Are Building Materials Tax Deductible

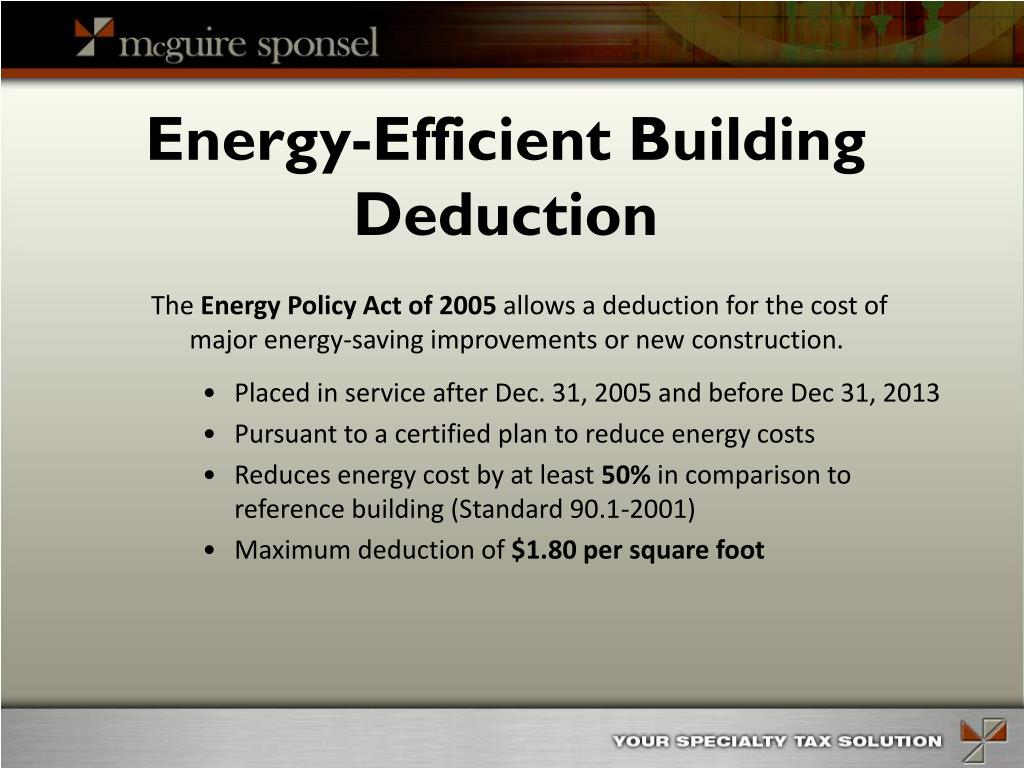

Are Building Materials Tax Deductible - A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. The tax rate is equal to your state's general sales tax rate; Almost any items used for home renovation or construction that you paid sales tax on are considered eligible. You can deduct the sales tax on your home renovation or construction if all of these conditions apply: How do i apply for a building materials exemption certificate (bmec)?. Determining whether you can claim building materials on your taxes requires a thorough understanding of tax laws and specific. If you are in the business of selling building materials, the concrete. Building materials may be reported on the business portion of your tax return in more than one area. Buying power tools, trucks or other equipment your employees will need. However, all of the following must apply: If you are in the business of selling building materials, the concrete. Who is eligible to obtain an illinois department of revenue building materials exemption certificate (bmec)? You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. Tax deductions for building materials are often tied to specific circumstances‚ such as home improvements or business expenses. The answer depends on several factors, such as the type of roof and specific tax guidelines. You can deduct the rent you paid to occupy a building for the tax year. Taxpayers can deduct the irs defined fair market value of the donated materials as an itemized deduction on their schedule a or as a charitable contribution on their 1120 if. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. Whether you’re paying your business. Yes, ropes and chains and the other items permanently affixed (or not meant to be removed and used elsewhere) would be considered building materials and could be used for. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. The answer depends on several factors, such as the type of roof and specific tax guidelines. These essential construction business tax deductions can help minimize your tax liability and maximize your savings. Whether you’re paying. Remember that this is an itemized deduction on schedule a, and if. Whether you’re paying your business. You're taking the sales tax deduction, as opposed to. The irs will usually allow you to get deductions on ordinary and necessary expenses for the construction industry. If you are in the business of selling building materials, the concrete. You can deduct the rent you paid to occupy a building for the tax year. You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. You're taking the sales tax deduction, as opposed to the state/local income tax deduction; Remember that this is an itemized deduction on schedule a, and. Taxpayers can deduct the irs defined fair market value of the donated materials as an itemized deduction on their schedule a or as a charitable contribution on their 1120 if. You must report the value of all tax exempt building materials purchased between january 1, 2024, and december 31, 2024. You're taking the sales tax deduction, as opposed to the. Building materials may be reported on the business portion of your tax return in more than one area. Homeowners often wonder if a new roof is tax deductible. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. These essential construction business tax deductions can. The answer depends on several factors, such as the type of roof and specific tax guidelines. The tax rate is equal to your state's general sales tax rate; Building materials may be reported on the business portion of your tax return in more than one area. However, all of the following must apply: Homeowners often wonder if a new roof. How do i apply for a building materials exemption certificate (bmec)?. Who is eligible to obtain an illinois department of revenue building materials exemption certificate (bmec)? A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. You're taking the sales tax deduction, as opposed to.. The tax rate is equal to your state's general sales tax rate; Determining whether you can claim building materials on your taxes requires a thorough understanding of tax laws and specific. Building materials may be reported on the business portion of your tax return in more than one area. The answer depends on several factors, such as the type of. Building materials may be reported on the business portion of your tax return in more than one area. Taxpayers can deduct the irs defined fair market value of the donated materials as an itemized deduction on their schedule a or as a charitable contribution on their 1120 if. Tax deductions for building materials refer to the allowable expenses associated with. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. You can deduct the rent you paid to occupy a building for the tax year. Tax deductions for building materials are often tied to specific circumstances‚ such as home improvements or business expenses. Additionally, you. For homeowners‚ deductions might apply to. However, all of the following must apply: You're taking the sales tax deduction, as opposed to the state/local income tax deduction; Almost any items used for home renovation or construction that you paid sales tax on are considered eligible. Building materials may be reported on the business portion of your tax return in more than one area. Remember that this is an itemized deduction on schedule a, and if. You can deduct the rent you paid to occupy a building for the tax year. Tax deductions for building materials refer to the allowable expenses associated with the purchase, installation, and use of qualifying building materials. The law requires reports to be filed with idor on or before. A taxpayer claiming the credit for exterior windows or skylights, exterior doors, and insulation materials or systems (including air sealing materials or systems) must have. How do i apply for a building materials exemption certificate (bmec)?. If you are in the business of selling building materials, the concrete. Buying power tools, trucks or other equipment your employees will need. The answer depends on several factors, such as the type of roof and specific tax guidelines. These essential construction business tax deductions can help minimize your tax liability and maximize your savings. Additionally, you can deduct up to 12 months of prepaid rent, as long as the payment covers 12 months or.Tax Deduction Checklist For Construction Workers

Criteria for Tax Deductible Home Improvements Roof Masters

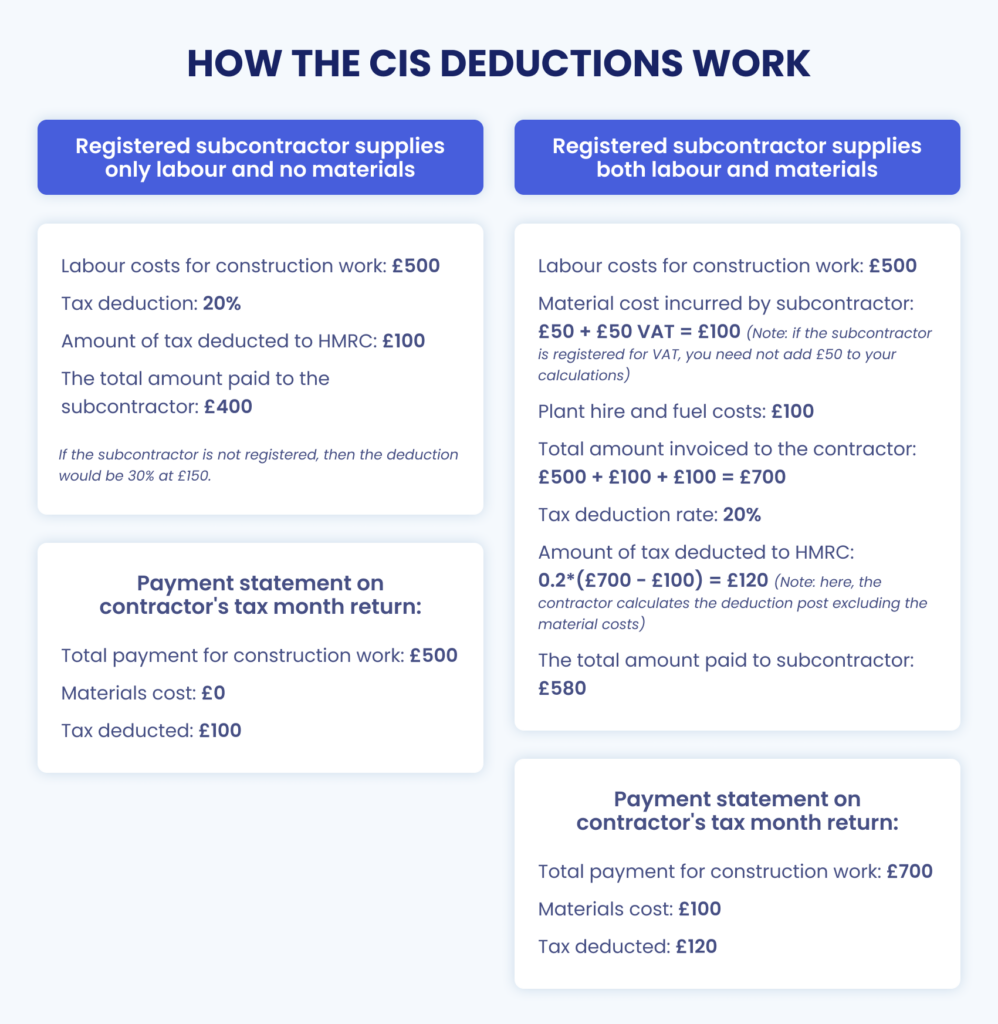

A Guide to the Construction Industry Scheme (CIS) Archdesk

What household improvements are taxdeductible? Leia aqui Can you

VAT Reverse Charge for Construction Industry FAQs

7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions

PPT 179D Energy Efficient Commercial Building Tax Deduction

Budget 201718 Industry demands relaxation in tax

Most Common Tax Deductions for Construction Contractors

Common tax deductions for construction companies Accuratee

Whether You’re Paying Your Business.

Who Is Eligible To Obtain An Illinois Department Of Revenue Building Materials Exemption Certificate (Bmec)?

The Tax Rate Is Equal To Your State's General Sales Tax Rate;

Up To 8% Cash Back You May Qualify For A Home Renovation Tax Deduction On The Sales Tax For The Materials You Purchased.

Related Post:

![7 Home Improvement Tax Deductions [INFOGRAPHIC] Tax deductions](https://i.pinimg.com/originals/bb/c7/4e/bbc74ee927d067f43bbaf4252e12eb28.jpg)