Will Leasing A Car Build Credit

Will Leasing A Car Build Credit - Your payment history is the most important factor in determining your credit score, so if. Benefit from a federal tax credit of up to $7,500 for qualifying new evs and $4,000 for used options. In the quest to build credit, leasing a car can positively impact if managed responsibly. At the end of the. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Return the vehicle to the leasing company, purchase the car, or renew your lease. Differences between new and used. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Dobry specjalista z car lease polska chętnie przedstawi ci pułapki czyhające na każdego przedsiębiorcę, a także sposoby na to, jak z nimi walczyć. You make monthly payments based on the vehicle’s depreciation during the lease term. Differences between new and used. At the end of the lease, you have three options: Learn more about how leasing a car can affect your credit history. Technically speaking, there is no “required” credit score to be able to lease a car, though as previously explained, the higher your score, the more flexibility you have in terms of. Benefit from a federal tax credit of up to $7,500 for qualifying new evs and $4,000 for used options. Dobry specjalista z car lease polska chętnie przedstawi ci pułapki czyhające na każdego przedsiębiorcę, a także sposoby na to, jak z nimi walczyć. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. Generally speaking, when looking at paying a car lease build credit, both buying and leasing can benefit your score. At the end of the lease, you have three options: Leasing a car could also help you build your credit if you make your payments on time. Generally speaking, when looking at paying a car lease build credit, both buying and leasing can benefit your score. There's a lot to consider before you decide to lease an ev in the. You make monthly payments based on the vehicle’s depreciation during the lease term. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. Where do i get the vin? Return the vehicle to the. Leasing a car can help you build credit just as an auto loan can. In the quest to build credit, leasing a car can positively impact if managed responsibly. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. You make monthly payments based on the vehicle’s depreciation. Your payment history is the most important factor in determining your credit score, so if. In the quest to build credit, leasing a car can positively impact if managed responsibly. You make monthly payments based on the vehicle’s depreciation during the lease term. At the end of the. Learn more about how leasing a car can affect your credit history. At the end of the. Return the vehicle to the leasing company, purchase the car, or renew your lease. Your payment history is the most important factor in determining your credit score, so if. There's a lot to consider before you decide to lease an ev in the u.s. As long as your leasing company reports to all three credit. Leasing a car could also help you build your credit if you make your payments on time. At the end of the. Generally speaking, when looking at paying a car lease build credit, both buying and leasing can benefit your score. Learn more about how leasing a car can affect your credit history. Timely payments and a diverse credit mix. Leasing a car can help you build credit just as an auto loan can. Generally speaking, when looking at paying a car lease build credit, both buying and leasing can benefit your score. Differences between new and used. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. There's a lot to. Your payment history is the most important factor in determining your credit score, so if. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. At the end of the. You make monthly payments based on the vehicle’s depreciation during the lease term. Leasing a car can help build your credit, but. Differences between new and used. In the quest to build credit, leasing a car can positively impact if managed responsibly. Timely payments and a diverse credit mix are key factors that contribute to an improved credit history. Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Return the vehicle to the. Return the vehicle to the leasing company, purchase the car, or renew your lease. However, while auto loans are accessible to consumers across the credit spectrum, it can be difficult to get approved for a lease if your credit score is less than stellar. Leasing a car could also help you build your credit if you make your payments on. Leasing a car can help build your credit, but it also can hurt your credit score if you default on the loan. At the end of the lease, you have three options: Benefit from a federal tax credit of up to $7,500 for qualifying new evs and $4,000 for used options. Applicants with poor credit may be required to provide more money upfront in order to. There's a lot to consider before you decide to lease an ev in the u.s. You make monthly payments based on the vehicle’s depreciation during the lease term. Dobry specjalista z car lease polska chętnie przedstawi ci pułapki czyhające na każdego przedsiębiorcę, a także sposoby na to, jak z nimi walczyć. Even with less than ideal credit, there are options that can allow you to lease a vehicle. As long as your leasing company reports to all three credit bureaus—experian, equifax and transunion—and all your payments are made in a timely manner, an auto lease can certainly. Leasing a car is similar to renting it for a fixed period, usually between 2 to 4 years. Learn more about how leasing a car can affect your credit history. Where do i get the vin? Edmunds lease calculator will help you estimate your monthly car payment on a new car or truck lease. Leasing a car can help you build credit just as an auto loan can. Car leasing agreements are reported to credit bureaus similarly to traditional auto loans. In the quest to build credit, leasing a car can positively impact if managed responsibly.Does Leasing a Car Build Credit? What to Know SoFi

Does Leasing a Car Build Credit? Self. Credit Builder.

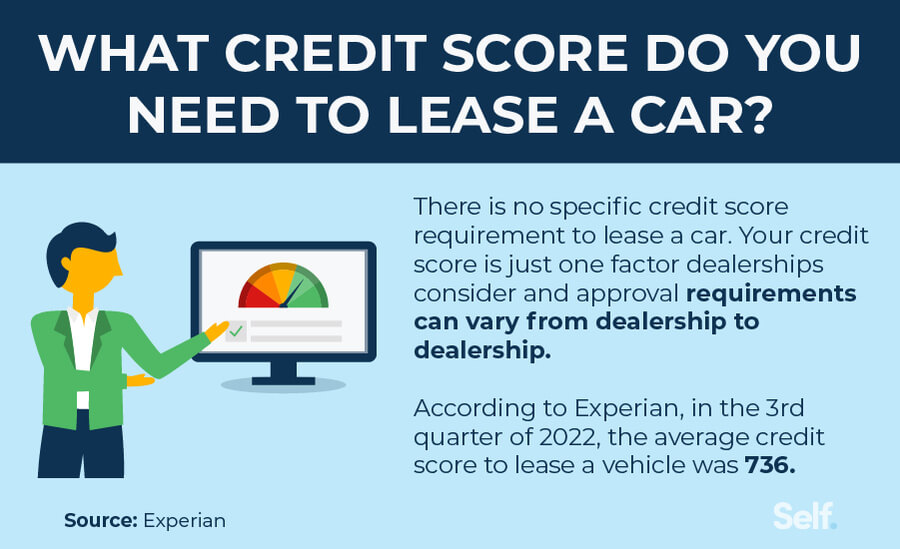

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Chase

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? Self. Credit Builder.

Does Leasing a Car Build Credit? The Answer Might Surprise You… — Grow

What Credit Score Do You Need to Lease A Car? Self. Credit Builder.

Does Leasing a Car Build Credit? Credello

Enter The Vin Of The Vehicle The Dealer Quoted You.

Generally Speaking, When Looking At Paying A Car Lease Build Credit, Both Buying And Leasing Can Benefit Your Score.

Return The Vehicle To The Leasing Company, Purchase The Car, Or Renew Your Lease.

Leasing A Car Could Also Help You Build Your Credit If You Make Your Payments On Time.

Related Post: