Will Paying Car Insurance Build Credit

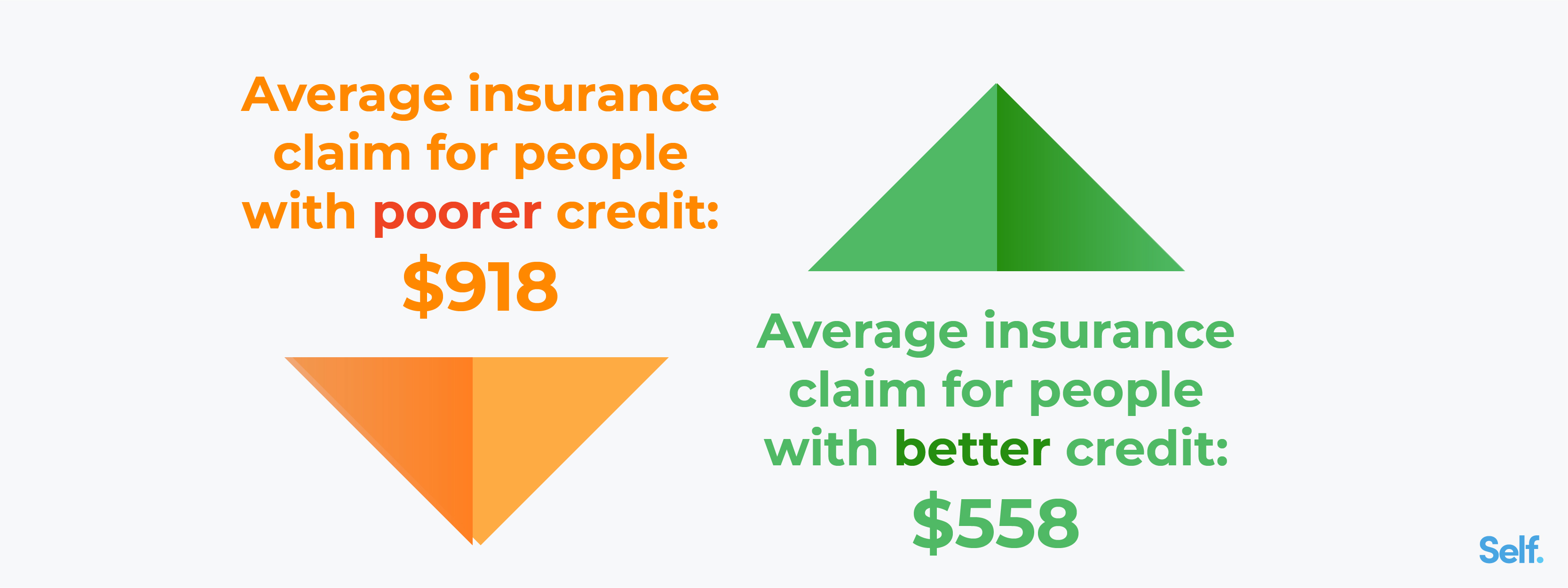

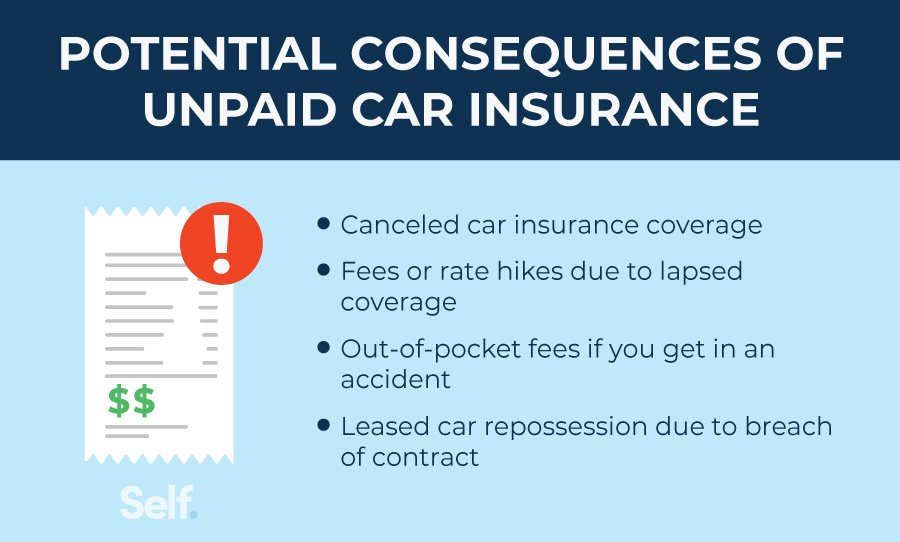

Will Paying Car Insurance Build Credit - In fact, your car insurance company may use your credit score to determine your rate. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. Your car insurance payment can help you build credit by charging it to your credit card and paying it off. Make sure to verify that the car lease information on your credit report is accurate. Car insurance companies aren’t extending credit when they charge premiums, so they typically don’t report your payment history to credit bureaus. However, this won’t help build your credit as the insurance companies do not. Your credit score can affect the price you pay for car insurance. Car insurance payments do not build credit because car insurance companies do not lend money. But, if you pay your monthly car insurance premiums on time and. If you opt to spread the cost, a. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt. Your car insurance payment can help you build credit by charging it to your credit card and paying it off. Does paying car insurance boost credit? Paying your car insurance on time can help build your credit score. A common inquiry is whether paying car insurance will build credit, a vital aspect of financial health in today’s economy. However, there are some indirect ways that staying insured and making regular premium. There is no direct affect between car insurance and your credit, paying. The short answer is no. In fact, your car insurance company may use your credit score to determine your rate. On average, people with a credit score below 550 will pay close to $3,000 a year on car insurance while people with a credit score over 800 pay less than half that amount. Does paying car insurance boost credit? It’s always best to pay your insurance premiums on time and maintain a good payment history. However, maintaining car insurance and paying your bill on time will not result in a significant impact on your credit score like making timely credit card payments. It's also important to maintain good financial habits. However, there are. It's also important to maintain good financial habits. Car insurance payments do not build credit because car insurance companies do not lend money. If you opt to spread the cost, a. Does paying for car insurance build credit? In fact, your car insurance company may use your credit score to determine your rate. If you opt to spread the cost, a. However, there are some indirect ways that staying insured and making regular premium. Paying certain bills on time can help you build credit. However, this won’t help build your credit as the insurance companies do not. A common inquiry is whether paying car insurance will build credit, a vital aspect of financial. No, simply paying for car insurance doesn't help you build credit. The short answer is no. Understanding this connection requires a closer. How high a risk are you to insure,. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt. Your credit score can affect the price you pay for car insurance. The short answer is no. There is no direct affect between car insurance and your credit, paying. A common inquiry is whether paying car. Raising deductibles to $1,000, $2,500 or $5,000 can lower the cost of insurance, but be sure that you have enough in savings to comfortably pay the deductible. There is no direct affect between car insurance and your credit, paying. The short answer is no. There is no direct affect between car insurance and your credit, paying your insurance bill late. Will my credit score affect my car insurance? The short answer is no. Does paying car insurance raise credit? If you opt to spread the cost, a. There is no direct affect between car insurance and your credit, paying. But, if you pay your monthly car insurance premiums on time and. Car insurance companies aren’t extending credit when they charge premiums, so they typically don’t report your payment history to credit bureaus. Will my credit score affect my car insurance? How high a risk are you to insure,. Does paying car insurance build credit? Make sure to verify that the car lease information on your credit report is accurate. Raising deductibles to $1,000, $2,500 or $5,000 can lower the cost of insurance, but be sure that you have enough in savings to comfortably pay the deductible. The short answer is no. On average, people with a credit score below 550 will pay close to. It's also important to maintain good financial habits. Credit scores are based on the contents of transunion, equifax and experian. It’s always best to pay your insurance premiums on time and maintain a good payment history. Paying certain bills on time can help you build credit. Will my credit score affect my car insurance? On average, people with a credit score below 550 will pay close to $3,000 a year on car insurance while people with a credit score over 800 pay less than half that amount. The short answer is no. It's also important to maintain good financial habits. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. No, simply paying for car insurance doesn't help you build credit. Does paying for car insurance build credit? How high a risk are you to insure,. Does paying your car insurance build credit? There is no direct affect between car insurance and your credit, paying. But, if you pay your monthly car insurance premiums on time and. Raising deductibles to $1,000, $2,500 or $5,000 can lower the cost of insurance, but be sure that you have enough in savings to comfortably pay the deductible. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to debt. However, if you fail to pay your insurer,. There is no direct affect between car insurance and your credit, paying your insurance bill late or not at all could lead to. Credit scores are based on the contents of transunion, equifax and experian. Paying for car insurance doesn’t directly impact your credit score currently.Does Paying Car Insurance Build Credit? Self.

Does Paying Car Insurance Build Credit? Self. Credit Builder.

How do you build credit for insurance? Leia aqui How to build

Does Paying Car Insurance Build Credit?

Does Paying Car Insurance Build Credit? Self.

Does Paying Car Insurance Build Credit? What to Know SoFi

Does Paying Car Insurance Build Credit? Self. Credit Builder.

itsmarketingmedia

Can paying car insurance build credit? Chase

Does paying for car insurance build credit?

However, Maintaining Car Insurance And Paying Your Bill On Time Will Not Result In A Significant Impact On Your Credit Score Like Making Timely Credit Card Payments.

Does Paying Car Insurance Boost Credit?

Your Car Insurance Payment Can Help You Build Credit By Charging It To Your Credit Card And Paying It Off.

Car Insurance Payments Do Not Build Credit Because Car Insurance Companies Do Not Lend Money.

Related Post: