Which Type Of Credit Is Used To Lease A Building

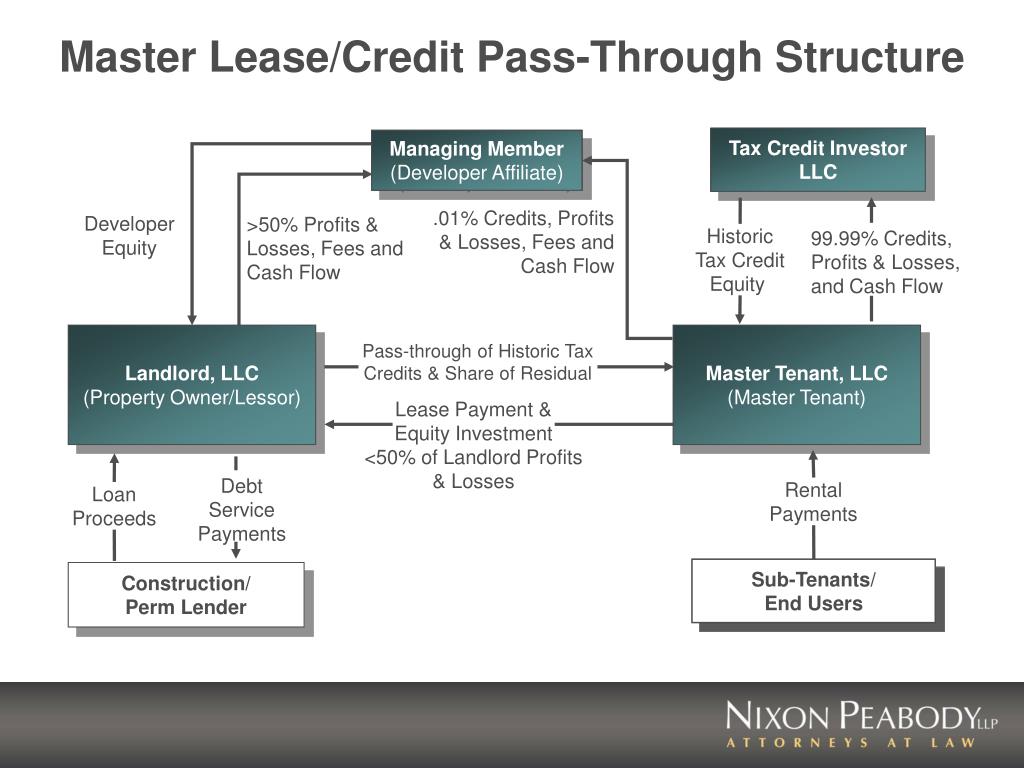

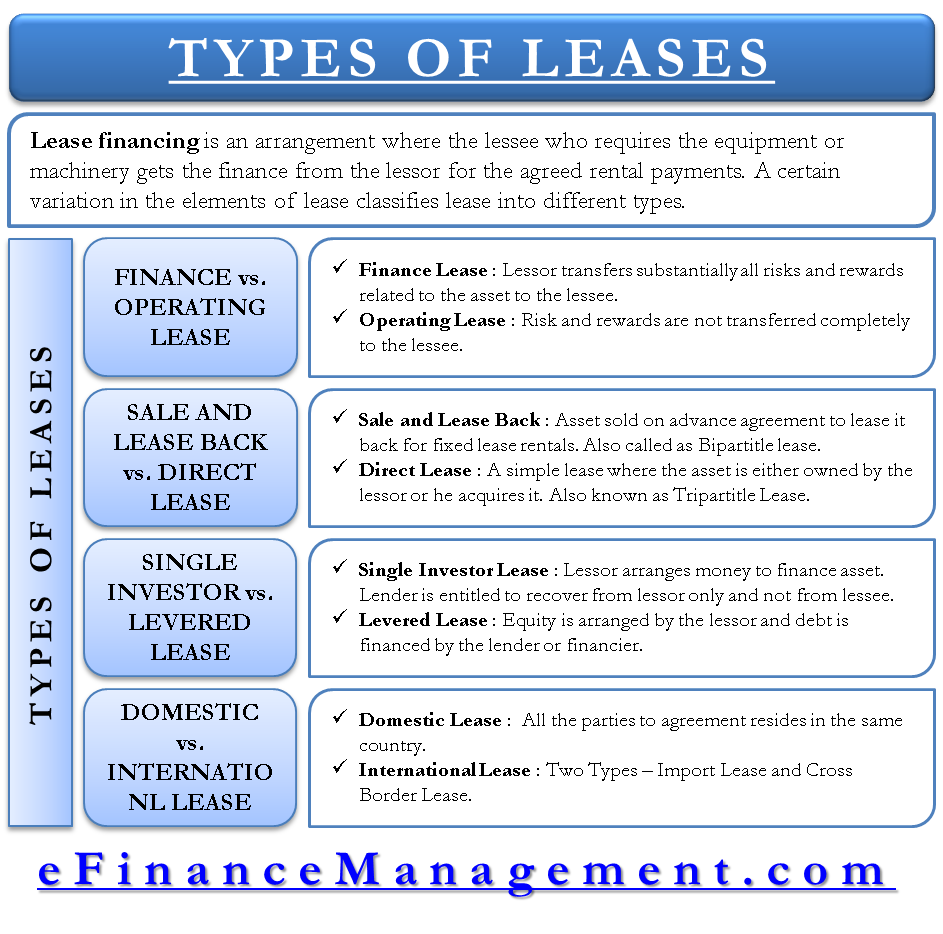

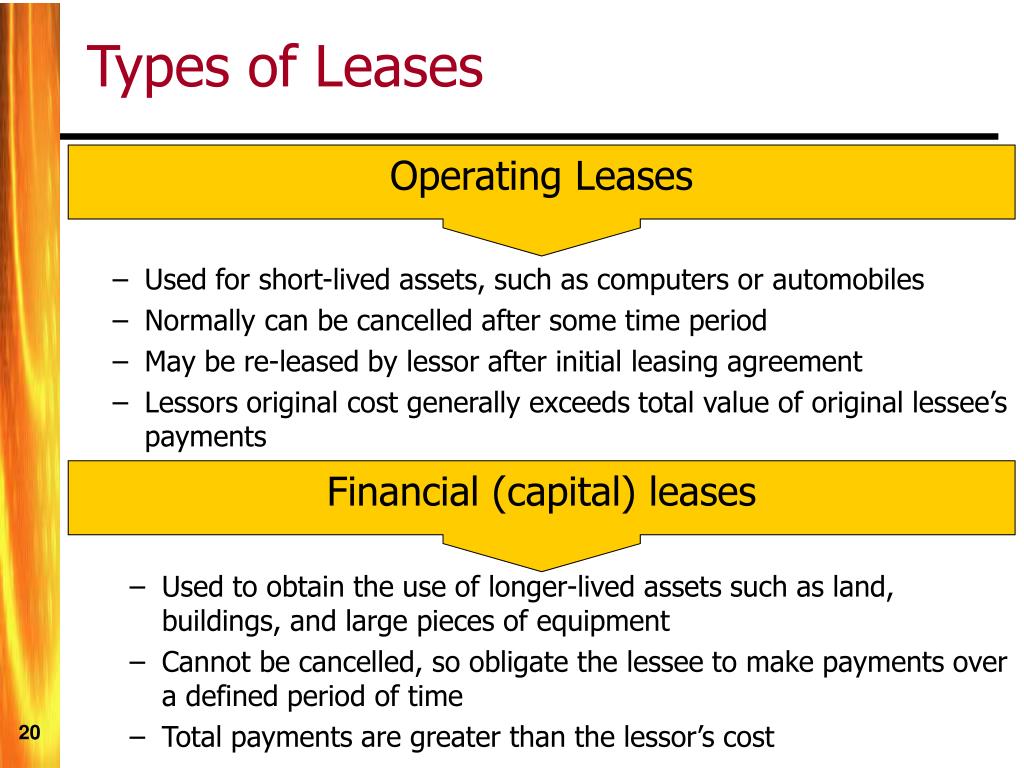

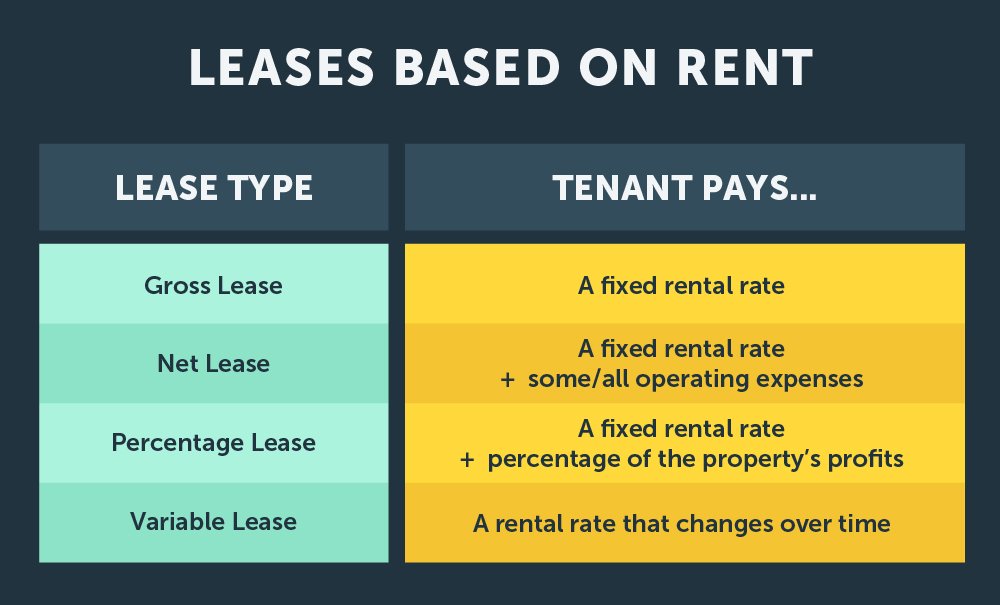

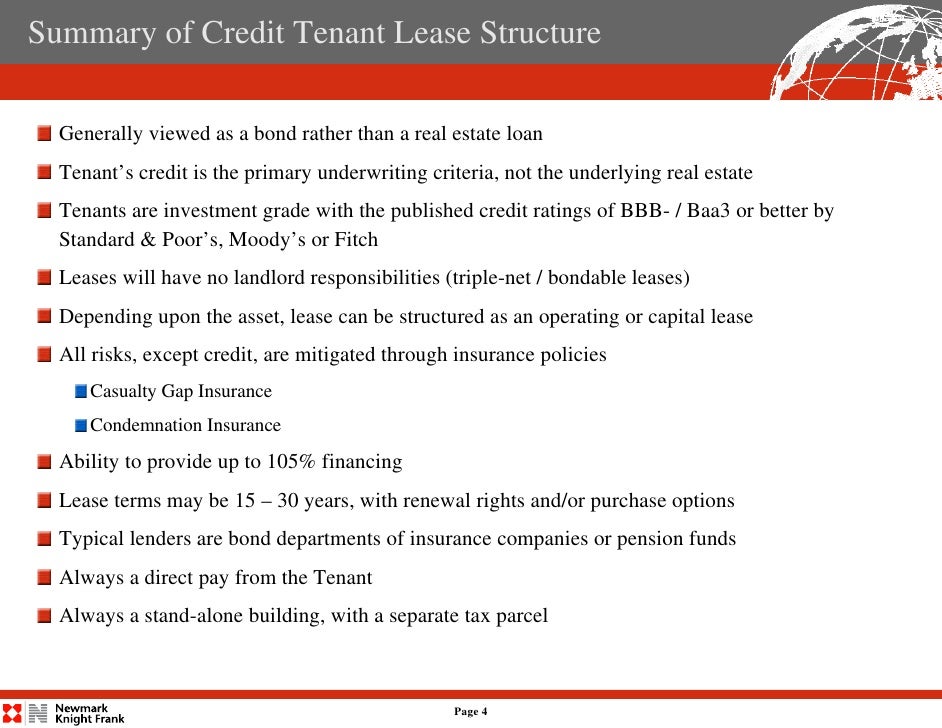

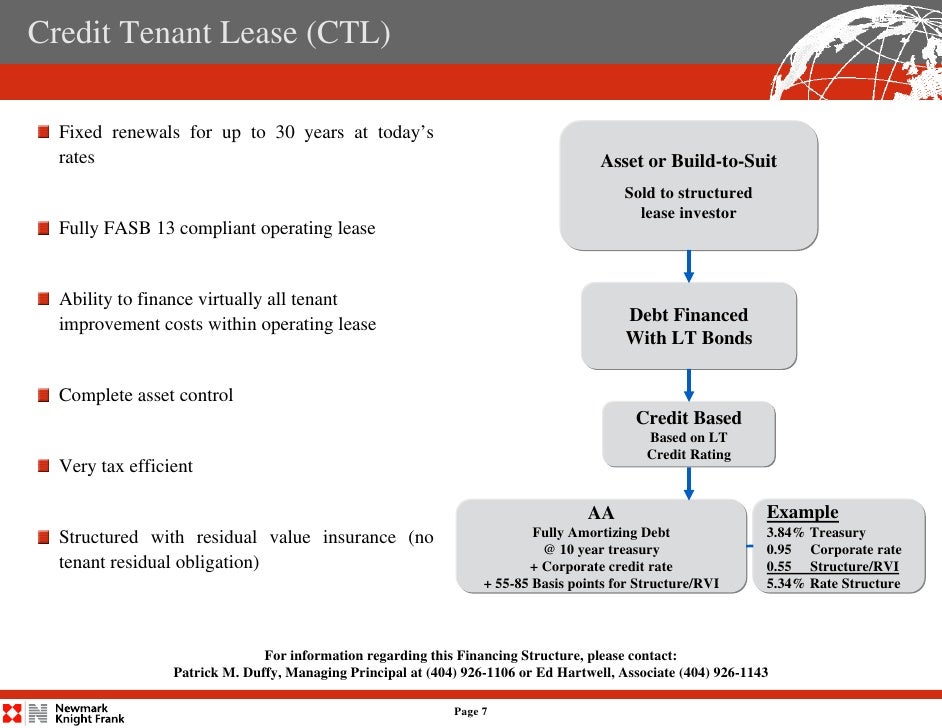

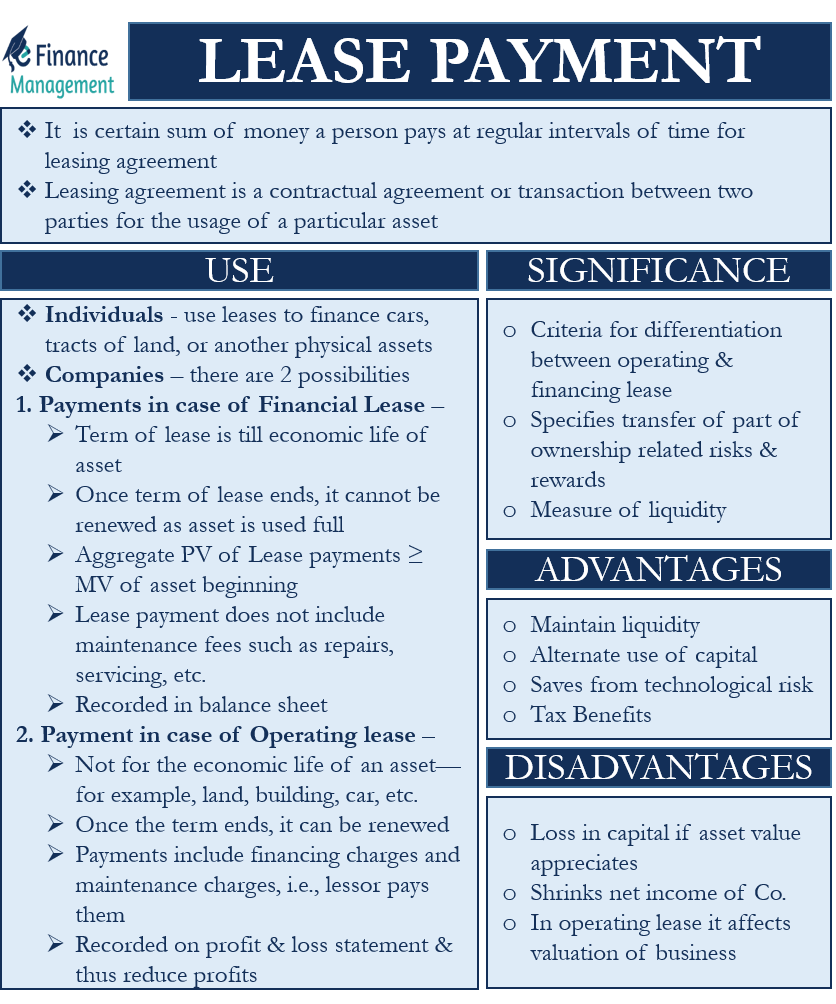

Which Type Of Credit Is Used To Lease A Building - Nafar wants to start her own business as a contract writer. It is based on trust in the borrower's ability to pay and does not involve collateral, differentiating it from secured and. Credit tenant leases (ctls) are transactions where debt is supported by both the lease and the underlying asset. If you want to lease a building, the type of. Commercial real estate financing plays a significant role in. To do this, she needs to build an office addition to her house. Installment credit secured credit card service credit unsecured credit card Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. In this informative video, we will discuss essential financial tools used in the commercial real estate sect. The type of credit used to lease a building is service credit. In this informative video, we will break down the different types of financing. Installment credit secured credit card service credit unsecured credit card An installment loan's interest rate may occasionally vary, such as with mortgages. Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. The process of evaluating credit options for building leases should involve a thorough assessment of the organization’s creditworthiness, lease terms, interest rates, and. Which type of credit is used to lease a building? Not the question you're looking for? It is based on trust in the borrower's ability to pay and does not involve collateral, differentiating it from secured and. Study with quizlet and memorize flashcards containing terms like which type of credit is used to lease a building?, nafar wants to start her own business as a contract writer. Which type of credit is used for utilities? Study with quizlet and memorize flashcards containing terms like which type of credit is used to lease a building?, nafar wants to start her own business as a contract writer. The question asks about the type of credit used to lease a building. To do this, she needs to build an office addition to her house. When it comes to. Installment credit secured credit card service credit unsecured credit card. An installment loan's interest rate may occasionally vary, such as with mortgages. Which type of credit is used for utilities? 【solved】click here to get an answer to your question : In this informative video, we will discuss essential financial tools used in the commercial real estate sect. Not the question you're looking for? Which type of credit is used to lease a building? (01.10 lc) which type of credit is used to lease a building? Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. Which type of credit is used to lease a. The building's title stays with the seller,. Nafar wants to start her own business as a contract writer. In this informative video, we will discuss essential financial tools used in the commercial real estate sect. Credit tenant leases (ctls) are transactions where debt is supported by both the lease and the underlying asset. The landlord has control over what type. The building's title stays with the seller,. The landlord/owner has to maximize revenue and limit risks as much. The type of credit used to lease a building is service credit. Nafar wants to start her own business as a contract writer. Commercial real estate financing plays a significant role in. Thus, the type of credit used to lease a building is called installment credit. The type of credit that is used to lease a building is service credit.what is a service credit?service credit is the credit extended by a service provider to a consumer allowing the. Installment credit secured credit card service credit unsecured credit card To do this, she. Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. Installment credit secured credit card service credit unsecured credit card Buying a building means you can lease out extra space, and you can use depreciation of the building on your taxes. What type of credit is used. Which type of credit is used to lease a building? Buying a building means you can lease out extra space, and you can use depreciation of the building on your taxes. Not the question you're looking for? Which type of credit is used to lease a building? It is based on trust in the borrower's ability to pay and does. The question asks about the type of credit used to lease a building. Commercial real estate financing plays a significant role in. The correct type of credit used for leasing a building is a secured loan. The landlord has control over what type of use a tenant can have in the building before signing the lease. Installment credit, secured credit. The building's title stays with the seller,. The landlord/owner has to maximize revenue and limit risks as much. Thus, the type of credit used to lease a building is called installment credit. Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. The question asks about the. The type of credit that is used to lease a building is service credit.what is a service credit?service credit is the credit extended by a service provider to a consumer allowing the. In this informative video, we will break down the different types of financing. This is because leasing typically involves a legal agreement where the leased property serves as collateral, ensuring. The process of evaluating credit options for building leases should involve a thorough assessment of the organization’s creditworthiness, lease terms, interest rates, and. Buying a building means you can lease out extra space, and you can use depreciation of the building on your taxes. What type of credit is used to lease a building? If you want to lease a building, the type of. The building's title stays with the seller,. In this informative video, we will discuss essential financial tools used in the commercial real estate sect. Typically, the lessee is a highly rated obligor, creating a strong likelihood that. Credit tenant leases (ctls) are transactions where debt is supported by both the lease and the underlying asset. Option a is correct because to lease a building, you need installment credit, which offers upfront financing in return for regular monthly payments. Commercial real estate financing plays a significant role in. The correct type of credit used for leasing a building is a secured loan. It is based on trust in the borrower's ability to pay and does not involve collateral, differentiating it from secured and. Installment credit secured credit card service credit unsecured credit cardPPT Syndication Leasing Structures PowerPoint Presentation, free

Types of Lease Classified based on Risk, Reward, No. of Parties etc.

PPT LongTerm Debt And Leasing PowerPoint Presentation, free download

Understanding Letters of Credit A Commercial Leasing Guide Occupier

Which Type of Credit Is Used to Lease a Building DesiraehasFisher

Credit Tenant Lease

Credit Tenant Lease

Types of Lease Leasing Notes Financial Service BBAmantra

Lease Definition, Features, Advantages, Disadvantages, Types

Lease Payment eFinanceManagement Sources of Finance

【Solved】Click Here To Get An Answer To Your Question :

Not The Question You're Looking For?

The Landlord Has Control Over What Type Of Use A Tenant Can Have In The Building Before Signing The Lease.

Which Type Of Credit Is Used For Utilities?

Related Post: