Builder Loan Requirements

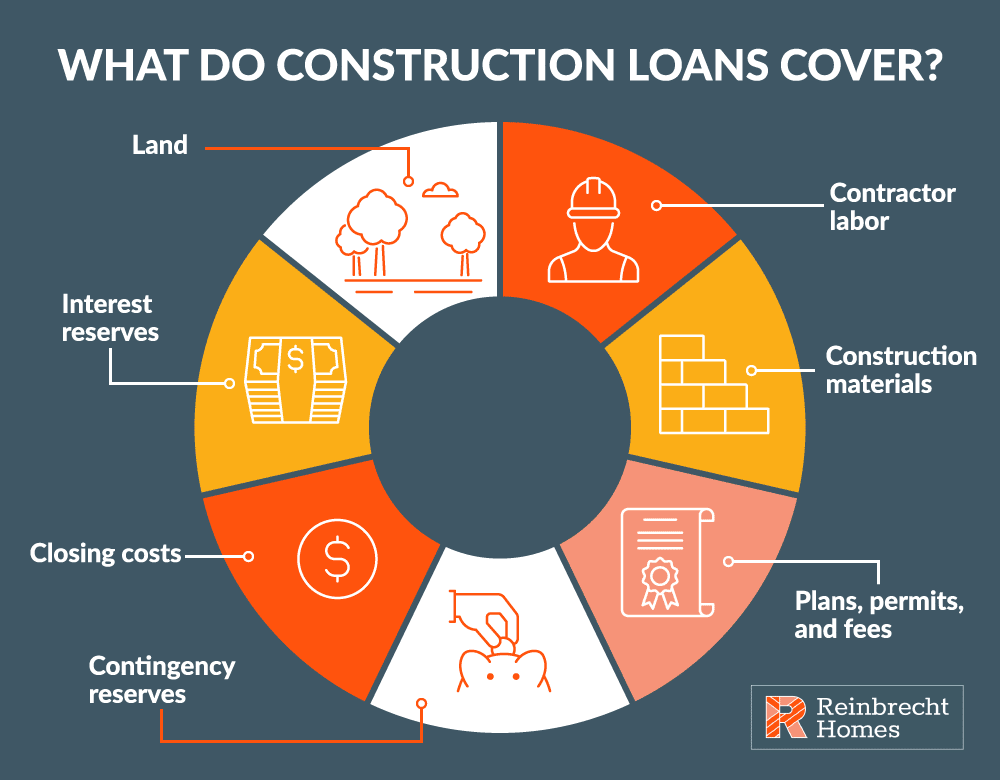

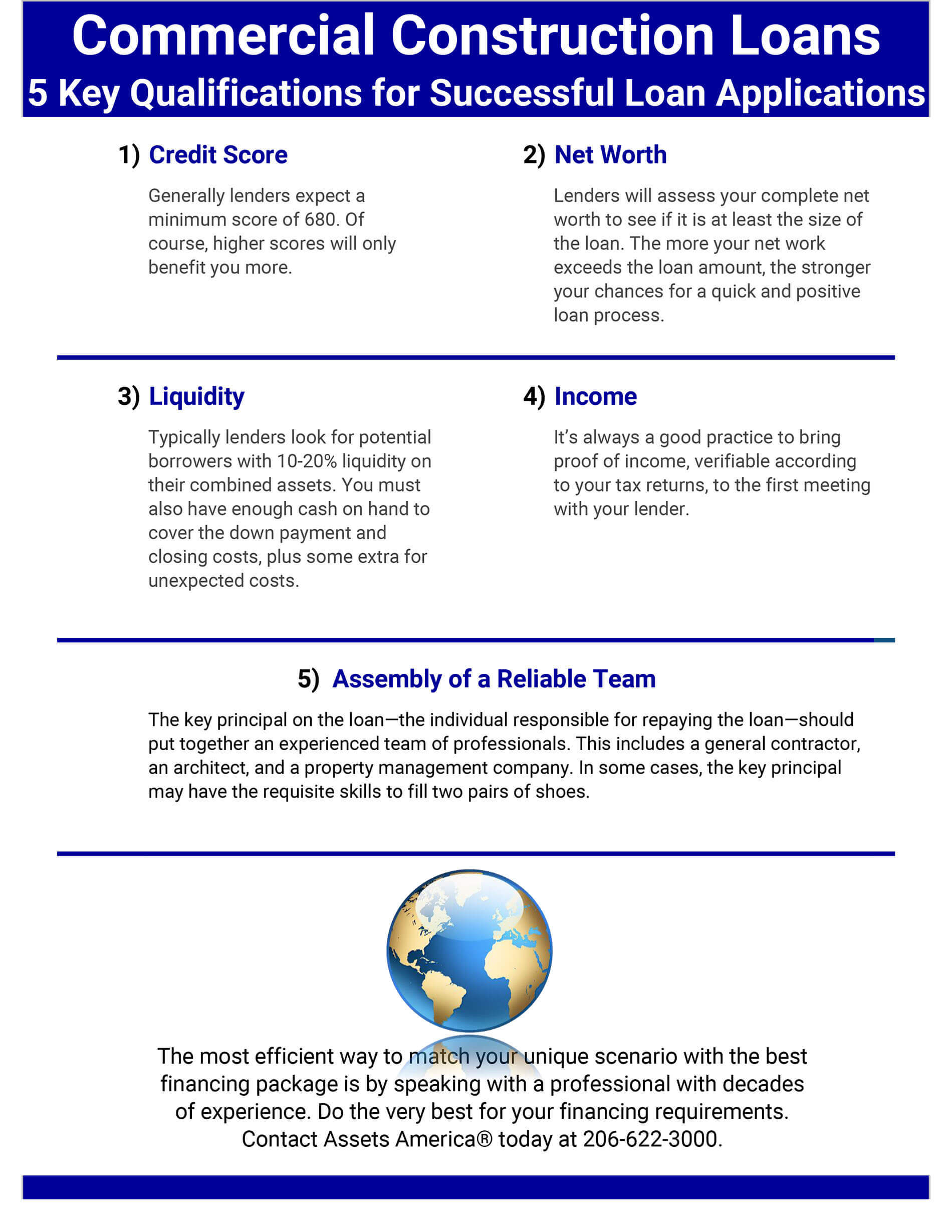

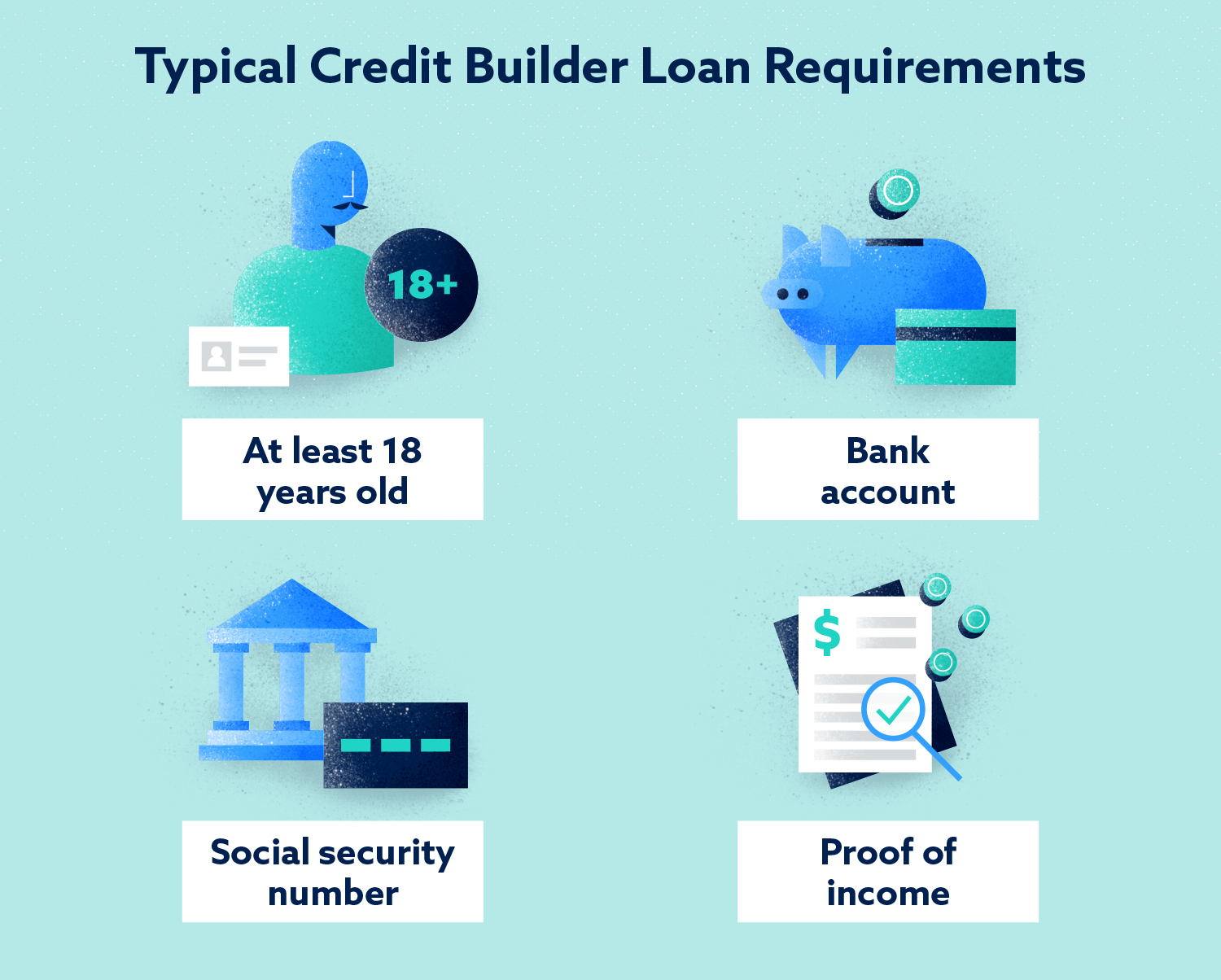

Builder Loan Requirements - To qualify for a construction loan, borrowers typically need to meet certain criteria: Acts like a line of credit, with installment payments made to your home builder as stages of construction are completed, based on timeline; Some construction loans can be converted to mortgages after your home is finished. To secure a construction loan, a strong credit score and financial stability are prerequisites. Here are some common prerequisites: Lenders often require a good credit score to approve a construction loan. Lenders typically require a credit score above. Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you’re in the market and work to increase. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. Securing a construction home loan involves several distinct requirements compared to traditional home mortgages. Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you’re in the market and work to increase. Typically, you must have good to excellent credit. Obtaining a construction loan requires meeting specific criteria that differ from traditional mortgages. Qualifications for a construction loan can vary between lenders but here are some common requirements. As with any loan, when qualifying for a construction loan, you will need to meet some specific requirements. Here are some common prerequisites: Understanding these prerequisites is essential for potential borrowers. Securing a construction home loan involves several distinct requirements compared to traditional home mortgages. Fha title 1 loans don’t have set credit score requirements, and many types of properties are eligible for financing. Here is a list of requirements. Here are some common prerequisites: Acts like a line of credit, with installment payments made to your home builder as stages of construction are completed, based on timeline; Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well.. Understanding these prerequisites is essential for potential borrowers. To secure a construction loan, a strong credit score and financial stability are prerequisites. Fha construction loan requirements although an fha construction loan comes with many benefits, it’s not always easy to meet fha standards. After construction is done, many homeowners. Fha minimum property standards & house requirements. Getting a construction loan requires a lot of planning because lenders want to see a clear construction plan before issuing this type of loan. Acts like a line of credit, with installment payments made to your home builder as stages of construction are completed, based on timeline; As with any loan, when qualifying for a construction loan, you will need. Fha construction loan requirements although an fha construction loan comes with many benefits, it’s not always easy to meet fha standards. Fha minimum property standards & house requirements. At first glance, getting approval for a new construction loan may seem similar to. Lenders typically require a credit score above. Here is a list of requirements. Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you’re in the market and work to increase. At first glance, getting approval for a new construction loan may seem similar to. Understanding these prerequisites is essential for potential borrowers. Some construction loans can be converted to mortgages. Banks assess credit scores to evaluate the borrower's creditworthiness and risk. Here are some common prerequisites: Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you’re in the market and work to increase. At first glance, getting approval for a new construction loan may seem similar to.. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. Acts like a line of credit, with installment payments made to your home builder as stages of construction are completed, based on timeline; Fha minimum property standards &. If you want to use. Fha construction loan requirements although an fha construction loan comes with many benefits, it’s not always easy to meet fha standards. To qualify for a construction loan, borrowers typically need to meet certain criteria: Lenders typically require a credit score above. Lenders often require a good credit score to approve a construction loan. If a borrower already has equity in a. Banks assess credit scores to evaluate the borrower's creditworthiness and risk. Qualifications for a construction loan can vary between lenders but here are some common requirements. To secure a construction loan, a strong credit score and financial stability are prerequisites. Understanding these prerequisites is essential for potential borrowers. Construction loan requirements are the criteria set by lenders that borrowers must meet to secure financing for a new build or major renovation, such as a complete teardown. Lenders typically require a credit score above. Ensure your home meets fha guidelines for safety, livability, and loan approval. Fha minimum property standards & house requirements. Acts like a line of credit,. Construction loans are a bit. Lenders often require a good credit score to approve a construction loan. Qualifications for a construction loan can vary between lenders but here are some common requirements. As with any loan, when qualifying for a construction loan, you will need to meet some specific requirements. Some construction loans can be converted to mortgages after your home is finished. Here are some common prerequisites: If you want to use. Fha minimum property standards & house requirements. Unless you are paying cash for your project, you will need a construction loan to pay for the materials and labor, and you can use it to buy the land as well. Construction loan requirements are the criteria set by lenders that borrowers must meet to secure financing for a new build or major renovation, such as a complete teardown. At first glance, getting approval for a new construction loan may seem similar to. To qualify for a construction loan, borrowers typically need to meet certain criteria: Acts like a line of credit, with installment payments made to your home builder as stages of construction are completed, based on timeline; Obtaining a construction loan requires meeting specific criteria that differ from traditional mortgages. Construction loans and mortgages, especially, require good credit to get approved, so make sure to review your credit report many months before you’re in the market and work to increase. Fha construction loan requirements although an fha construction loan comes with many benefits, it’s not always easy to meet fha standards.Everything You Need to Know About Construction to Permanent Loan

Construction Loans 101 Everything You Need To Know

Total Mortgage Mortgage Lender Services & Financing Solutions Nationwide

Top 5 Construction Loan Requirements Fast Approval Secrets

Draw Schedule Construction Loan Construction loans, Buying first

Commercial Construction Loans Guide + Financing from 5M

What is a Credit Builder Loan and Do They Work? Lexington Law

Required Documents for Home Construction Loan Application [2024]

Construction Financing Requirements. Finding a bank for ownerbuilder

Construction Loans 101 Everything You Need To Know

Banks Assess Credit Scores To Evaluate The Borrower's Creditworthiness And Risk.

To Secure A Construction Loan, A Strong Credit Score And Financial Stability Are Prerequisites.

Getting A Construction Loan Requires A Lot Of Planning Because Lenders Want To See A Clear Construction Plan Before Issuing This Type Of Loan.

After Construction Is Done, Many Homeowners.

Related Post:

![Required Documents for Home Construction Loan Application [2024]](https://www.aavas.in/uploads/images/blog/documents-required-for-a-home-construction-loan-1-1375216954.png)