Accounting For Building Construction Costs

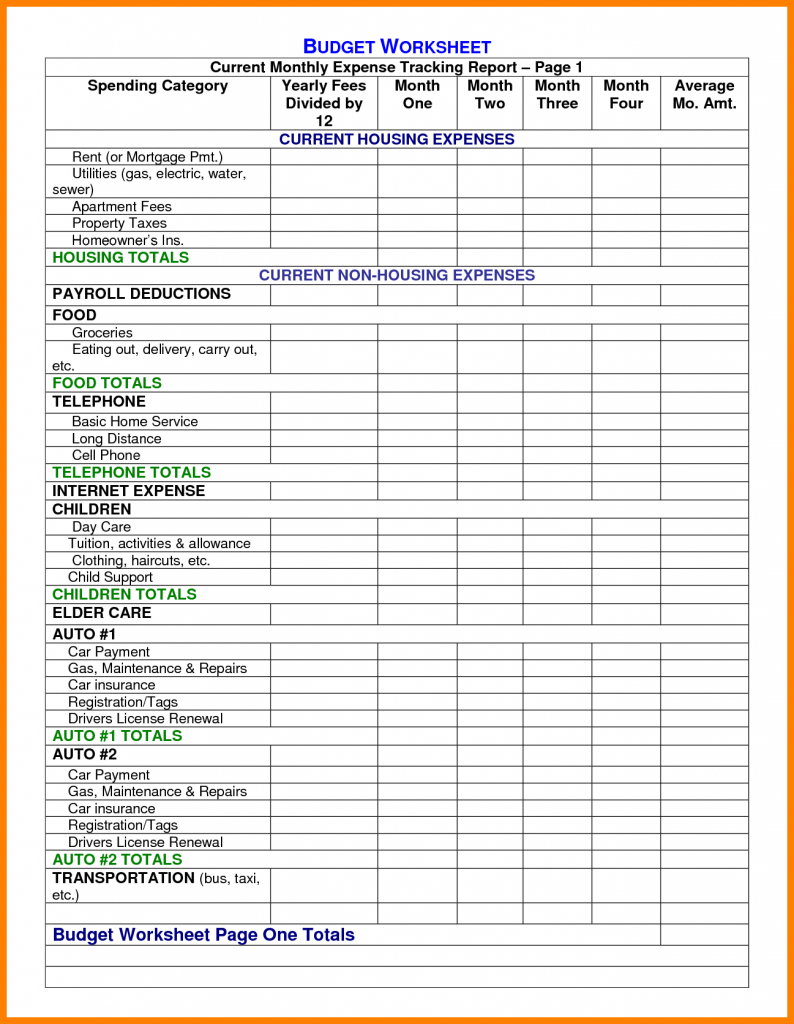

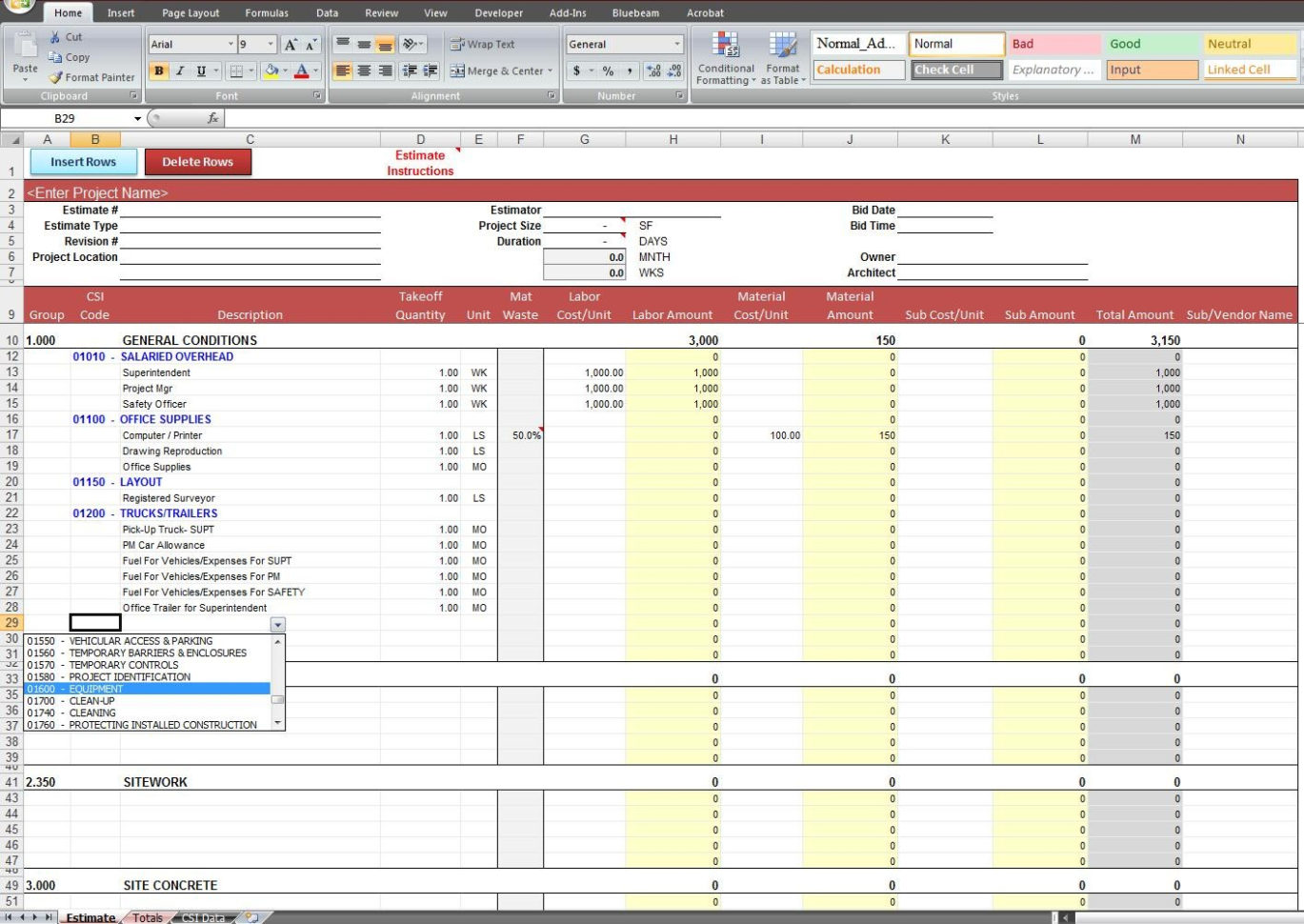

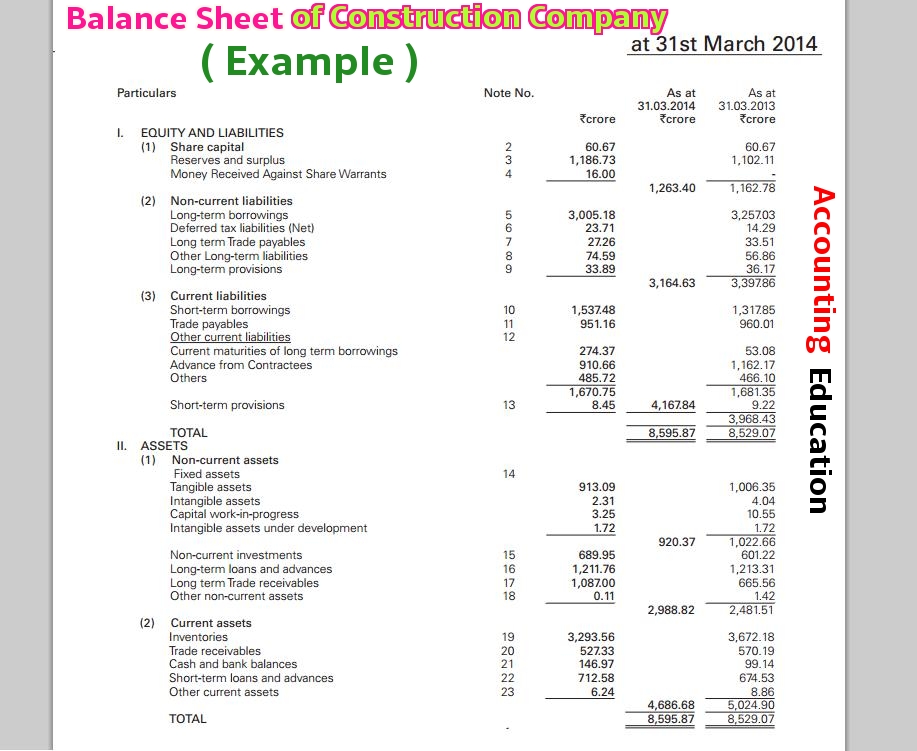

Accounting For Building Construction Costs - Cost accounting in construction is essential for tracking every expense associated with a project, from labor and materials to overhead. Construction costs are accounted for by categorizing expenses and tracking them through the project lifecycle. Construction accounting involves unique practices such as job costing, revenue recognition and managing overhead costs that are specific to each project. In some situations, the cost of meeting regulatory standards and compliance certifications is prohibitive, which results in reduced competition for. The majority of construction projects experience an average cost overrun of 28%. Maintain detailed records of all expenses,. Unlike many other types of businesses,. The cost of buildings encompasses a broad range of expenditures, from basic construction to incidental costs tied to site preparation. 7 best construction accounting software i recommend. Construction accounting is a specialized form of accounting used to track, record and manage revenue, expenses and profitability for a construction business. They might keep on hand items such as building materials, supplies,. Proper accounting treatment of these expenses is. Cost accounting in construction is essential for tracking every expense associated with a project, from labor and materials to overhead. Construction accounting is a form of project accounting in which costs are assigned to specific contracts. Construction accounting is a more robust and specialized form of accounting. Instead of recognizing revenue when a product is delivered, construction companies must account for revenue and costs over the life of a project. Construction projects are often complex, and costs can quickly escalate if they are not managed carefully. Many construction businesses reach a point in their growth when they decide to maintain inventories. The majority of construction projects experience an average cost overrun of 28%. To effectively deliver construction projects, all while managing job costs and budgets to ensure you maximize roi can be challenging, however, this is feasible through construction. 7 best construction accounting software i recommend. To effectively deliver construction projects, all while managing job costs and budgets to ensure you maximize roi can be challenging, however, this is feasible through construction. Construction accounting involves unique practices such as job costing, revenue recognition and managing overhead costs that are specific to each project. A separate job is set up. Proper accounting treatment of these expenses is. Unlike many other types of businesses,. This approach ensures financial statements. Construction projects are often complex, and costs can quickly escalate if they are not managed carefully. Construction accounting involves unique practices such as job costing, revenue recognition and managing overhead costs that are specific to each project. Construction accounting is a highly specialized type of financial management because of the industry's unique characteristics. Monitor direct and indirect costs associated with construction. A separate job is set up in the accounting system for each. Construction accounting is a more robust and specialized form of accounting. This granular tracking enables accurate. How do you do construction accounting? Construction accounting is a form of project accounting in which costs are assigned to specific contracts. Cost management is a critical aspect of construction accounting. Deltek computerease for job costing and financial. Interest capitalization, as outlined in ias 23, requires determining borrowing costs directly attributable to the construction project and incorporating them into the. Unique aspects of construction accounting. This granular tracking enables accurate. 7 best construction accounting software i recommend. They might keep on hand items such as building materials, supplies,. Construction accounting involves several key steps, including: Proper accounting treatment of these expenses is. Identifying the root causes of excess expenditure can help projects succeed and thrive. Construction accounting is a more robust and specialized form of accounting. Construction accounting involves unique practices such as job costing, revenue recognition and managing overhead costs that are specific to each project. Maintain detailed records of all expenses,. It’s for the construction industry to track job costs, manage subcontractor payments, and invoice. Identifying capital projects and determining which costs should be capitalized is a key focus in the accounting for construction projects and plant additions. Deltek computerease for job costing and financial. The cost of buildings encompasses a broad range of expenditures, from basic construction to incidental costs. A separate job is set up in the accounting system for each. Deltek computerease for job costing and financial. Instead of recognizing revenue when a product is delivered, construction companies must account for revenue and costs over the life of a project. They might keep on hand items such as building materials, supplies,. Construction accounting is a specialized form of. Cost management is a critical aspect of construction accounting. Construction accounting is a highly specialized type of financial management because of the industry's unique characteristics. Identifying the root causes of excess expenditure can help projects succeed and thrive. Proper accounting treatment of these expenses is. This granular tracking enables accurate. This summary is provided for informational purposes only and should be. Many construction businesses reach a point in their growth when they decide to maintain inventories. Identifying capital projects and determining which costs should be capitalized is a key focus in the accounting for construction projects and plant additions. They might keep on hand items such as building materials, supplies,.. Construction accounting is a highly specialized type of financial management because of the industry's unique characteristics. Unlike many other types of businesses,. Many construction businesses reach a point in their growth when they decide to maintain inventories. Cost management is a critical aspect of construction accounting. In this guide, we’ll explore 6 key construction accounting methods and provide practical advice on how to apply them effectively. Construction accounting is a form of project accounting in which costs are assigned to specific contracts. Cost accounting in construction is essential for tracking every expense associated with a project, from labor and materials to overhead. Deltek computerease for job costing and financial. This granular tracking enables accurate. Proper accounting treatment of these expenses is. Identifying the root causes of excess expenditure can help projects succeed and thrive. 7 best construction accounting software i recommend. Instead of recognizing revenue when a product is delivered, construction companies must account for revenue and costs over the life of a project. It’s for the construction industry to track job costs, manage subcontractor payments, and invoice. Construction costs are accounted for by categorizing expenses and tracking them through the project lifecycle. They might keep on hand items such as building materials, supplies,.Construction Spreadsheet with Property Expenses Spreadsheet Accounting

How To Build A Construction Company That Can Grow Without You

Free Construction Cost Accounting Templates For Google Sheets And

Construction Estimate Template Free Download Example of Spreadshee

How to Make Balance Sheet of Construction Company Accounting Education

Free Excel Construction Templates For All Your Project Needs

Construction Budget Excel Template / Cost Control Template webQS

House Construction Cost Calculator Excel Sheet Free Download

Construction Cost Sheet for General Contractor

Create Chart of Accounts for Construction Company in Excel

This Summary Is Provided For Informational Purposes Only And Should Be.

To Effectively Deliver Construction Projects, All While Managing Job Costs And Budgets To Ensure You Maximize Roi Can Be Challenging, However, This Is Feasible Through Construction.

Identifying Capital Projects And Determining Which Costs Should Be Capitalized Is A Key Focus In The Accounting For Construction Projects And Plant Additions.

Maintain Detailed Records Of All Expenses,.

Related Post: