Windows Depreciation Life Commercial Building

Windows Depreciation Life Commercial Building - For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. If the receipt itemizes each window separately, it is possible they could be deducted via. The election to expense them. Any additions or improvements placed in service after 1986, including any components of a building (such as plumbing, wiring, storm windows, etc.), are depreciated using macrs,. Commercial real estate depreciation lets investors expense the cost of income producing property over time, lower the amount of personal income tax paid, and even roll over and defer the. You may qualify to expense these windows entirely instead of depreciating them as improvements which are depreciated over a 27.5 useful life. No, they would not qualify for section 179, they would be depreciated over 39 years. [3] can i depreciate the cost of land? But, could these be expensed under the repair regulations?. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. If the receipt itemizes each window separately, it is possible they could be deducted via. What are the irs rules concerning capitalization and depreciation? But, could these be expensed under the repair regulations?. The lifespan of a roof impacts financial. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. You may qualify to expense these windows entirely instead of depreciating them as improvements which are depreciated over a 27.5 useful life. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. If the window is exposed to. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. The election to expense them. The lifespan of a roof impacts financial. Understanding the depreciation life of windows in a rental property is crucial for landlords and property managers. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively. The election to expense them. Commercial real estate depreciation lets investors expense the cost of income producing property over time, lower the amount of personal income tax paid, and even roll over and defer the. Depreciation affects tax deductions, impacting cash flow. What are the irs rules concerning capitalization and depreciation? If the window is exposed to. This guide covers the fundamentals of commercial real estate depreciation, explains how it works, and highlights strategies like cost segregation studies and bonus depreciation to help you. The election to expense them. If the receipt itemizes each window separately, it is possible they could be deducted via. Understanding the depreciation life of a commercial roof is essential for businesses to. Depreciation affects tax deductions, impacting cash flow. No, they would not qualify for section 179, they would be depreciated over 39 years. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. The election to expense them. What are the irs rules concerning capitalization and depreciation? There are several types of capital assets that can be depreciated when you use them in your business. You normally would depreciate the windows as a capital improvement to your rental property, and claim depreciation over 27.5 years. Land can never be depreciated. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. Commercial buildings. We have incurred costs for substantial work on our residential rental property. But, could these be expensed under the repair regulations?. This guide covers the fundamentals of commercial real estate depreciation, explains how it works, and highlights strategies like cost segregation studies and bonus depreciation to help you. Calculating depreciation for commercial property involves a systematic approach that incorporates various. This guide covers the fundamentals of commercial real estate depreciation, explains how it works, and highlights strategies like cost segregation studies and bonus depreciation to help you. Windows are considered to be part of the. Assets mentioned above, such as roofs, hvac property, fire protection, alarm systems, and. No, they would not qualify for section 179, they would be depreciated. You may qualify to expense these windows entirely instead of depreciating them as improvements which are depreciated over a 27.5 useful life. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. No you don't have the option of choosing a shorter depreciable life even when you know it won't last. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. Depreciation affects tax deductions, impacting cash flow. Commercial real estate depreciation lets investors expense the cost of income producing property over time, lower the amount of personal income tax paid, and even roll over and defer the. The lifespan of a roof impacts financial. We. Windows are considered to be part of the. Understanding the depreciation life of windows in a rental property is crucial for landlords and property managers. Assets mentioned above, such as roofs, hvac property, fire protection, alarm systems, and. If the window is exposed to. Land can never be depreciated. You normally would depreciate the windows as a capital improvement to your rental property, and claim depreciation over 27.5 years. If the receipt itemizes each window separately, it is possible they could be deducted via. The process begins by determining the asset’s. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. You may qualify to expense these windows entirely instead of depreciating them as improvements which are depreciated over a 27.5 useful life. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Land can never be depreciated. If the window is exposed to. Depreciation affects tax deductions, impacting cash flow. The election to expense them. Windows are considered to be part of the. The lifespan of a roof impacts financial. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. There are several types of capital assets that can be depreciated when you use them in your business. We have incurred costs for substantial work on our residential rental property. But, could these be expensed under the repair regulations?.How to Calculate Building Depreciation Bizfluent

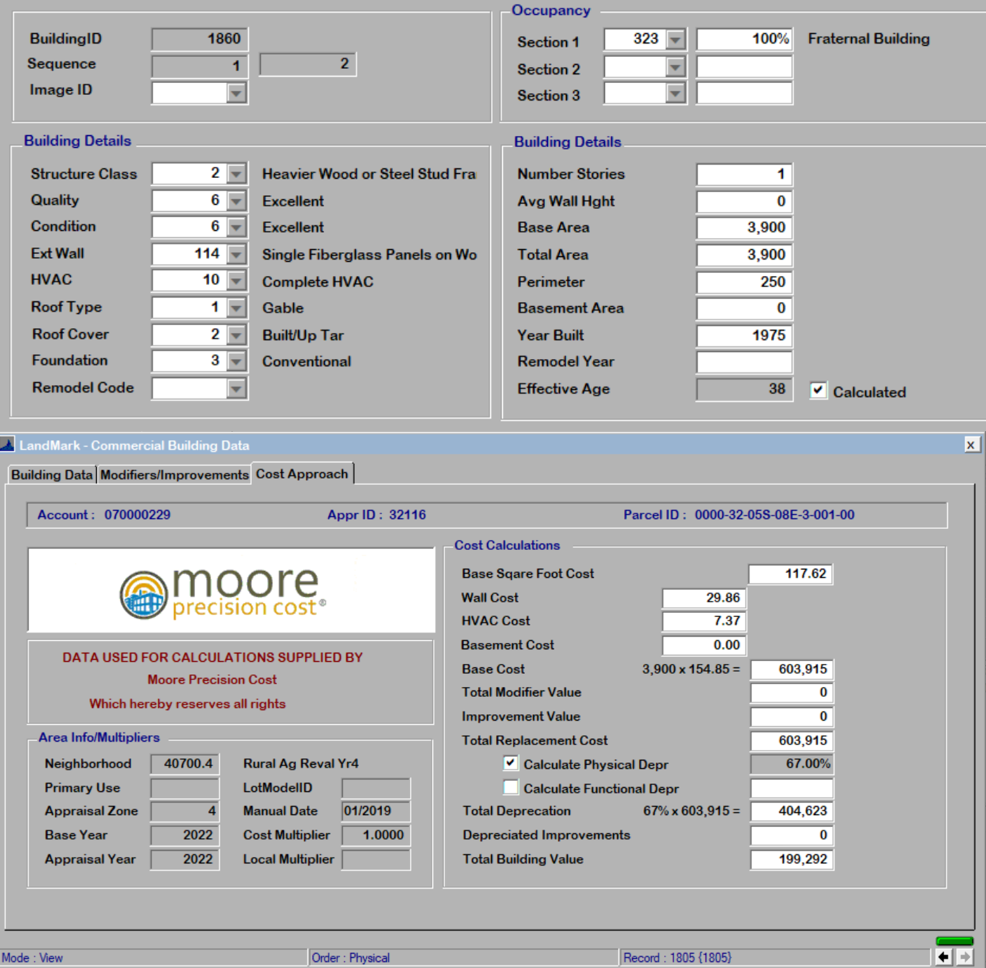

Commercial Building Depreciation Commercial Appraisal File 1

Difference between Depreciation and Obsolescence Value of Building

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Commercial Building Depreciation Design Mechanical

Depreciation for Building Definition, Formula, and Excel Examples

Depreciation for Building Definition, Formula, and Excel Examples

How Rental Property Depreciation Works & The Benefits to You

What Is the Depreciation of the Roof on a Commercial Building?

Understanding the Depreciation of a Commercial Building

Understanding The Depreciation Life Of Windows In A Rental Property Is Crucial For Landlords And Property Managers.

This Guide Covers The Fundamentals Of Commercial Real Estate Depreciation, Explains How It Works, And Highlights Strategies Like Cost Segregation Studies And Bonus Depreciation To Help You.

Assets Mentioned Above, Such As Roofs, Hvac Property, Fire Protection, Alarm Systems, And.

Commercial And Residential Buildings Can Be Depreciated Over A Certain Number Of Years Based On The Type Of Property.

Related Post: