Can You Build Credit Under 18

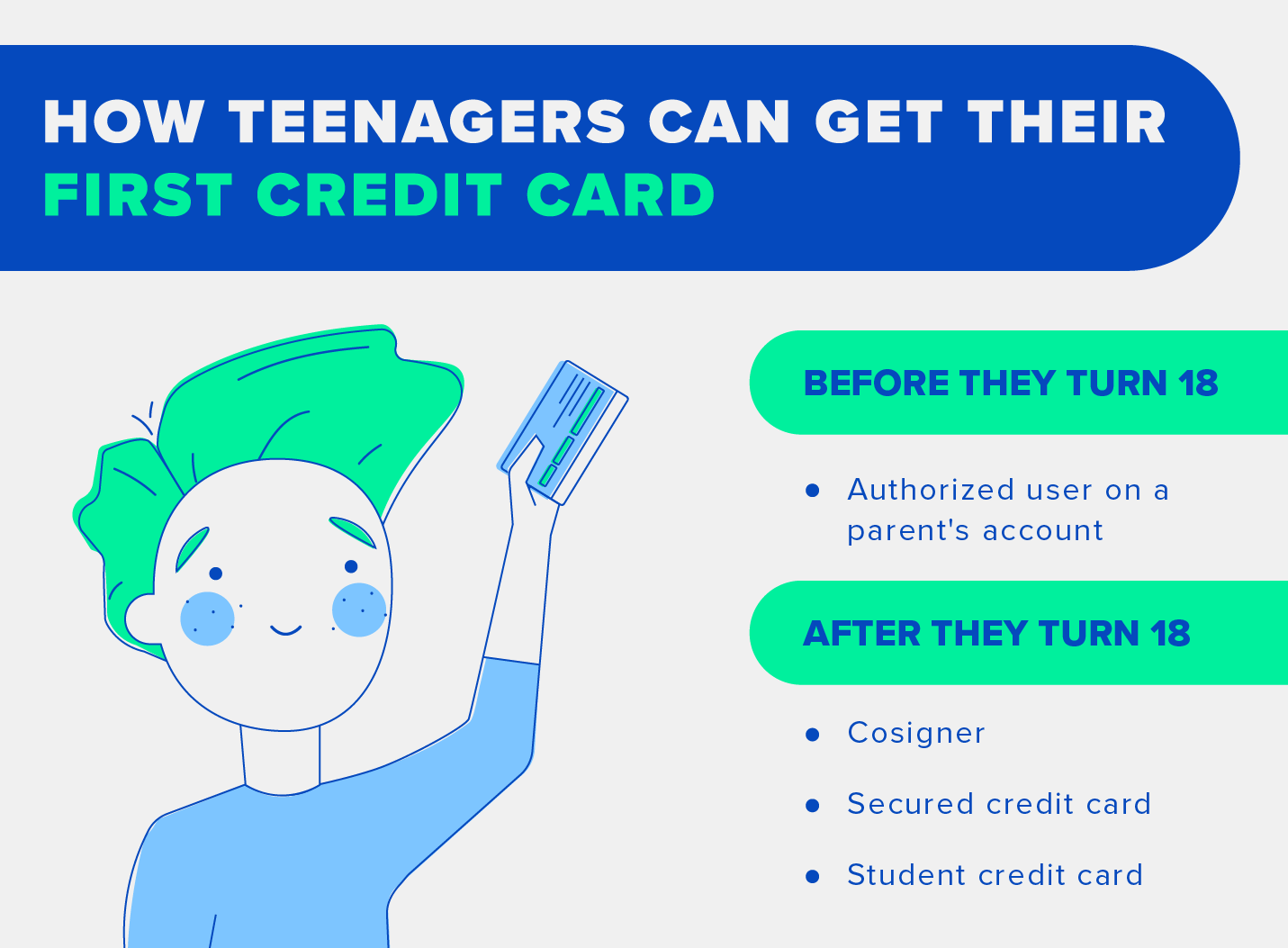

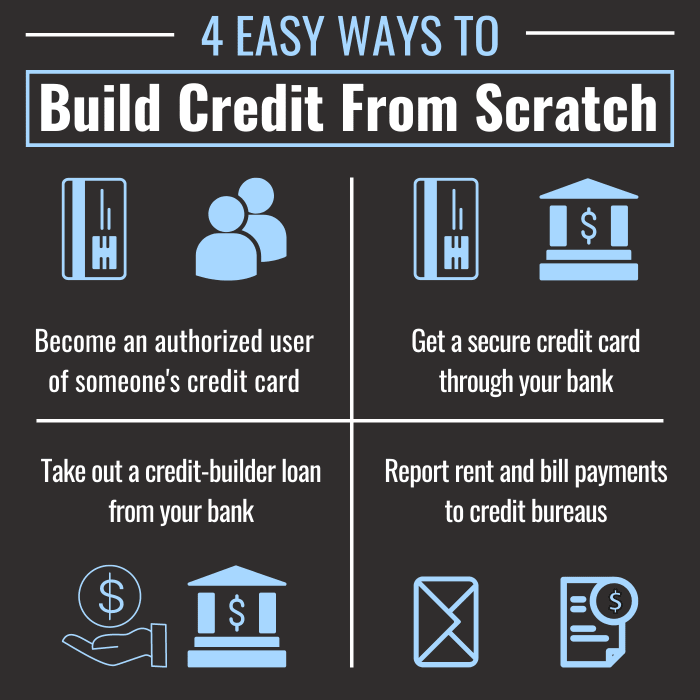

Can You Build Credit Under 18 - Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. Only legal adults that are 18 years or older can apply for a credit card. Yes, parents can help their child’s credit during their high school years by adding them on their credit card account as an authorized. A child usually needs to be. How can i build credit as a minor? Here are eight ways to get started building a credit history. It's important to set your kids up with a good financial foundation, and building a credit score is a great place to start. Empower your teen with financial wisdom: Yes, you can build your credit before you turn 18! Can you build your credit before 18? Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. It's important to set your kids up with a good financial foundation, and building a credit score is a great place to start. Although you can only have a credit score from age 18 and up, there are several ways you can establish a solid financial foundation by building credit long before you reach adulthood. What’s the first step to doing anything? Intellect increases your essence capacity (image credit: If you’re 18 or older, other options include a secured credit card or a. There are many ways to do it that don’t require any money. Only legal adults that are 18 years or older can apply for a credit card. Empower your teen with financial wisdom: The simplest way may be to add him or her as an authorized user on your credit card today. If you’re 18 or older, other options include a secured credit card or a. It's important to set your kids up with a good financial foundation, and building a credit score is a great place to start. There are many ways to do it that don’t require any money. You can build credit as a minor by becoming an authorized. The simplest way may be to add him or her as an authorized user on your credit card today. If you’re able to help your child start building credit at 18, they will be better off than if they started at 24. Only legal adults that are 18 years or older can apply for a credit card. It's important to. Although you can only have a credit score from age 18 and up, there are several ways you can establish a solid financial foundation by building credit long before you reach adulthood. There are a number of attributes you can put points into when building your. It's important to set your kids up with a good financial foundation, and building. Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. There are a number of attributes you can put points into when building your. You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. Yes, parents can help their. Learn how to help your teen do it, here. In this article, we’ll discuss at what age you can start building credit as well as when and how you should start working on building your teens’ financial futures. How can i build credit as a minor? There are many ways to do it that don’t require any money. It's important. Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. There are a number of attributes you can put points into when building your. There are many ways to do it that don’t require any money. Here are eight ways to get started building a credit history. Only legal adults. And, more specifically, at what age can you start building credit? Learn how to help your teen do it, here. Intellect increases your essence capacity (image credit: What’s the first step to doing anything? You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. Only legal adults that are 18 years or older can apply for a credit card. Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. Your child does not need to be 18 to start building credit. Learn how to help your teen do it, here. A child usually needs. If you’re under 18, the main path forward is becoming an authorized user on a family member’s account. Learn how to help your teen do it, here. Your child does not need to be 18 to start building credit. The simplest way may be to add him or her as an authorized user on your credit card today. In this. Yes, you can build your credit before you turn 18! If you’re under 18, the main path forward is becoming an authorized user on a family member’s account. Can you build your credit before 18? If you’re 18 or older, other options include a secured credit card or a. What’s the first step to doing anything? Parents can use a bank account as a tool for teaching good financial habits and creating opportunities for meaningful conversations. If you’re 18 or older, other options include a secured credit card or a. Can you build your credit before 18? A child usually needs to be. Yes, parents can help their child’s credit during their high school years by adding them on their credit card account as an authorized. These factors are most important when building. Empower your teen with financial wisdom: You can build credit as a minor by becoming an authorized user on a friend or family member’s credit card account. And, more specifically, at what age can you start building credit? Intellect increases your essence capacity (image credit: If you’re under 18, the main path forward is becoming an authorized user on a family member’s account. If you’re able to help your child start building credit at 18, they will be better off than if they started at 24. There are many ways to do it that don’t require any money. Yes, you can build your credit before you turn 18! What’s the first step to doing anything? Only legal adults that are 18 years or older can apply for a credit card.Best Credit Cards For Teenagers How to Build Credit Under 18 YouTube

How to Build Credit Under 18 Step Mobile YouTube

How To Build Credit Under 18 YouTube

A Parent’s Guide to Teaching High School and College Students About Credit

How to Build Credit as a Minor [Starting Before Age 18]

Teenager’s Guide to Credit Cards How to Build Credit Under 18 YouTube

4 Ways to Safely Build Credit When You Have None TheStreet

5 Best Credit Cards for Teens [Build Credit in 2024]

Credit Card and Debit Card For Under 18 Age For Everyone How To

How to Build Credit Under 18 FullPocket

Here Are Eight Ways To Get Started Building A Credit History.

Adding Your Teen As An Authorized User On Your Own Credit Card May Be A Way For Them To Learn How.

Your Child Does Not Need To Be 18 To Start Building Credit.

There Are A Number Of Attributes You Can Put Points Into When Building Your.

Related Post:

![How to Build Credit as a Minor [Starting Before Age 18]](https://wealthup.com/wp-content/uploads/parents-helping-minor-child-build-credit.jpg)

![5 Best Credit Cards for Teens [Build Credit in 2024]](https://youngandtheinvested.com/wp-content/uploads/step-signup-new-nocode.jpg)