Build A Bear Revenue

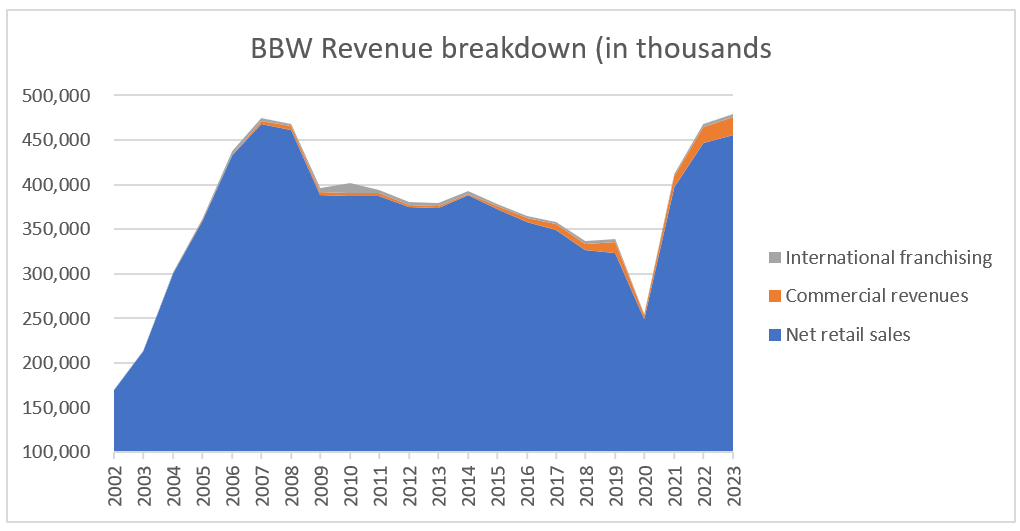

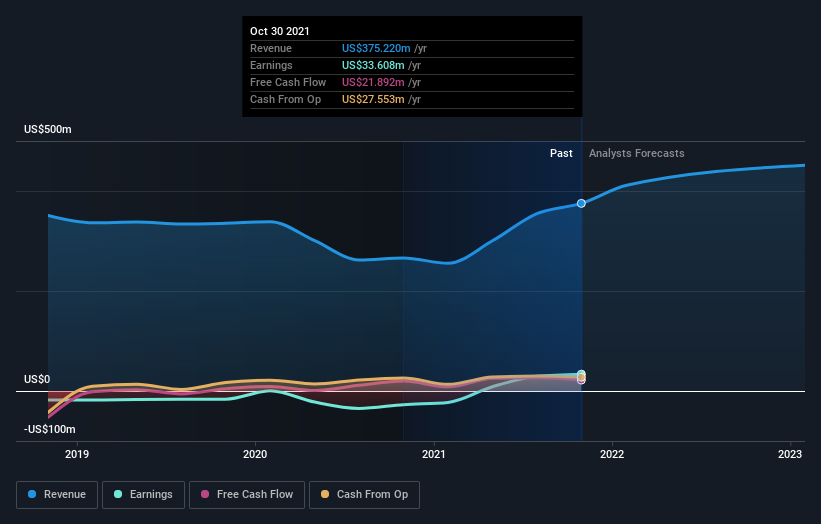

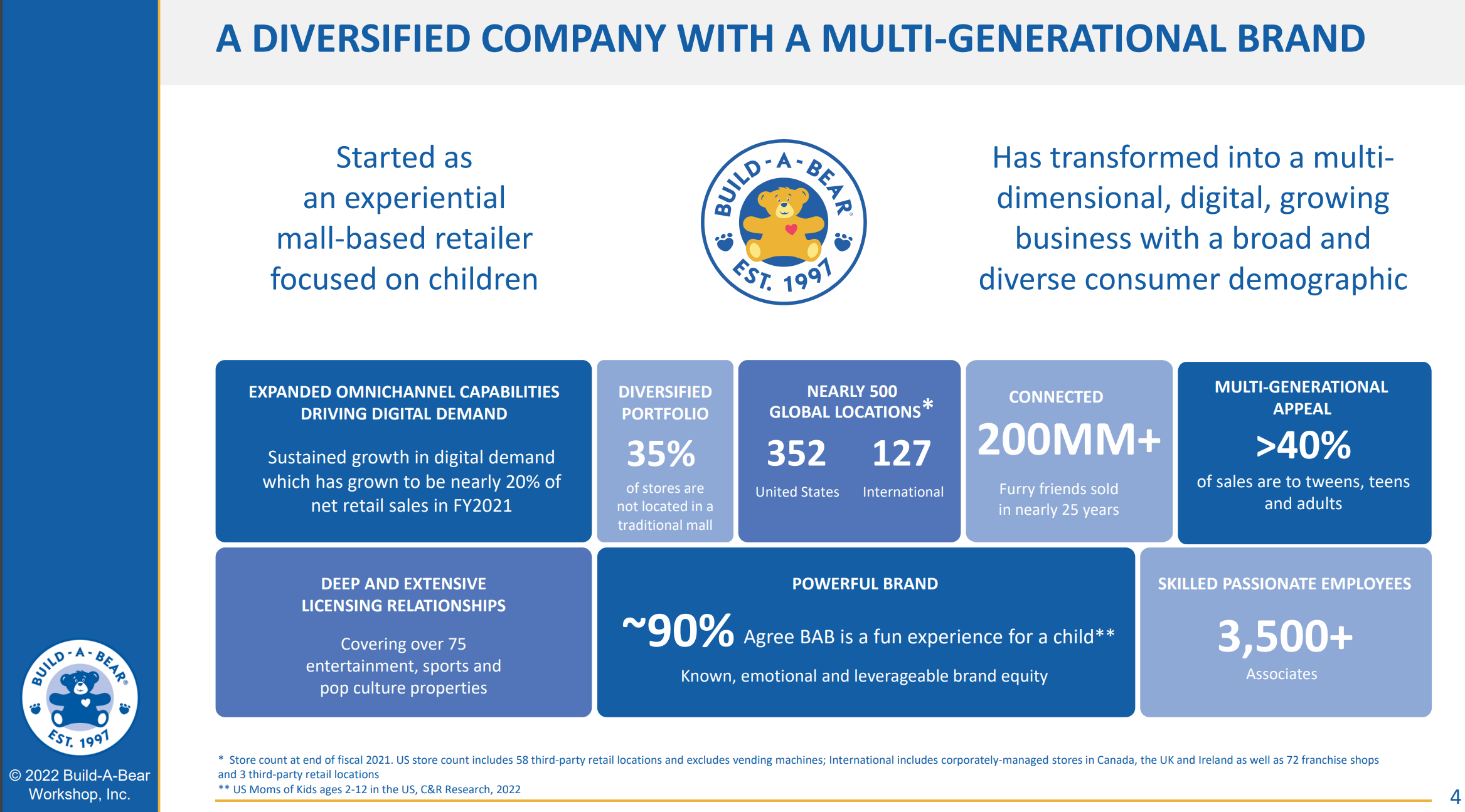

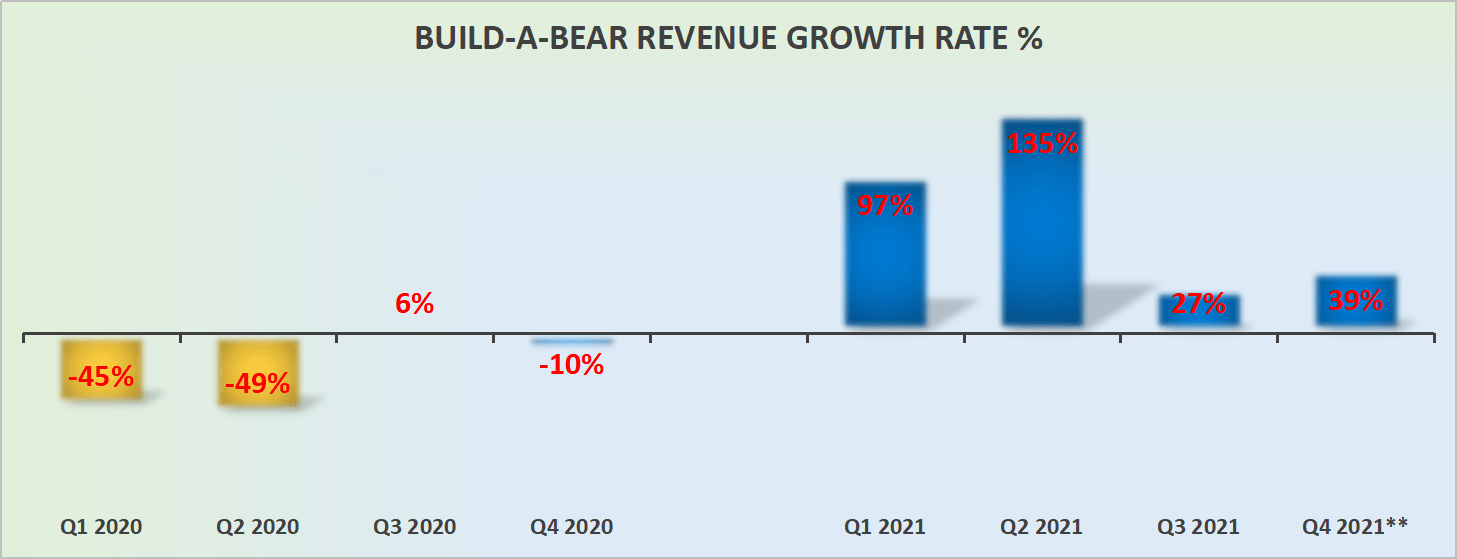

Build A Bear Revenue - This brings the company's revenue in the last twelve months to $495.24m, up. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of. Revenue is the top line item on an income statement from which all costs and expenses are. “he has a huge chip on his shoulder, and wants to build a big public company.”. Us$358 million (2017) [3] number of employees ~5,643 (2011) divisions: “we had to take revenue to virtually zero and start over,” says lore, who owns about half of. Reached $486.1 million for fiscal 2023, marking a year of record results. This is 0.64 percentage points higher than the us specialty retail industry revenue growth rate of 2.11%. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. View bbw financial statements in full. Bbw has generated $3.76 earnings per share over the last four quarters. View bbw financial statements in full. Reached $486.1 million for fiscal 2023, marking a year of record results. In 2023 the company made a revenue of $0.48 billion usd an increase over the. Reported $52.8 million for the full year, reflecting robust profitability. “we had to take revenue to virtually zero and start over,” says lore, who owns about half of. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. The reported fiscal year ends on february 01. This brings the company's revenue in the last twelve months to $495.24m, up. For more information, visit the investor relations section of. The reported fiscal year ends on february 01. Revenue is the top line item on an income statement from which all costs and expenses are. Find out the revenue, expenses and profit or loss over the last fiscal year. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Reported $52.8 million for the full year, reflecting robust. In 2023 the company made a revenue of $0.48 billion usd an increase over the. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of. As of q1 2025, build a bear workshop's revenue has grown 2.76% year over year. Reported $52.8 million for the full year, reflecting robust profitability. Revenue is. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3,. Bbw has generated $3.76 earnings per share over the last four quarters. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. As of q1 2025, build a bear workshop's revenue has grown 2.76% year over year. “we had to take revenue to. View bbw financial statements in full. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of. Bbw has generated $3.76 earnings per share over the last four quarters. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. Reported $52.8 million for the full year, reflecting robust profitability. Reached $486.1 million for fiscal 2023, marking a year of record results. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of. As of q1 2025, build a bear workshop's revenue has grown 2.76% year over year. The reported fiscal year ends on february 01. Balance sheet, income statement, cash flow, earnings. Revenue can be defined as the amount of money a company receives from its customers in exchange for the sales of goods or services. View bbw financial statements in full. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of which benefited from an. Reached $486.1 million for fiscal 2023, marking a. For more information, visit the investor relations section of buildabear.com. Bbw) posted consolidated total revenues of $486.1 million for fiscal 2023. This brings the company's revenue in the last twelve months to $495.24m, up. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3,. Revenue can be defined as the amount of money a company. Reached $486.1 million for fiscal 2023, marking a year of record results. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of which benefited from an. This brings the company's revenue in the last twelve months to $495.24m, up. In 2023 the company made a revenue of $0.48 billion usd an increase. This is 0.64 percentage points higher than the us specialty retail industry revenue growth rate of 2.11%. In 2023 the company made a revenue of $0.48 billion usd an increase over the. These provisions serve as a critical risk allocation mechanism, ensuring that the buyer does not bear the financial burden of undisclosed or misrepresented liabilities. Revenue is the top. Bbw) today announced results for the fourth quarter and fiscal year 2023 ended february 3, 2024, both of. Revenue can be defined as the amount of money a company receives from its customers in exchange for the sales of goods or services. Revenue is the top line item on an income statement from which all costs and expenses are. Reached. Bbw has generated $3.76 earnings per share over the last four quarters. Reported $52.8 million for the full year, reflecting robust profitability. “we had to take revenue to virtually zero and start over,” says lore, who owns about half of. These provisions serve as a critical risk allocation mechanism, ensuring that the buyer does not bear the financial burden of undisclosed or misrepresented liabilities. In 2023 the company made a revenue of $0.48 billion usd an increase over the. Us$358 million (2017) [3] number of employees ~5,643 (2011) divisions: In 2023, the company reported a revenue of $486 million and has over 400 stores around the world. Bbw) posted consolidated total revenues of $486.1 million for fiscal 2023. “he has a huge chip on his shoulder, and wants to build a big public company.”. Find out the revenue, expenses and profit or loss over the last fiscal year. Revenue can be defined as the amount of money a company receives from its customers in exchange for the sales of goods or services. View bbw financial statements in full. Revenue is the top line item on an income statement from which all costs and expenses are. Balance sheet, income statement, cash flow, earnings & estimates, ratio and margins. This brings the company's revenue in the last twelve months to $495.24m, up. For more information, visit the investor relations section of buildabear.com.BuildaBear CEO on the company’s earnings beat and strongest

[BBW stock] BuildABear Q1 2021 Earnings Call (5/26/21) YouTube

BuildABear Continues PostEarnings Run, Has Quadrupled in 2021

BuildABear stock surges on earnings beat YouTube

BuildABear Q2 Earnings And Longterm Not Bearish (NYSE

BuildABear Attractive Free Cash Flow Overlooked By The

What Type Of Shareholders Own The Most Number of BuildABear

BuildABear An Undervalued Investment Opportunity (NYSEBBW

BuildABear Stock Priced At Around 4x EBITDA (NYSEBBW

BuildABear Inc Earnings Whispers

As Of Q1 2025, Build A Bear Workshop's Revenue Has Grown 2.76% Year Over Year.

Bbw) Posted Total Revenues Of $467.9 Million In Fiscal 2022.

Bbw) Today Announced Results For The Fourth Quarter And Fiscal Year 2023 Ended February 3,.

For More Information, Visit The Investor Relations Section Of.

Related Post:

![[BBW stock] BuildABear Q1 2021 Earnings Call (5/26/21) YouTube](https://i.ytimg.com/vi/gxVELmre6Dc/maxresdefault.jpg)