What Is The Cap Rate On An Apartment Building

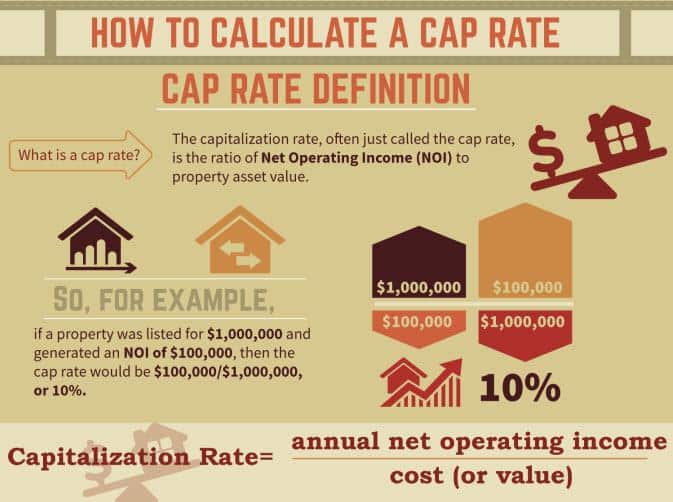

What Is The Cap Rate On An Apartment Building - It’s also your rate of return if you bought your. So, for example, if a property. The property value is $1,000,000. The capitalization rate, typically just called the “cap rate”, is the ratio of net operating income (noi) to property asset value. What is a cap rate in real estate? A cap rate or capitalization rate is a key metric that real estate investors use to analyze and objectively compare potential investments. See how cap rates across the country stack up and learn more about real estate investing! Use our cap rate calculator to find current cap rates for apartment rental properties throughout the united states. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. Enter different addresses to compare properties. *****want to get every new video plus bonus curated content? What is the cap rate and why is it important? So, for example, if a property. A capitalization rate, or simply cap rate, is used in multifamily financing to determine the annual net gain or loss of profit on an investment that is expected to be. The noi is $80,000 ($120,000 —. Enter different addresses to compare properties. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and changes to immigration policies that could. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. Use our cap rate calculator to find current cap rates for apartment rental properties throughout the united states. A cap rate or capitalization rate is a key metric that real estate investors use to analyze and objectively compare potential investments. It’s also your rate of return if you bought your. The capitalization rate is a popular measure to assess a real estate investment property’s return potential. Find current cap rates for apartment buildings by county. There are three kinds of caps: See how cap rates across the country stack up and learn more about real estate investing! Enter different addresses to compare properties. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. The noi is $80,000 ($120,000 —. Apartment buildings california oakland 149. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. What is a cap rate in real estate? Apartment buildings california oakland 149. Enter different addresses to compare properties. A cap rate or capitalization rate is a key metric that real estate investors use to analyze and objectively compare potential investments. The cap rate for an apartment transaction is. The capitalization rate is a popular measure to assess a real estate investment property’s return potential. The capitalization rate, typically just called the “cap rate”, is the ratio of net operating income (noi) to property asset value. The noi is $80,000 ($120,000 —. In short, cap rate is, “the process of converting anticipated future income into present value” according to. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. The property value is $1,000,000. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. *****want to get every new video plus bonus curated content? What is a cap rate in real estate? Apartment buildings california oakland 149. It’s also your rate of return if you bought your. The cap rate for an apartment transaction is. The property value is $1,000,000. There are three kinds of caps: A capitalization rate, or simply cap rate, is used in multifamily financing to determine the annual net gain or loss of profit on an investment that is expected to be. See how cap rates across the country stack up and learn more about real estate investing! It’s also your rate of return if you bought your. The property value is. There are three kinds of caps: In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. So, for example, if a property. A cap rate or capitalization rate is a key metric that real estate investors use to analyze and objectively compare potential investments. It’s also your rate of. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. What is the cap rate and why is it important? In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. However, concerns were raised about political and economic uncertainties, such as potential tariffs on construction materials and. So, for example, if a property. For your convenience, the list also includes the average cap rate. The property value is $1,000,000. Imagine a multiunit apartment building with an annual rental income of $120,000 and operating expenses of $40,000. Use the cap rate list tool to search for the average cap rate (capitalization rate) by top us cities and states. The property value is $1,000,000. Use our cap rate calculator to find current cap rates for apartment rental properties throughout the united states. Enter different addresses to compare properties. It’s also your rate of return if you bought your. Capitalization rates, or cap rates, are a way of estimating the general rate of return of an apartment building by buyers or sellers. A cap rate or capitalization rate is a key metric that real estate investors use to analyze and objectively compare potential investments. Imagine a multiunit apartment building with an annual rental income of $120,000 and operating expenses of $40,000. 21 unit apartment building $3,265,000 ($155,476/unit) 10.28% cap rate oakland, ca 94610. What is a cap rate? A capitalization rate, or simply cap rate, is used in multifamily financing to determine the annual net gain or loss of profit on an investment that is expected to be. What is the cap rate and why is it important? It’s also your rate of return if you bought your. For your convenience, the list also includes the average cap rate. In short, cap rate is, “the process of converting anticipated future income into present value” according to the american heritage dictionary. Apartment buildings california oakland 149. See how cap rates across the country stack up and learn more about real estate investing!What is the CAP Rate for Apartments? Willowdale Equity

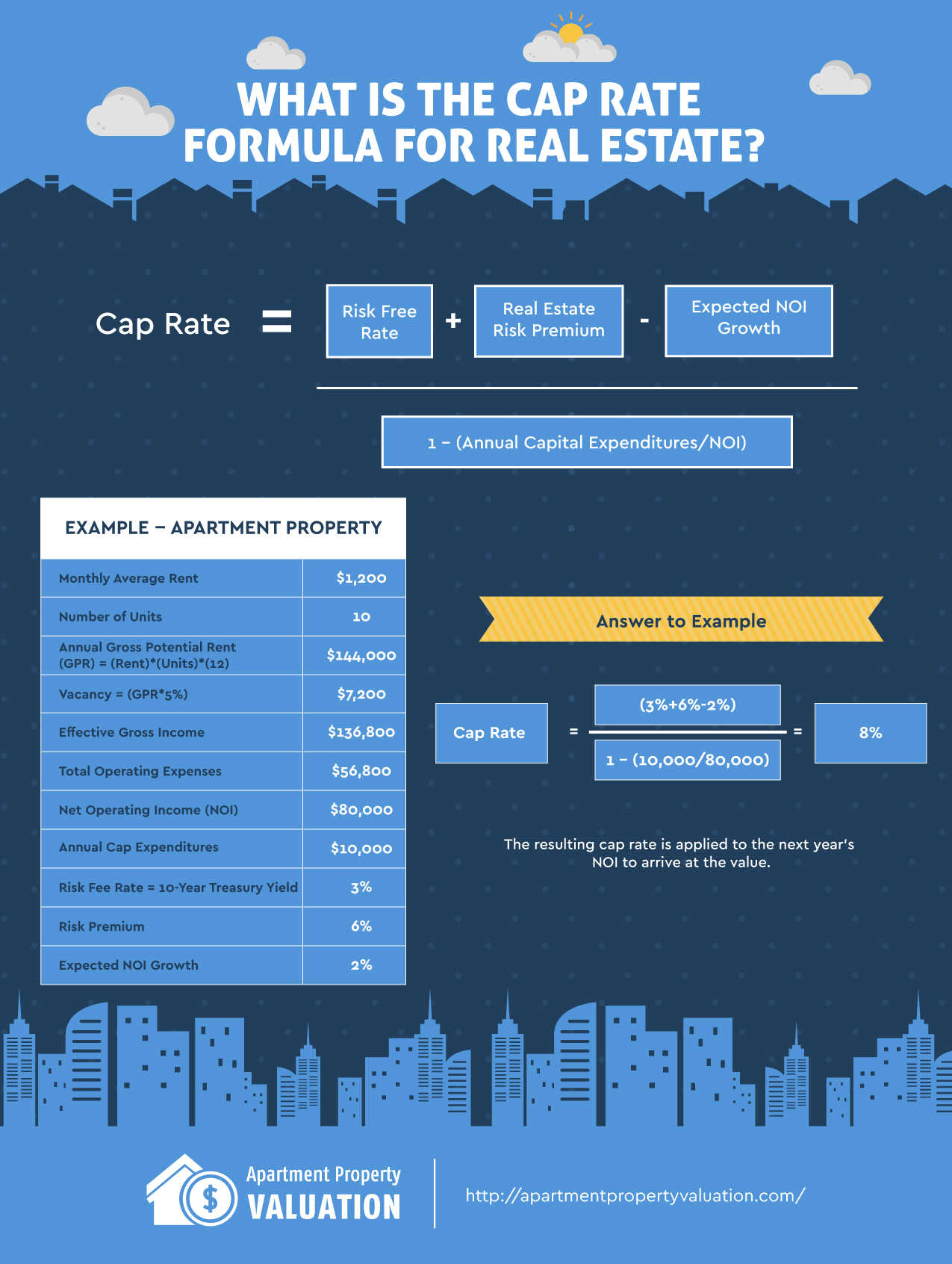

Cap Rate Formula for Real Estate Apartment Property Valuation

Easy Cap Rate Calculator

Which is a Better Gauge Capitalization Rate or CashonCash Return?

Capitalization Rate Formula & What a Good Cap Rate Is

Understanding and Calculating Cap Rate For Rental Properties

What Is Cap Rate & How to Calculate It? Infographic Mashvisor

What Is A Cap Rate On An Apartment Building Storables

What is CAP Rate in Real Estate?

What is Cap Rate? Everything House Hacking

Use The Cap Rate List Tool To Search For The Average Cap Rate (Capitalization Rate) By Top Us Cities And States.

The Capitalization Rate Is A Popular Measure To Assess A Real Estate Investment Property’s Return Potential.

The Noi Is $80,000 ($120,000 —.

The Capitalization Rate, Typically Just Called The “Cap Rate”, Is The Ratio Of Net Operating Income (Noi) To Property Asset Value.

Related Post: