 650, the requirements for construction financing. A good credit score to buy a house is 720 or higher. These loans aren't insured by a government agency and. What is the minimum credit score for a home construction loan? Higher scores reflect a better credit. Your credit report and your credit score are two different things. Most lenders will require you to have a minimum credit score of 620 or higher in order to qualify for a construction loan. With this unique financing option, you can buy land and build a home with a usda construction loan—rolling the cost of the land, construction, and permanent mortgage into one. West virginia has the most affordable housing, where homebuyers need to earn around $64,000 per year to afford the median house.Credit Score Needed to Buy a House YouTube

this is a credit score for a modular home

What is a Good Credit Score to Buy a House in 2019 Homes for Heroes

What Credit Score is Needed to Buy a House? Lakewood Realty Blog

What Credit Score Is Needed To Buy A House (Updated For 2018)

What Credit Score Do You Need to Buy a House in Utah? Intercap Lending

What Credit Score Do You Need To Buy a House? Mortgage

What Should My Credit Score be to Buy a House? YouTube

What Credit Score is Needed to Buy a House? Credit score, Credit

What Credit Score Do You Need to Buy a House?

The First Thing You Want To Do Is Make Sure You Qualify For An Fha Construction Loan.

Its Estimated Market Value And Its.

Find Out The Necessary Credit Score For A Construction Loan In The Finance Industry.

This Official Evaluation Of The Home Determines Two Things:

Related Post: