When Can You Start Building Credit For Your Child

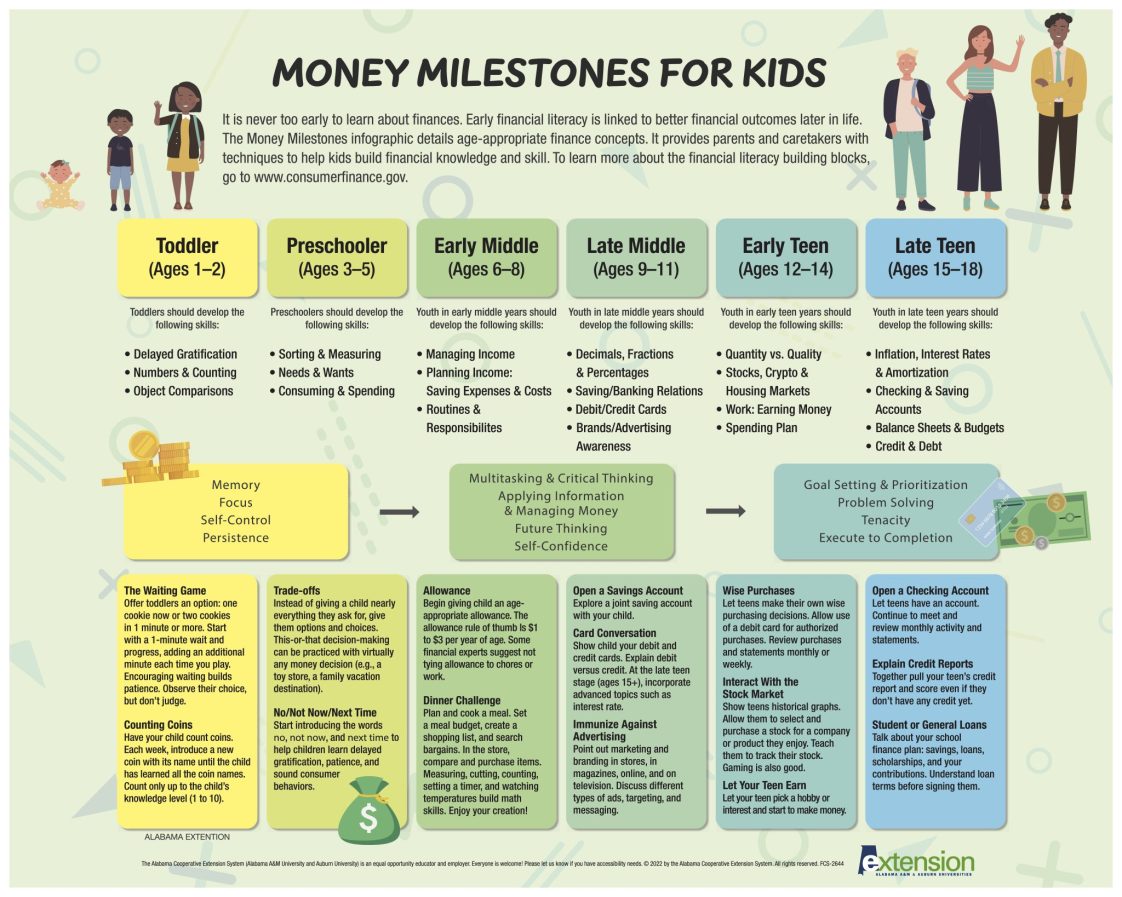

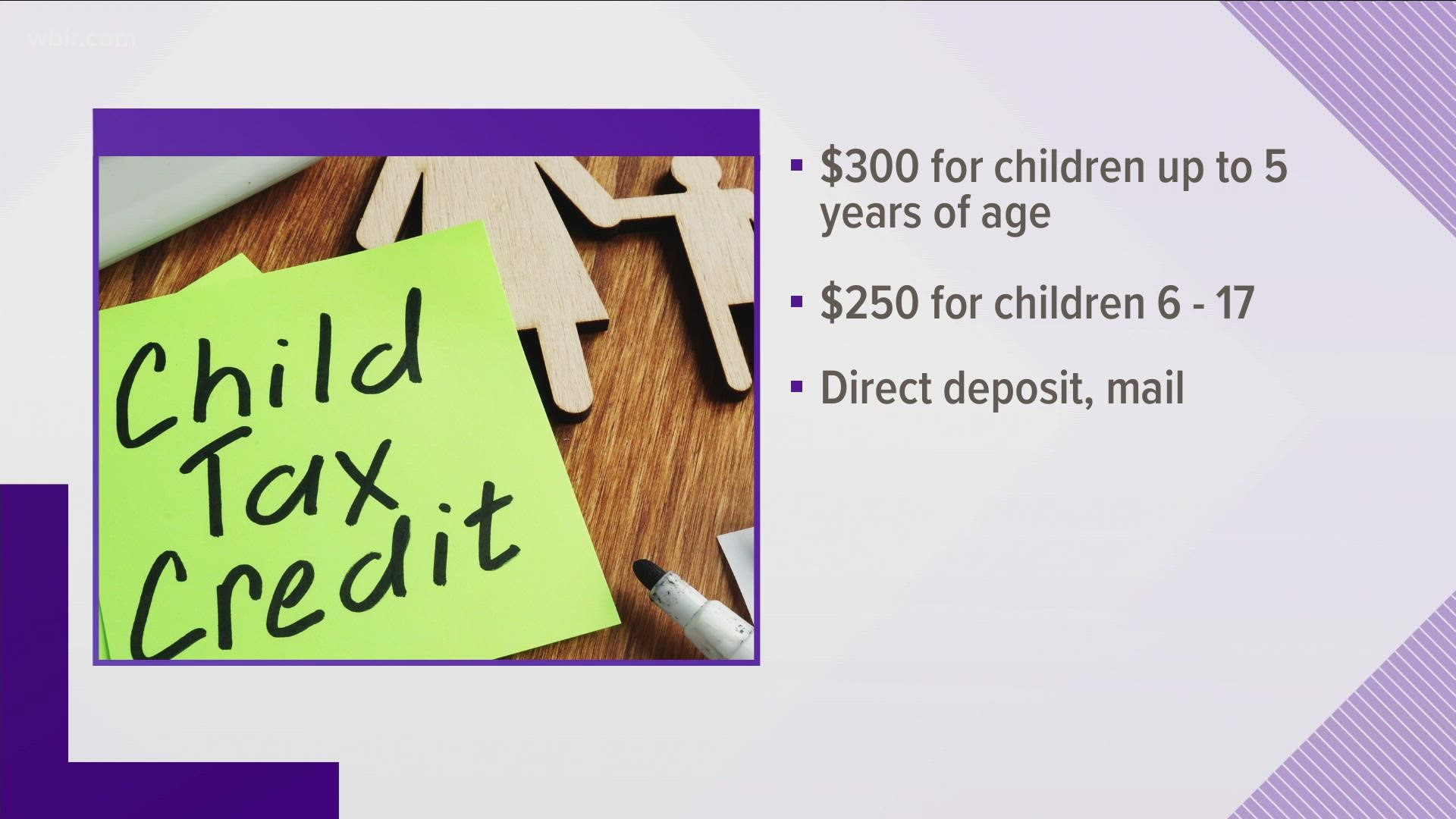

When Can You Start Building Credit For Your Child - The short answer is that 18 is the minimum age for financial products such as loans and credit cards. For more, find out how the saver's credit might be able to. Find out when children can start building credit and how to help them get started in. You can start building credit for your child by adding them as an authorized user at a young age, opening a credit card in their account when they’re a teenager and cosigning on. Fortunately, as a parent, you can give your child’s credit a bit of a jump start before they even turn 18. You can get $1,700 per child back in a separate. Once you’ve set your goal, it’s time to choose the right investment account for your child’s education. Your child does not need to be 18 to start building credit. At this age, you can apply for more loans and credit cards. And, more specifically, at what age can you start building credit? When should you start helping your child build credit? After all, it is still possible to build credit as a minor. The right time is going to depend on two important. 👏 you can help them establish a solid credit history and credit score that’ll. The simplest way may be to add him or her as an authorized user on your credit card today. You can get $1,700 per child back in a separate. Fortunately, as a parent, you can give your child’s credit a bit of a jump start before they even turn 18. The general answer to the question “what age can you start building credit?” is 18, but there’s more to it than that. In summary, your child can start building credit as a teen, so long as you allow them to be an authorized user on your credit card, your credit history is good, and that credit card. You need to be 18 to open your own credit card, but that doesn’t mean you have to wait until then to start building your credit. Cnbc select spoke to three financial experts who shared their best tips on how to help your child build credit and use. Once you’ve set your goal, it’s time to choose the right investment account for your child’s education. When should you start helping your child build credit? For more, find out how the saver's credit might be able to.. The credit union boasts a. The earlier you start, the more time you have to build a solid credit history that will serve your child well into adulthood. The credit you can receive per child begins to decrease by $50 per $1,000 of income you make over those thresholds. Once you’ve set your goal, it’s time to choose the right. Which minors can start using at the age of 13. Fortunately, as a parent, you can give your child’s credit a bit of a jump start before they even turn 18. The right time is going to depend on two important. The earlier you start, the more time you have to build a solid credit history that will serve your. As a parent, you can help your child build their credit score. It’s never too early to start. The credit you can receive per child begins to decrease by $50 per $1,000 of income you make over those thresholds. Which minors can start using at the age of 13. 👏 you can help them establish a solid credit history and. And, more specifically, at what age can you start building credit? Teaching your kids about financial responsibility at a young age helps build strong financial liter. The credit union boasts a. In this article, we’ll discuss at what age you can start building credit as well as when and how you should start working on building your teens’ financial futures.. For more, find out how the saver's credit might be able to. Once you’ve set your goal, it’s time to choose the right investment account for your child’s education. Find out when children can start building credit and how to help them get started in. You need to be 18 to open your own credit card, but that doesn’t mean. The earlier you start, the more time you have to build a solid credit history that will serve your child well into adulthood. Once you’ve set your goal, it’s time to choose the right investment account for your child’s education. And, more specifically, at what age can you start building credit? There's no perfect time to help your child start. Cnbc select spoke to three financial experts who shared their best tips on how to help your child build credit and use. As a parent, you can help your child build their credit score. The right time is going to depend on two important. The credit union boasts a. Most of us don’t get started until our mid 20s, but. In this article, we’ll discuss at what age you can start building credit as well as when and how you should start working on building your teens’ financial futures. And, more specifically, at what age can you start building credit? Which minors can start using at the age of 13. Fortunately, as a parent, you can give your child’s credit. Teaching your kids about financial responsibility at a young age helps build strong financial liter. As a parent, you can help your child build their credit score. It’s never too early to start. The credit union boasts a. In summary, your child can start building credit as a teen, so long as you allow them to be an authorized user. According to cnbc, any young adult over 18 can begin. Helping your child establish and build credit early can lead them to financial success. In this article, we’ll discuss at what age you can start building credit as well as when and how you should start working on building your teens’ financial futures. Building credit should start early if you want to set your child up for financial success. The simplest way may be to add him or her as an authorized user on your credit card today. At this age, you can apply for more loans and credit cards. In summary, your child can start building credit as a teen, so long as you allow them to be an authorized user on your credit card, your credit history is good, and that credit card. 👏 you can help them establish a solid credit history and credit score that’ll. You can start building credit for your child by adding them as an authorized user at a young age, opening a credit card in their account when they’re a teenager and cosigning on. The short answer is that 18 is the minimum age for financial products such as loans and credit cards. Here are three popular options to consider. When should you start helping your child build credit? After all, it is still possible to build credit as a minor. The general answer to the question “what age can you start building credit?” is 18, but there’s more to it than that. It’s never too early to start. Most of us don’t get started until our mid 20s, but the truth is that you can start building credit as young as 18.At what age can you help your child build credit? Leia aqui Can I help

What age can I start building my child’s credit? Leia aqui Can a 13

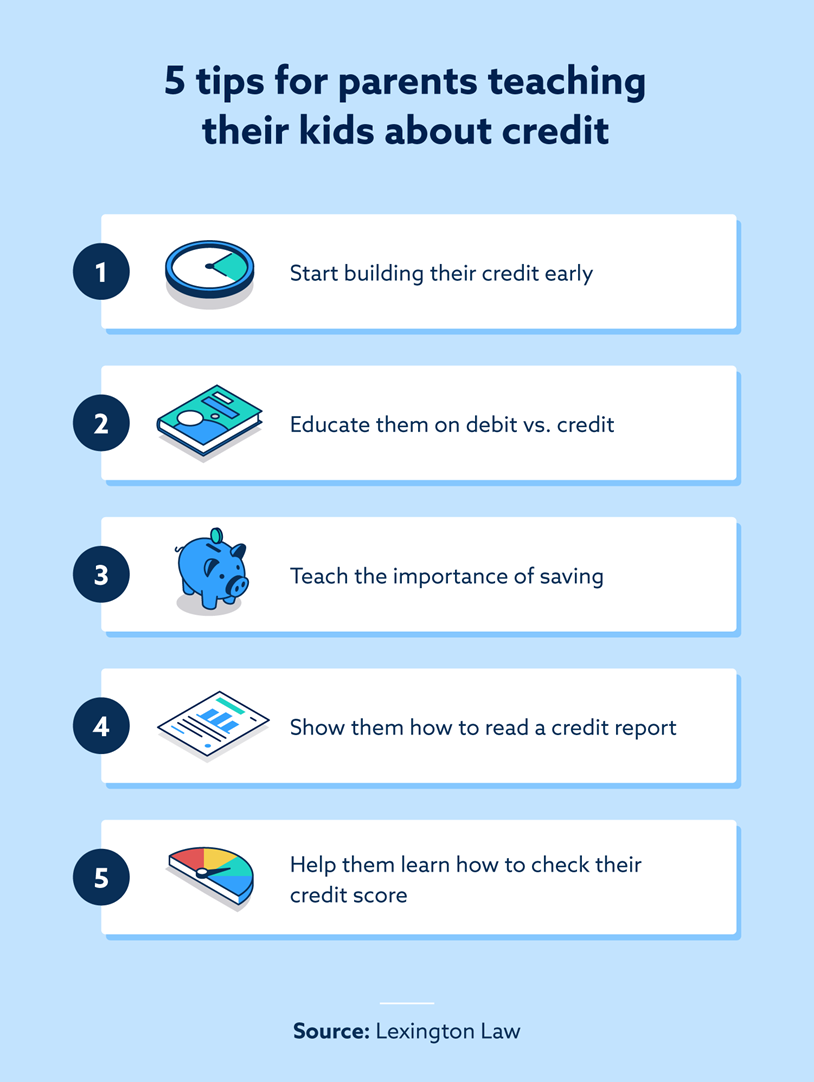

10 Tips to Start Building Credit for Your Child Lexington Law

Why It's Important to Start Building Credit at a Young Age Raising

How to Build Credit The 7Step Guide Chime

When can a kid start building credit? Leia aqui How soon can a child

10 Tips to Start Building Credit for Your Child Lexington Law

How to Build Credit for Your Kids While They're Young What to Do

How can my 17 year old start building credit? Leia aqui How do I start

How to Start Building Credit for Your Child Core Credit Solutions

There's No Perfect Time To Help Your Child Start Building Credit.

The Right Time Is Going To Depend On Two Important.

For More, Find Out How The Saver's Credit Might Be Able To.

The Credit Union Boasts A.

Related Post: