Buyer Defaults On Loan For Commercial Building New York

Buyer Defaults On Loan For Commercial Building New York - The recent trajectory of a case involving a property at 12 east 48th street in manhattan before judge frank p. The us$308 million mortgage on a manhattan office tower owned by blackstone is up for sale again after the private equity giant defaulted on the debt more than a year ago. When examining commercial, office building loans, there are a myriad of people and properties that can be affected when a commercial loan is in default. This holland & knight alert highlights several important considerations in dealing with potential condominium loan defaults, including the key decision of whether to issue a. Gfp real estate has defaulted on a $103m loan it owes on a midtown east office tower, according to a fitch ratings report. Mounting financial obligations and the lack of easily accessible cash has turned the u.s. (1) the base case, which would typically apply; Endnotes explain and comment on the model provisions, and when and why one might want. Nervo of the new york state supreme court (new york. The new york state court of appeals on march 21, 2013 rendered a decision in which it has defined how to measure a seller’s damages for a buyer’s breach of contract in the sale of real. The recent trajectory of a case involving a property at 12 east 48th street in manhattan before judge frank p. According to new york’s specific rules, lenders must follow particular steps and fill out certain. Brokerage jones lang lasalle was hired to sell blackstone's defaulted new york city loan. From the loan for interest on the building loan (but not for interest on the senior or project loans), and the lender’s (but not the borrower’s) legal fees associated with the building loan. What’s at stake for the lender is their priority position in case of a default or legal dispute. Commercial real estate market upside down in recent months. A defaulting buyer will forfeit its down payment, and, if the seller defaults, the buyer will be entitled to commence an action for specific performance. The us$308 million mortgage on a manhattan office tower owned by blackstone is up for sale again after the private equity giant defaulted on the debt more than a year ago. (1) the base case, which would typically apply; As of late may, an. According to new york’s specific rules, lenders must follow particular steps and fill out certain. Nervo of the new york state supreme court (new york. The new york state court of appeals on march 21, 2013 rendered a decision in which it has defined how to measure a seller’s damages for a buyer’s breach of contract in the sale of. As of late may, an. Gfp real estate has defaulted on a $103m loan it owes on a midtown east office tower, according to a fitch ratings report. A defaulting buyer will forfeit its down payment, and, if the seller defaults, the buyer will be entitled to commence an action for specific performance. Brokerage jones lang lasalle was hired to. Nervo of the new york state supreme court (new york. This practice note discusses borrower default and lender remedy provisions in commercial real estate financing documentation in new york and provides an overview of commonly used. Gfp real estate has defaulted on a $103m loan it owes on a midtown east office tower, according to a fitch ratings report. David. Brokerage jones lang lasalle was hired to sell blackstone's defaulted new york city loan. Nervo of the new york state supreme court (new york. For leases, and again for loan documents, this article offers two sets of sample provisions: The recent trajectory of a case involving a property at 12 east 48th street in manhattan before judge frank p. Mounting. Brokerage jones lang lasalle was hired to sell blackstone's defaulted new york city loan. This holland & knight alert highlights several important considerations in dealing with potential condominium loan defaults, including the key decision of whether to issue a. What’s at stake for the lender is their priority position in case of a default or legal dispute. According to new. Mounting financial obligations and the lack of easily accessible cash has turned the u.s. Owner will also want to: Nervo of the new york state supreme court (new york. David hoffman, a vice chairman at cushman & wakefield (cwk), represents a boutique financial services firm that was testing the waters of a new york city presence with a. (1) the. When examining commercial, office building loans, there are a myriad of people and properties that can be affected when a commercial loan is in default. This holland & knight alert highlights several important considerations in dealing with potential condominium loan defaults, including the key decision of whether to issue a. And (2) special cases, which would apply only sometimes. Owner. Brokerage jones lang lasalle was hired to sell blackstone's defaulted new york city loan. Gfp real estate has defaulted on a $103m loan it owes on a midtown east office tower, according to a fitch ratings report. Commercial real estate market upside down in recent months. As matters stand in this case, there is conflicting evidence as to the property's. Owner will also want to: When examining commercial, office building loans, there are a myriad of people and properties that can be affected when a commercial loan is in default. (1) the base case, which would typically apply; This holland & knight alert highlights several important considerations in dealing with potential condominium loan defaults, including the key decision of whether. This practice note discusses borrower default and lender remedy provisions in commercial real estate financing documentation in new york and provides an overview of commonly used. As matters stand in this case, there is conflicting evidence as to the property's fair market value when the buyer defaulted, an issue of fact, which precludes summary judgment. According to new york’s specific. As matters stand in this case, there is conflicting evidence as to the property's fair market value when the buyer defaulted, an issue of fact, which precludes summary judgment. This practice note discusses borrower default and lender remedy provisions in commercial real estate financing documentation in new york and provides an overview of commonly used. Brokerage jones lang lasalle was hired to sell blackstone's defaulted new york city loan. Gfp real estate has defaulted on a $103m loan it owes on a midtown east office tower, according to a fitch ratings report. The new york state court of appeals on march 21, 2013 rendered a decision in which it has defined how to measure a seller’s damages for a buyer’s breach of contract in the sale of real. The recent trajectory of a case involving a property at 12 east 48th street in manhattan before judge frank p. According to new york’s specific rules, lenders must follow particular steps and fill out certain. What’s at stake for the lender is their priority position in case of a default or legal dispute. Nervo of the new york state supreme court (new york. (1) the base case, which would typically apply; From the loan for interest on the building loan (but not for interest on the senior or project loans), and the lender’s (but not the borrower’s) legal fees associated with the building loan. David hoffman, a vice chairman at cushman & wakefield (cwk), represents a boutique financial services firm that was testing the waters of a new york city presence with a. The us$308 million mortgage on a manhattan office tower owned by blackstone is up for sale again after the private equity giant defaulted on the debt more than a year ago. And (2) special cases, which would apply only sometimes. Mounting financial obligations and the lack of easily accessible cash has turned the u.s. Owner will also want to:Developer of Brooklyn’s tallest skyscraper defaults on 240M loan — 93

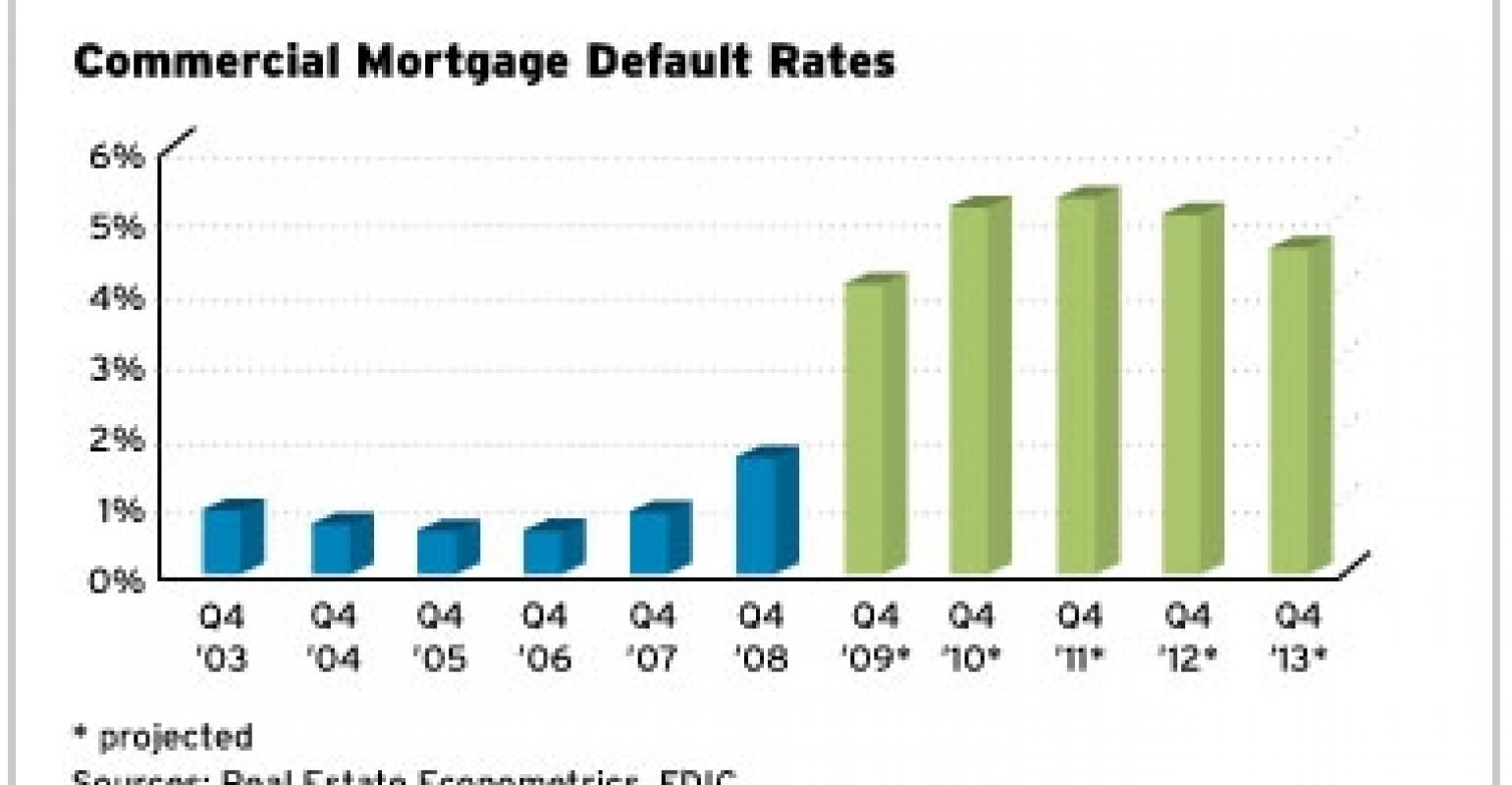

Commercial Mortgage Defaults Hit 17Year High National Real Estate

Cunard Building’s 250M CMBS Loan in Special Servicing

What Does it Mean to Default on a Loan?

PPT Commercial Real Estate What you Need to Know PowerPoint

PPT Commercial Real Estate What you Need to Know PowerPoint

Free of Charge Creative Commons notice of default Image Real Estate 3

Midtown Dumont Building Defaults on 103M Loan

NYCB Reports 400 Jump in Defaults As Multifamily Fears Grow

Brooklyn Tower Developer Defaults on Loan, Building Could be Auctioned

As Of Late May, An.

A Defaulting Buyer Will Forfeit Its Down Payment, And, If The Seller Defaults, The Buyer Will Be Entitled To Commence An Action For Specific Performance.

For Leases, And Again For Loan Documents, This Article Offers Two Sets Of Sample Provisions:

Endnotes Explain And Comment On The Model Provisions, And When And Why One Might Want.

Related Post: