Will Prepaid Cards Build Credit

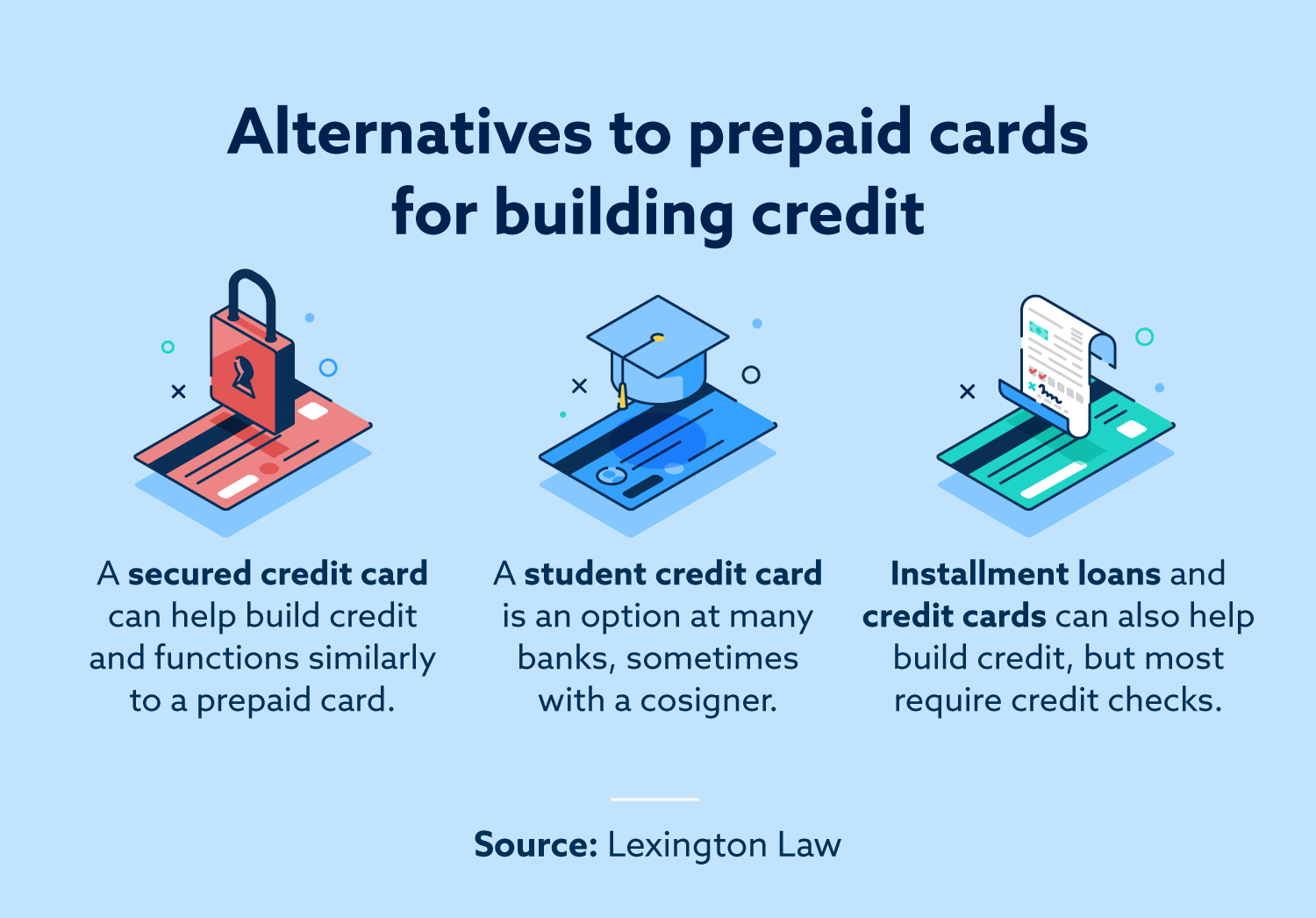

Will Prepaid Cards Build Credit - Similar to a regular debit card, a prepaid card will not require a credit check. Prepaid credit cards to build credit don’t technically exist as these cards aren’t linked to a bank account. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing. They’re both great options for canadians who have little,. Where possible, try and build up your credit worthiness. The card requires a $300 minimum security deposit that acts as your. Your deposit is returned to you when you close your credit card account or. However, when talking about prepaid credit cards, people are often. In the increasingly crowded market of prepaid credit cards, the $4 per month or $48 per year koho. However, when it comes to building credit, prepaid credit cards are no substitute for the real thing. The short answer is no. In the increasingly crowded market of prepaid credit cards, the $4 per month or $48 per year koho. The card requires a $300 minimum security deposit that acts as your. You’re not getting a loan and your payments aren’t reported to the three credit bureaus, so it’s not how. On the flip side, it also won’t help you build credit since spending on prepaid cards and debit cards is. Prepaid cards can’t help improve your credit because they don’t have a credit line attached to them like a credit card. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. Prepaid credit cards will not show up on your credit report, and they won't be. However, when talking about prepaid credit cards, people are often. You can get a prepaid card without a. Prepaid credit cards will not show up on your credit report, and they won't be. You can get a prepaid card without a. Your deposit is returned to you when you close your credit card account or. The short answer is no. Similar to a regular debit card, a prepaid card will not require a credit check. Prepaid credit cards will not show up on your credit report, and they won't be. They’re both great options for canadians who have little,. However, when talking about prepaid credit cards, people are often. You can use the money you load. If you’re worried you can’t get a standard credit card, there are other options such as credit builder cards. However, it’s important to note prepaid cards are not credit cards. On the flip side, it also won’t help you build credit since spending on prepaid cards and debit cards is. The card requires a $300 minimum security deposit that acts as your. They may sometimes be called “prepaid credit cards” or “prepaid debit. Prepaid cards can’t help improve your. Similar to a regular debit card, a prepaid card will not require a credit check. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing. On the flip side, it also won’t help you build credit since spending on prepaid cards and debit cards is.. Where possible, try and build up your credit worthiness. Prepaid cards can’t help improve your credit because they don’t have a credit line attached to them like a credit card. In the increasingly crowded market of prepaid credit cards, the $4 per month or $48 per year koho. However, when it comes to building credit, prepaid credit cards are no. Prepaid cards do not build credit, as they do not report to the credit bureaus and are more akin to gift cards or debit cards than credit cards. The short answer is no. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. Prepaid cards can’t help improve your credit because they don’t have a credit line. You can use the money you load. Grow your credit up to 22 points in 3 months with credit building for $10 / month. In a nutshell, a secured credit card is best if you want to build your credit history, whereas a prepaid card is primarily a way to prepay for purchases—and has no positive or. A secured credit. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards. Most credit cards — particularly those that cater to lower credit scores — have extremely high interest rates. You’re not getting a loan and your payments aren’t reported to the three credit bureaus, so it’s not how. To build good credit, you need to make sure that. Prepaid credit cards in the netherlands give you the benefits of a credit card, like shopping online and paying abroad, with zero risk of debt and no income requirements. The short answer is no. If you’re worried you can’t get a standard credit card, there are other options such as credit builder cards and prepaid cards. Most credit cards —. Most credit cards — particularly those that cater to lower credit scores — have extremely high interest rates. Prepaid cards let you make purchases with money you’ve loaded onto the card, instead of drawing from a bank account or line of credit. In the increasingly crowded market of prepaid credit cards, the $4 per month or $48 per year koho.. Prepaid credit cards and secured credit cards are generally two different credit card card types. Prepaid credit cards will not show up on your credit report, and they won't be. The perpay credit card, issued by celtic bank, is designed to help cardholders who want to build credit, but are seeking an alternative to secured credit cards.instead of requiring. You can use the money you load. Prepaid cards can’t help improve your credit because they don’t have a credit line attached to them like a credit card. Neither prepaid cards nor debit cards report usage information to the major credit bureaus, which means they have absolutely no impact on your credit standing. You can get a prepaid card without a. Both options provide a completely different solution. In a nutshell, a secured credit card is best if you want to build your credit history, whereas a prepaid card is primarily a way to prepay for purchases—and has no positive or. Your deposit is returned to you when you close your credit card account or. Prepaid credit cards to build credit don’t technically exist as these cards aren’t linked to a bank account. Grow your credit up to 22 points in 3 months with credit building for $10 / month. However, it’s important to note prepaid cards are not credit cards. Similar to a regular debit card, a prepaid card will not require a credit check. They may sometimes be called “prepaid credit cards” or “prepaid debit. Prepaid cards don’t build credit and shouldn’t be confused with secured credit cards.Do Prepaid Credit Cards Help Build Your Credit? SoFi

Does A Prepaid Credit Card Help To Build a Credit Score? Credello

What is a prepaid card? Prepaid, debit + credit cards Lexington Law

Best Prepaid Credit Cards to Build Credit 2019 Every Buck Counts

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

5 Prepaid Cards That Build Credit (2025)

Top 5 Best Prepaid Credit Cards To Build Credit AquilaResources

Build Credit by Using the Right Prepaid Credit Cards

5 Best Prepaid Credit Cards To Build Credit by Christinathomas Aug

A Secured Credit Card Is Just Like A Regular Credit Card, Except That It Requires A Security Deposit.

The Short Answer Is No.

They’re Both Great Options For Canadians Who Have Little,.

Where Possible, Try And Build Up Your Credit Worthiness.

Related Post: