What Is A Cap Rate On An Apartment Building

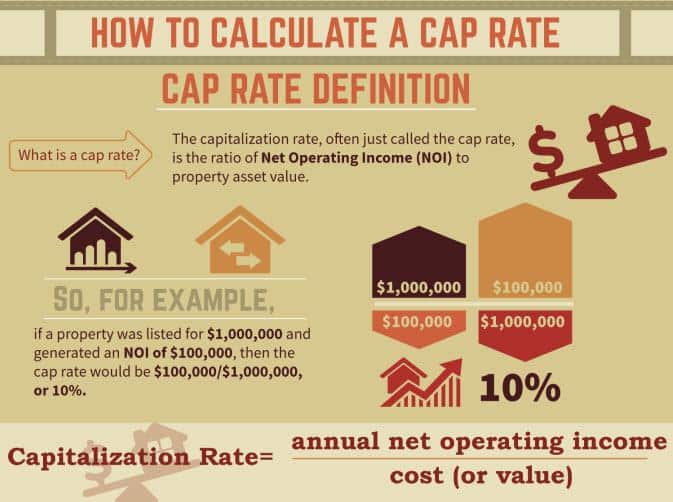

What Is A Cap Rate On An Apartment Building - Cap rate = net operating income (noi) / property value. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. It serves the same purpose as an earnings multiplier does for stock investors. A desirable cap rate for multifamily properties falls. Apartment buildings california oakland 149. There are three kinds of caps: However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and changes to immigration policies that could. That means its value is about $500,000 ($30,000 / 0.06). This translates to a cap rate of 8.1%, which is the expected annual return on your investment. Say the average local cap rate is 6%, and a property has an noi of $30,000. So listing brochures that advertise apartment buildings will often talk about the distinction between the current cap rate for the building and the market cap. For most investors, 4% is. This translates to a cap rate of 8.1%, which is the expected annual return on your investment. Cap rate = net operating income (noi) / property value. The noi refers to all the revenue you earn from the property minus necessary operating expenses. Typically, class a multifamily properties command a lower cap rate compared to class b or class c apartment buildings. The cap rate for an apartment transaction is. Cap rate is a measure that makes it possible to compare properties even though they produce different levels of operating earnings. Live in style with 52 luxury apartments for rent in hickman mills, kansas city, mo. Apartment buildings california oakland 149. Cap rate = net operating income (noi) / property value. Let apartments.com help you find your perfect fit. That means its value is about $500,000 ($30,000 / 0.06). Live in style with 52 luxury apartments for rent in hickman mills, kansas city, mo. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and. So listing brochures that advertise apartment buildings will often talk about the distinction between the current cap rate for the building and the market cap. Live in style with 52 luxury apartments for rent in hickman mills, kansas city, mo. Each rental property has different. For most investors, 4% is. However, concerns were raised about political and economic uncertainties, such. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. Cap rate is short for “capitalization rate.” it’s a key metric that real estate investors use to analyze potential investments and objectively compare one with another. Each rental property has different. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and. The noi refers to all the revenue you earn from the property minus necessary operating expenses. Let apartments.com help you find your perfect fit. You searched for apartments in st louis place. As one might expect, the higher the cap rate, the better. Cap rate is short for “capitalization rate.” it’s a key metric that real estate investors use to. Say the average local cap rate is 6%, and a property has an noi of $30,000. Each rental property has different. Click to view any of these 44 available rental units in saint louis to see photos, reviews, floor. A desirable cap rate for multifamily properties falls. The noi refers to all the revenue you earn from the property minus. It’s also your rate of return if you bought your. Each rental property has different. It serves the same purpose as an earnings multiplier does for stock investors. For most investors, 4% is. The noi refers to all the revenue you earn from the property minus necessary operating expenses. It serves the same purpose as an earnings multiplier does for stock investors. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. As one might expect, the higher the cap rate, the better. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction. Cap rate is short for “capitalization rate.” it’s a key metric that real estate investors use to analyze potential investments and objectively compare one with another. Apartment buildings california oakland 149. Typically, class a multifamily properties command a lower cap rate compared to class b or class c apartment buildings. It serves the same purpose as an earnings multiplier does. Live in style with 52 luxury apartments for rent in hickman mills, kansas city, mo. Say the average local cap rate is 6%, and a property has an noi of $30,000. Cap rate = net operating income (noi) / property value. It serves the same purpose as an earnings multiplier does for stock investors. For most investors, 4% is. This translates to a cap rate of 8.1%, which is the expected annual return on your investment. It serves the same purpose as an earnings multiplier does for stock investors. As one might expect, the higher the cap rate, the better. That means its value is about $500,000 ($30,000 / 0.06). In short, cap rate is, “the process of converting. The noi refers to all the revenue you earn from the property minus necessary operating expenses. Apartment buildings california oakland 149. Each rental property has different. Let apartments.com help you find your perfect fit. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and changes to immigration policies that could. A desirable cap rate for multifamily properties falls. Cap rate is short for “capitalization rate.” it’s a key metric that real estate investors use to analyze potential investments and objectively compare one with another. Cap rate is a measure that makes it possible to compare properties even though they produce different levels of operating earnings. You searched for apartments in st louis place. A capitalization rate, or simply cap rate, is used in multifamily financing to determine the annual net gain or loss of profit on an investment that is expected to be. Live in style with 52 luxury apartments for rent in hickman mills, kansas city, mo. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. That means its value is about $500,000 ($30,000 / 0.06). It’s also your rate of return if you bought your. Capitalization rates, or cap rates, are a way of estimating the general rate of return of an apartment building by buyers or sellers. Cap rate = net operating income (noi) / property value.What is CAP Rate in Real Estate?

What is the CAP Rate for Apartments? Willowdale Equity

What Is A Cap Rate On An Apartment Building Storables

What Is Cap Rate & How to Calculate It? Infographic Mashvisor

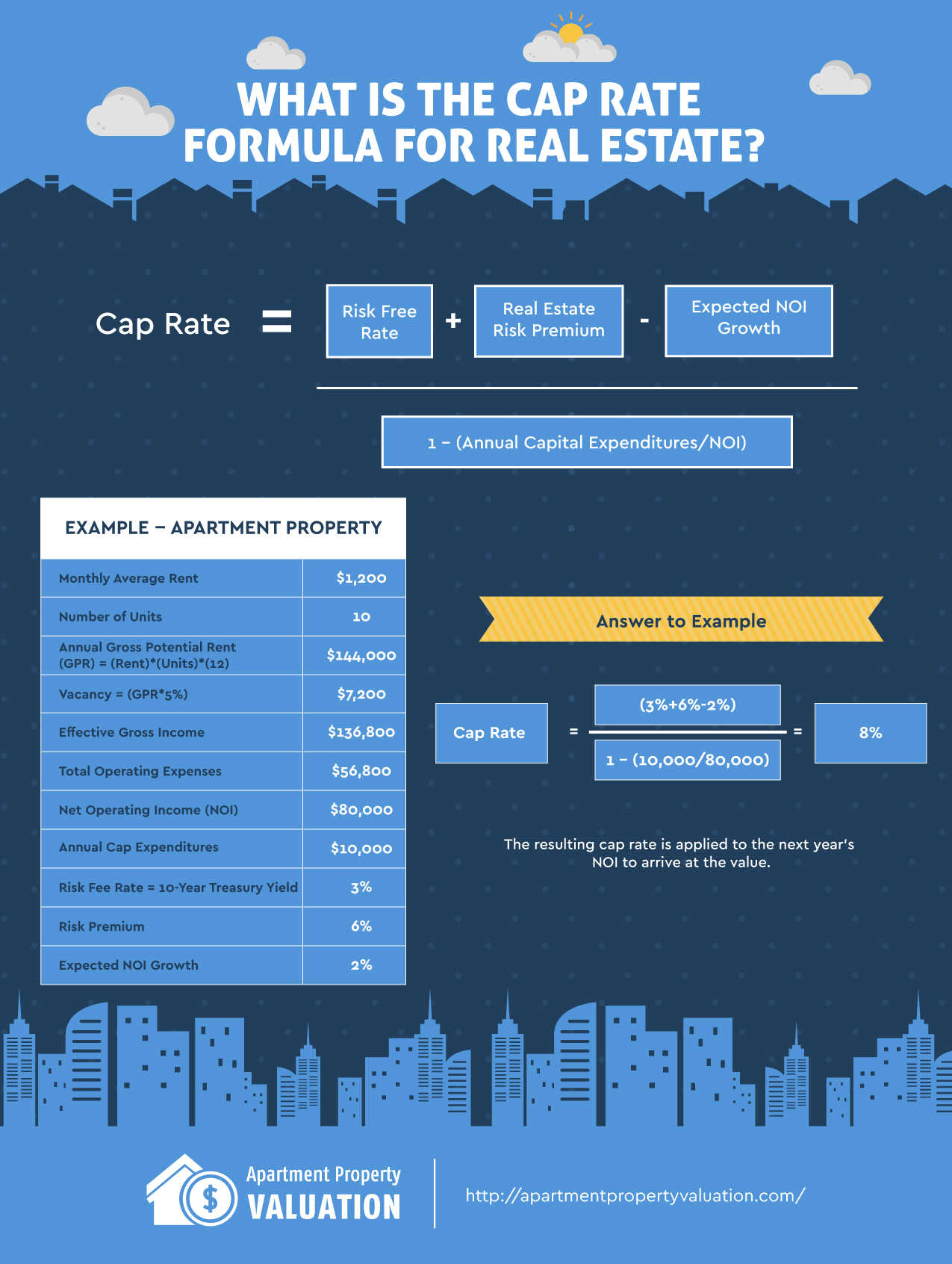

Cap Rate Formula for Real Estate Apartment Property Valuation

Which is a Better Gauge Capitalization Rate or CashonCash Return?

Capitalization Rate Formula & What a Good Cap Rate Is

What is Cap Rate? Everything House Hacking

Easy Cap Rate Calculator

Understanding and Calculating Cap Rate For Rental Properties

In Short, Cap Rate Is, “The Process Of Converting Anticipated Future Income Into Present Value” According To The American Heritage Dictionary.

Click To View Any Of These 44 Available Rental Units In Saint Louis To See Photos, Reviews, Floor.

Say The Average Local Cap Rate Is 6%, And A Property Has An Noi Of $30,000.

So Listing Brochures That Advertise Apartment Buildings Will Often Talk About The Distinction Between The Current Cap Rate For The Building And The Market Cap.

Related Post: