What Is A Tam Build In Finance Modeling

What Is A Tam Build In Finance Modeling - Latent labs is building ai foundation models to “make biology. The first part of the course practically applies excel within a financial framework to explore how forecast financial models can be efficiently created and modified. The broad acceptance and usage of tam makes it an essential metric every startup founder must be able to calculate, justify, and communicate to stakeholders inside and outside. Essential insights for targeted growth and success. How to use a tam model. Explore the tam, sam, som model in business strategy for market analysis and realistic goal setting. Building your total addressable market model. A total addressable market (tam) represents the annual revenue potential for your company if all customers who are a. Total addressable market or tam refers to the total market demand for a product or service = the maximum amount of revenue a business can possibly generate by selling their. This model has become essential for financial professionals seeking to evaluate a firm’s solvency. The first part of the course practically applies excel within a financial framework to explore how forecast financial models can be efficiently created and modified. Building your total addressable market model. In financial modeling, a tam build, or total addressable market build, is the process of quantifying the total revenue opportunity available in a specific market if a business. Essential insights for targeted growth and success. Understanding total addressable market (tam) enables b2b saas founders to make strategic decisions, allocate resources effectively, and appeal to investors—even within. Total addressable market, or tam is the entire revenue potential for a good or service in a market or industry. The efficient use of excel is. Up to 3.2% cash back what is total addressable market (tam)? Role in credit risk analysis the merton model offers a quantitative approach. It involves private sector entities financing, constructing, and. This model has become essential for financial professionals seeking to evaluate a firm’s solvency. Building your total addressable market model. The efficient use of excel is. Up to 3.2% cash back the finance team uses an internal budgeting tool. A total addressable market (tam) represents the annual revenue potential for your company if all customers who are a. A total addressable market (tam) represents the annual revenue potential for your company if all customers who are a. Creating a financial model in excel may sound intimidating at first, but with the right tools and guidance, it can become a manageable and even enjoyable task. Up to 3.2% cash back what is total addressable market (tam)? A new startup. In financial modeling, a tam build, or total addressable market build, is the process of quantifying the total revenue opportunity available in a specific market if a business. Up to 3.2% cash back what is total addressable market (tam)? Total addressable market or tam refers to the total market demand for a product or service = the maximum amount of. Explore the tam, sam, som model in business strategy for market analysis and realistic goal setting. In financial modeling, a tam build, or total addressable market build, is the process of quantifying the total revenue opportunity available in a specific market if a business. Essential insights for targeted growth and success. If you’re ready to build your own tam, check. If you’re ready to build your own tam, check out this article on building a total addressable market model for a b2b company. The first part of the course practically applies excel within a financial framework to explore how forecast financial models can be efficiently created and modified. Access the free market sizing, tam & sensitivity analysis template here along. The broad acceptance and usage of tam makes it an essential metric every startup founder must be able to calculate, justify, and communicate to stakeholders inside and outside. What exactly is a tam, and how can it be used? Latent labs is building ai foundation models to “make biology. Building your total addressable market model. Elon musk's department of government. Access the free market sizing, tam & sensitivity analysis template here along with full instructions on how to build your own model. Up to 3.2% cash back the finance team uses an internal budgeting tool. Understanding total addressable market (tam) enables b2b saas founders to make strategic decisions, allocate resources effectively, and appeal to investors—even within. How to use a. The efficient use of excel is. Essential insights for targeted growth and success. Access the free market sizing, tam & sensitivity analysis template here along with full instructions on how to build your own model. A new startup founded by a former google deepmind scientist is exiting stealth with $50 million in funding. Total addressable market (tam, occasionally referred to. This model has become essential for financial professionals seeking to evaluate a firm’s solvency. The broad acceptance and usage of tam makes it an essential metric every startup founder must be able to calculate, justify, and communicate to stakeholders inside and outside. Access the free market sizing, tam & sensitivity analysis template here along with full instructions on how to. A new startup founded by a former google deepmind scientist is exiting stealth with $50 million in funding. Latent labs is building ai foundation models to “make biology. What exactly is a tam, and how can it be used? Total addressable market, or tam is the entire revenue potential for a good or service in a market or industry. How. Total addressable market (tam, occasionally referred to as total available market) is a form of market sizing that enables a business to define the holistic revenue opportunity offered from its. Essential insights for targeted growth and success. This model has become essential for financial professionals seeking to evaluate a firm’s solvency. The broad acceptance and usage of tam makes it an essential metric every startup founder must be able to calculate, justify, and communicate to stakeholders inside and outside. What is tam and how do i estimate it? Role in credit risk analysis the merton model offers a quantitative approach. A total addressable market (tam) represents the annual revenue potential for your company if all customers who are a. Understanding total addressable market (tam) enables b2b saas founders to make strategic decisions, allocate resources effectively, and appeal to investors—even within. Total addressable market or tam refers to the total market demand for a product or service = the maximum amount of revenue a business can possibly generate by selling their. Up to 3.2% cash back what is total addressable market (tam)? Elon musk's department of government efficiency has targeted federal agencies like usaid, cfpb, and noaa to reduce government spending. Access the free market sizing, tam & sensitivity analysis template here along with full instructions on how to build your own model. In financial modeling, a tam build, or total addressable market build, is the process of quantifying the total revenue opportunity available in a specific market if a business. If you’re ready to build your own tam, check out this article on building a total addressable market model for a b2b company. Whether you're an investor, a financial analyst, or part of a corporate executive team, financial modeling offers a way to evaluate the current and future financial state of a company. It involves private sector entities financing, constructing, and.Building a Defensible TAM for Startup Funding

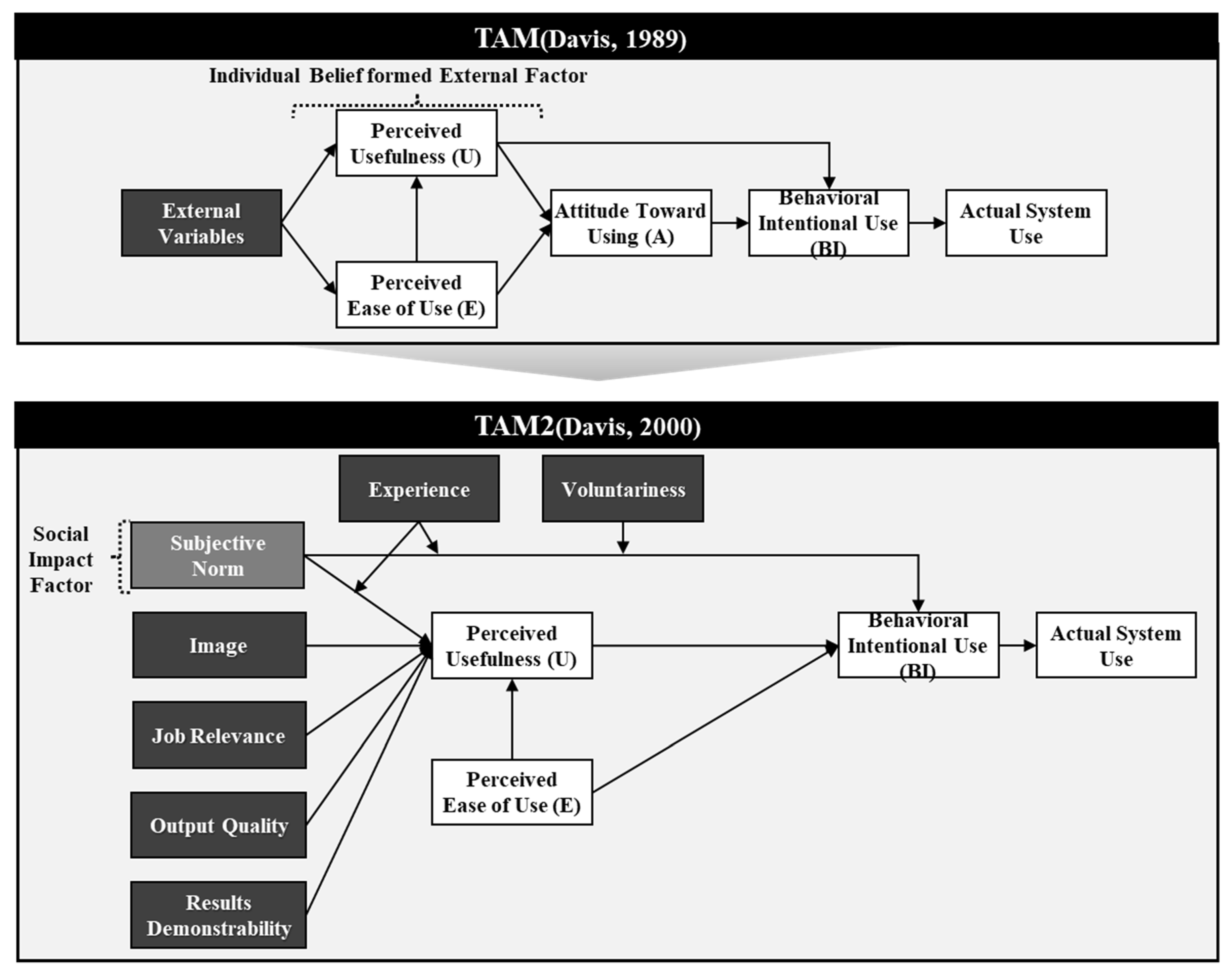

Block Diagrams (TAM)

The Difference Between TopDown and BottomUp TAM Market Sizing

Applied Sciences Free FullText Acceptance Model for Mobile

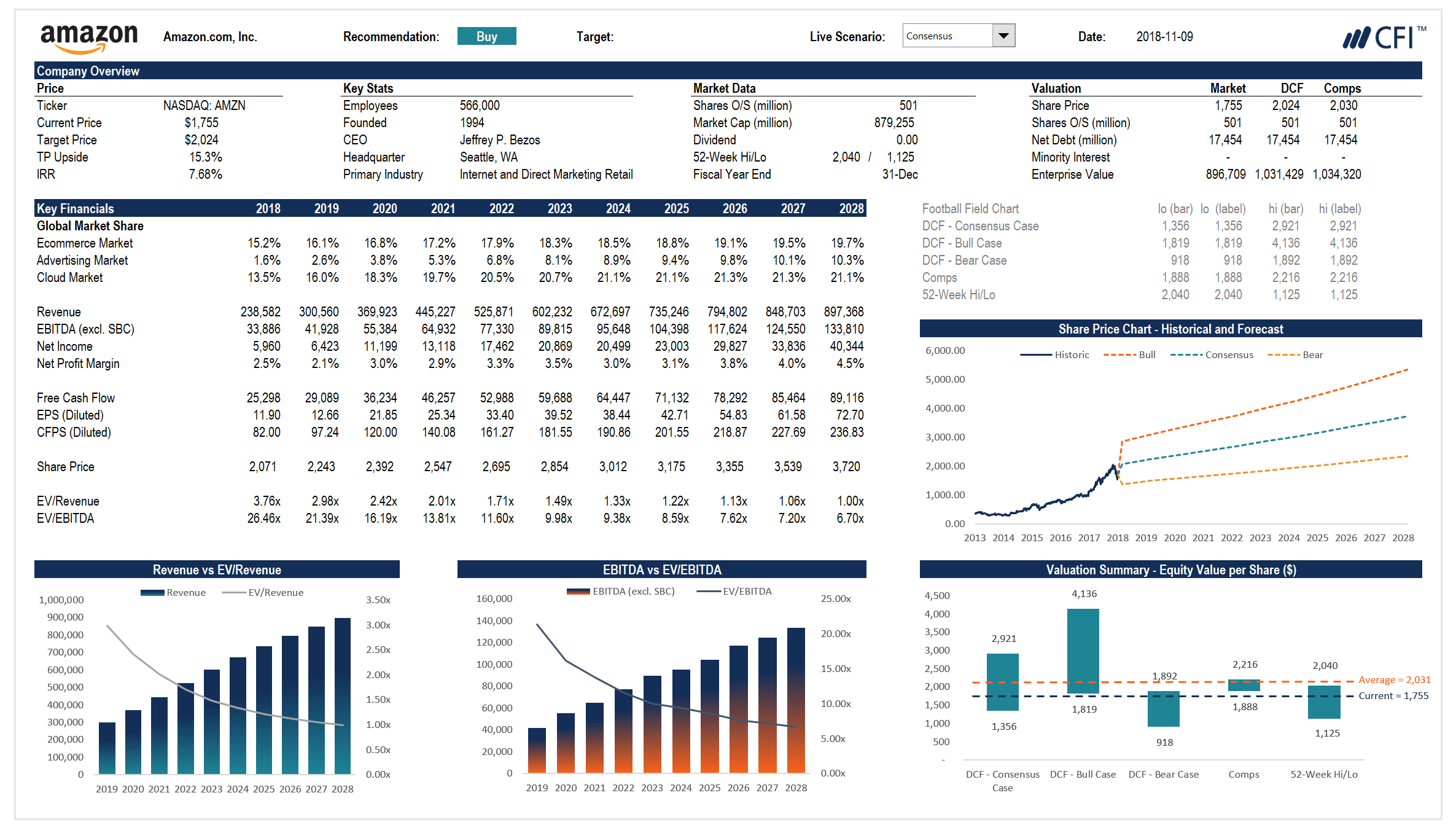

Complete Financial Modeling Guide Step by Step Best Practices

Building a Financial Model Building Financial Models

Market Sizing & TAM Modeling

Technology acceptance model (TAM) and electronic commerce. Download

Building a Defensible TAM for Startup Funding

The Importance of TAM, SAM, and SOM in Your Business Plan

The Sales Team Tracks New Deals In A Customer Relationship Management (Crm).

How To Use A Tam Model.

Explore The Tam, Sam, Som Model In Business Strategy For Market Analysis And Realistic Goal Setting.

Total Addressable Market, Or Tam Is The Entire Revenue Potential For A Good Or Service In A Market Or Industry.

Related Post: