What Happens When You Turn Off Safer Credit Building Chime

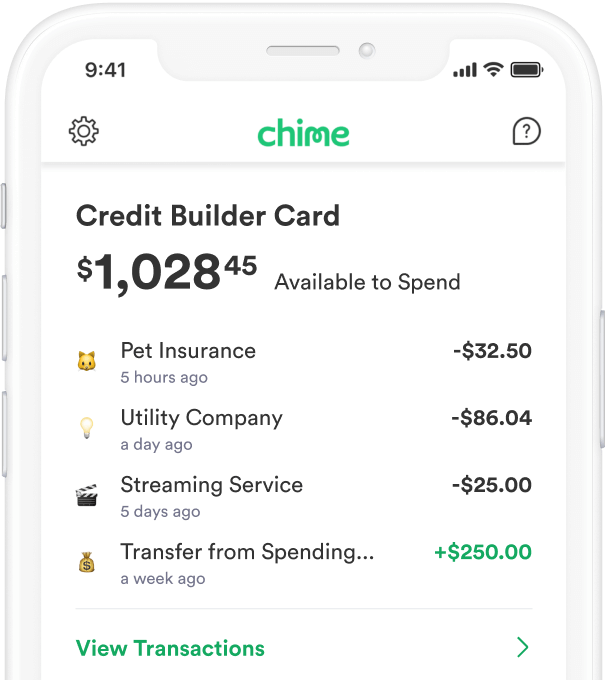

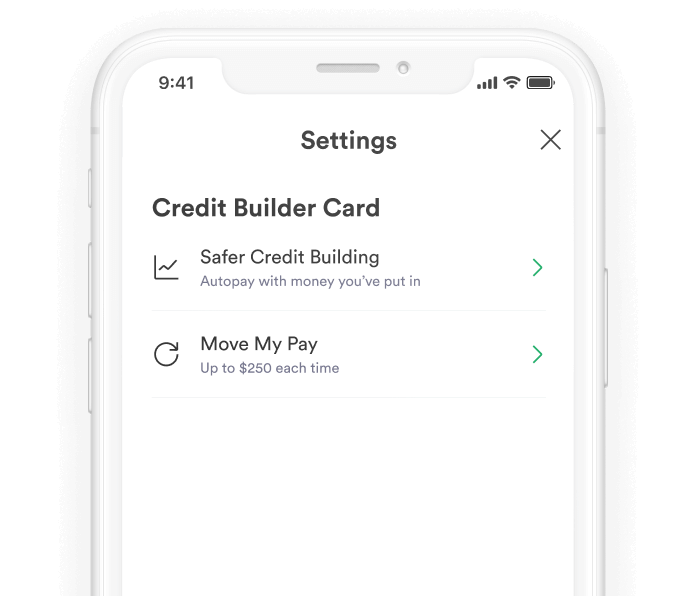

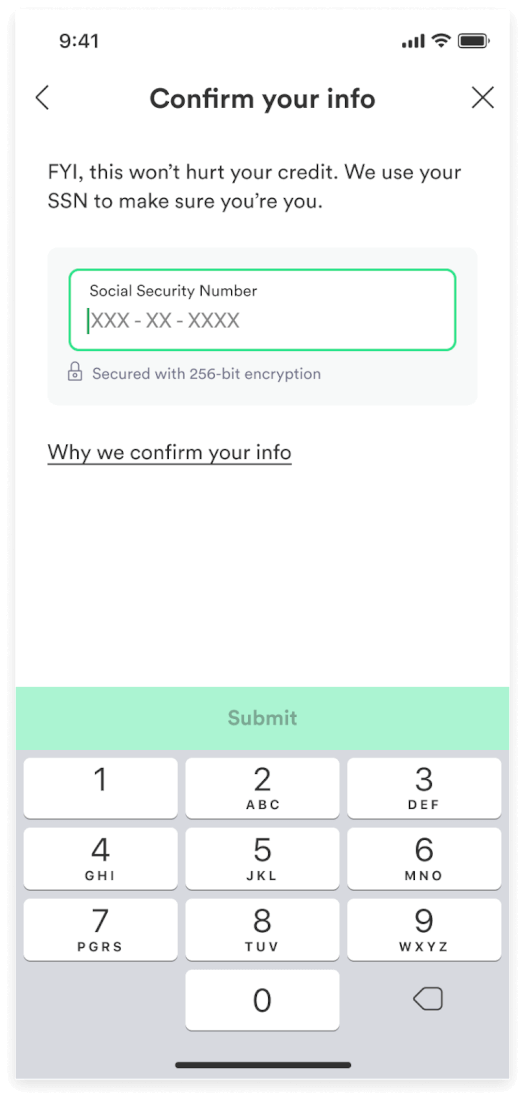

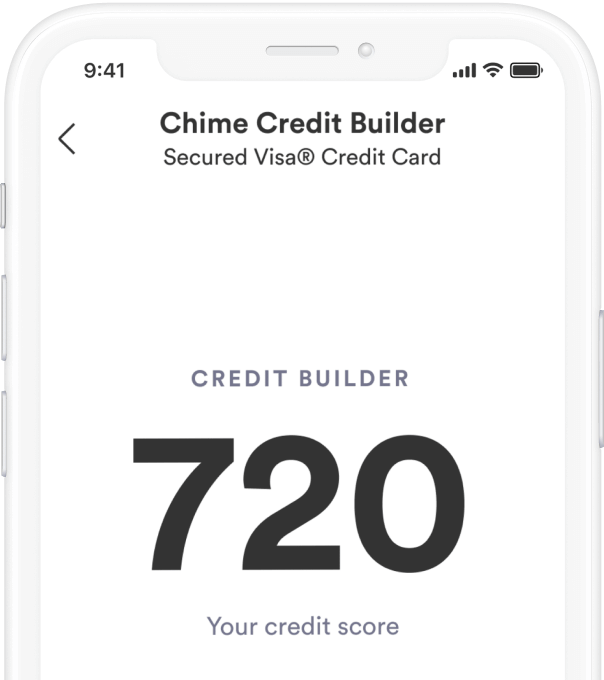

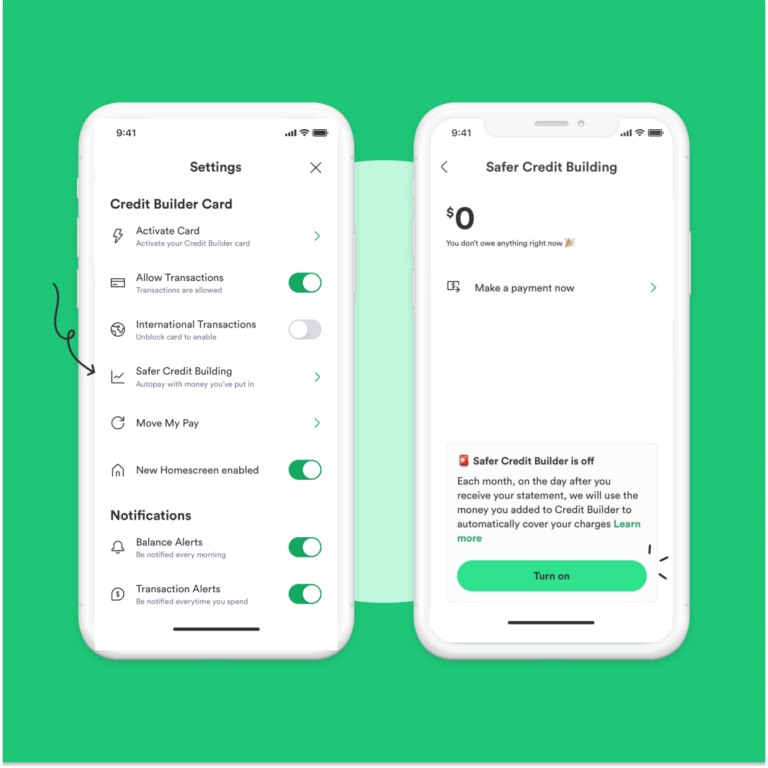

What Happens When You Turn Off Safer Credit Building Chime - You can stay on top of your payments by having safer credit building toggled on. You have to pay off your balance each month, which means paying on time and paying your. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. If you choose to turn on the safer credit building feature, your outstanding balance will be automatically paid on time every month with the money set aside. If you’ve turned on the optional safer credit building, which automatically pays off the card with the funds you’ve deposited in the account, you don’t have to worry about missing. Chime is a financial technology company, not a bank. This can help you build your. When you have safer credit building on you don’t see the balance you owe and the money they stored away in your secured account. Safer credit building is an autopay feature. No, you don't want safe credit building on. You have to pay off your balance each month, which means paying on time and paying your. You have to pay just like any other credit card or it becomes. Your payment is overdue if it hasn’t been paid by the. If you choose to turn on the safer credit building feature, your outstanding balance will be automatically paid on time every month with the money set aside. When you turn it off you can see the money in your. You'll learn about the importance of. Now you have your debit card account where you deposit your funds. If you’ve turned on the optional safer credit building, which automatically pays off the card with the funds you’ve deposited in the account, you don’t have to worry about missing. Banking services provided by the bancorp bank… We will notify you by email when your statement is available. The chime credit builder card will help you build credit safely simply because it's a charge card. This can help you build your. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. If you choose. Using this feature, your card automatically pays off your balance every month with money you transfer. If can't login and make your own payments, you. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. The chime credit builder card will help you build credit safely simply because. When you turn on safer credit building, your payments will be automatic. No, you don't want safe credit building on. The day after your monthly statement is issued, the hold on the money you’ve spent will be released,. We will notify you by email when your statement is available. Banking services provided by the bancorp bank… Your payment is overdue if it hasn’t been paid by the. This can help you build your. If you choose to turn on the safer credit building feature, your outstanding balance will be automatically paid on time every month with the money set aside. It's worth noting that chime doesn’t affect your credit when you apply for the secured chime®. When you have safer credit building on you don’t see the balance you owe and the money they stored away in your secured account. It uses the money you have in your secured account to pay off your credit builder monthly card account balance in full. From my understanding, the absolute only difference is that when disabled you have to. You will gain the most by making the payments yourself and login weekly and make them. You can stay on top of your payments by having safer credit building toggled on. Now you have your debit card account where you deposit your funds. Banking services provided by the bancorp bank… You have to pay off your balance each month, which. From my understanding, the absolute only difference is that when disabled you have to manually push a button to pay your balance, whereas when it's enabled it just pays it automatically. Your payment is overdue if it hasn’t been paid by the. Now you have your debit card account where you deposit your funds. The secured chime credit builder visa®. I was told that the funds transfered to the credit builder account sets the spending limit for the card, and without the safer credit building option enabled the funds will not be pulled from. Chime is a financial technology company, not a bank. The day after your monthly statement is issued, the hold on the money you’ve spent will be. The chime credit builder card will help you build credit safely simply because it's a charge card. If you choose to turn on the safer credit building feature, your outstanding balance will be automatically paid on time every month with the money set aside. 29k subscribers in the chimefinancial community. The day after your monthly statement is issued, the hold. This can help you build your. I’m not understanding why you would want to turn it off to make a manual payment, when the payment has already been paid as soon as you spend the credit limit you set for yourself. Your payment is overdue if it hasn’t been paid by the. No, you don't want safe credit building on.. Banking services provided by the bancorp bank… Your payment is overdue if it hasn’t been paid by the. When you turn on safer credit building, your payments will be automatic. From my understanding, the absolute only difference is that when disabled you have to manually push a button to pay your balance, whereas when it's enabled it just pays it automatically. If you choose to turn on the safer credit building feature, your outstanding balance will be automatically paid on time every month with the money set aside. It's worth noting that chime doesn’t affect your credit when you apply for the secured chime® credit builder visa® credit card, as it doesn’t perform a credit check. By turning on safer credit building, you authorize chime to automatically make transfers from your secured deposit account to your card account to pay off the monthly billing statement’s. Safer credit building is an autopay feature. Additionally, we will cover the implications of turning off this feature and how it shifts the responsibility of payment management to you. The day after your monthly statement is issued, the hold on the money you’ve spent will be released,. If you’ve turned on the optional safer credit building, which automatically pays off the card with the funds you’ve deposited in the account, you don’t have to worry about missing. You can stay on top of your payments by having safer credit building toggled on. When you turn it off you can see the money in your. You have to pay just like any other credit card or it becomes. When you have safer credit building on you don’t see the balance you owe and the money they stored away in your secured account. Now you have your debit card account where you deposit your funds.Credit Card To Build Credit Securely Chime

Chime Credit Builder Lowering Credit? r/chimefinancial

How Does Chime Credit Builder Work

How to build credit with Credit Builder Chime

How to build credit with Credit Builder Chime

How to Sign Up for Chime Credit Builder Chime

Credit Card To Build Credit Securely Chime

Does Chime mess up your credit? Leia aqui Why is Chime lowering my

How to Build Credit The 7Step Guide Chime

Credit Builder Understanding monthly statements and balances Chime

The Secured Chime Credit Builder Visa® Credit Card * May Be A Good Option For Cardholders Who Need To Rebuild Bad Credit Or Start Building Credit History From Scratch.

This Can Help You Build Your.

I Was Told That The Funds Transfered To The Credit Builder Account Sets The Spending Limit For The Card, And Without The Safer Credit Building Option Enabled The Funds Will Not Be Pulled From.

Using This Feature, Your Card Automatically Pays Off Your Balance Every Month With Money You Transfer.

Related Post: