Credit Builder Card With Ava

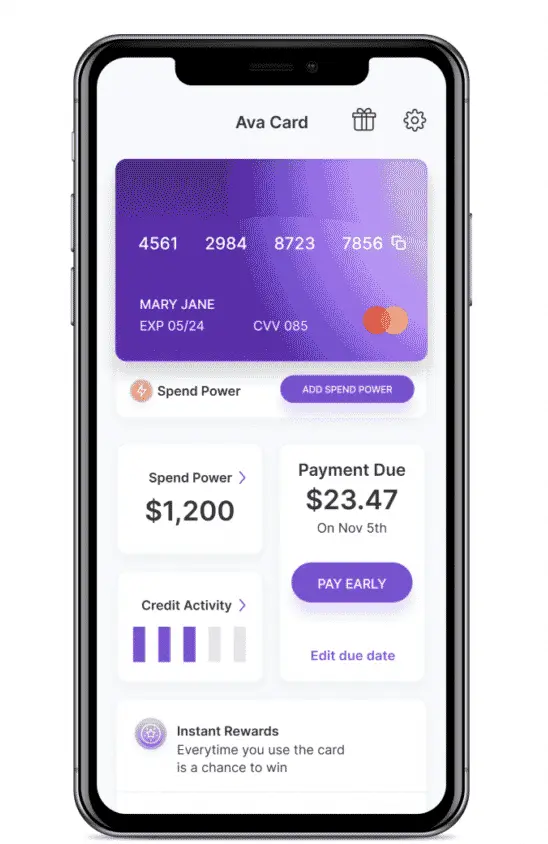

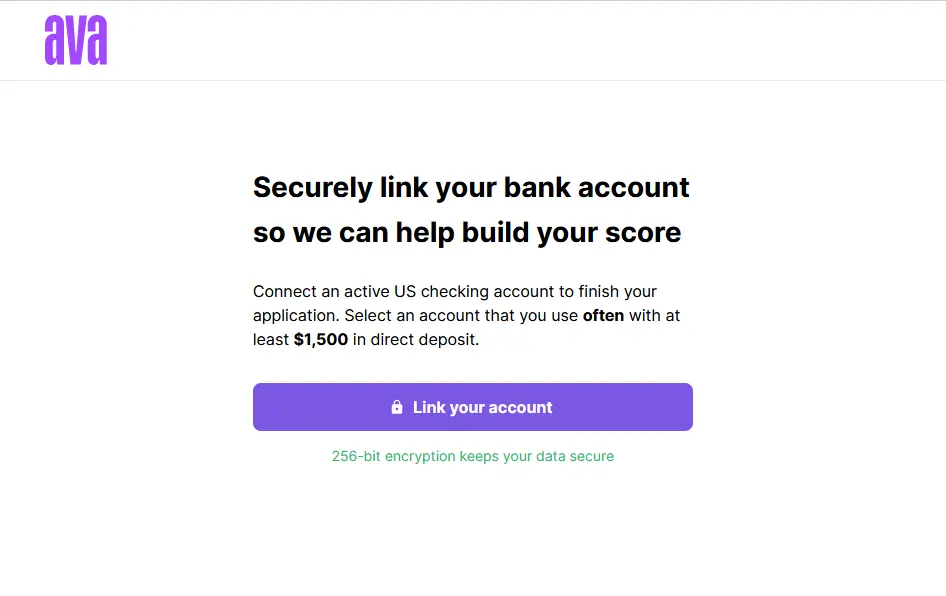

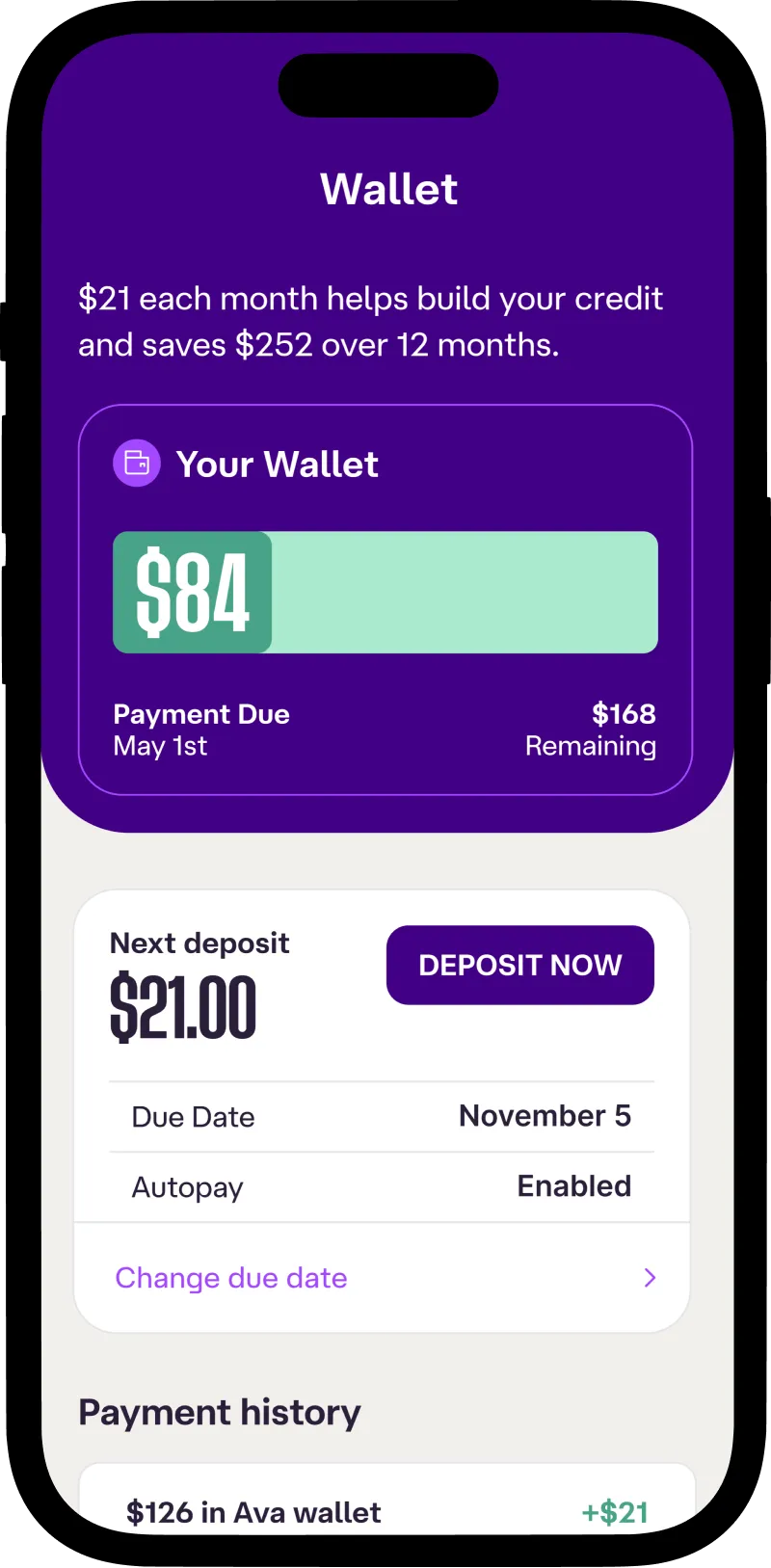

Credit Builder Card With Ava - A secured credit card is just like a regular credit card, except that it requires a security deposit. Take your financial power back with no credit check, no interest, and no late fees. Sign up and link a bank account where your paycheck is typically deposited. Many include free employee credit cards and basic expense management features. This is because they’re designed to help you if you’ve a low credit score. Firstly, it can only be used to pay for. Ava’s credit builder card allows you to pay for over 60 online subscriptions and bills like netflix and verizon, while also lowering your credit utilization. Some providers offer credit limit increases without additional deposits after. Ava’s credit builder card allows you to pay for over 60 online subscriptions and bills like netflix and verizon, while also lowering your credit utilization. With the ava credit builder card and the save & build account we provide you with a fast and easy way to build your credit history and positively impact your score so that you qualify for the. Use your ava credit builder mastercard to pay your everyday bills and build your credit profile effortlessly. Credit builder cards are sometimes also known as credit cards for bad credit. I just signed up for it, and opt in for their $2500 limit credit card, and the $21 monthly payment to boost my score up. 5) with ava's credit builder card and save & build account you add two new tradelines to your credit report that helps with your credit mix (10%) and credit history (15%). Has anyone used the ava credit builder program before? Your deposit is returned to you when you close your credit card account or switch to an. No credit check required, and. You’ll find several ways to build your credit. Take your financial power back with no credit check, no interest, and no late fees. The ava credit builder card is similar to a normal credit card, with some key differences designed to boost your credit score quickly. Sign up and link a bank account where your paycheck is typically deposited. Ava’s credit builder card allows you to pay for over 60 online subscriptions and bills like netflix and verizon, while also lowering your credit utilization. Firstly, it can only be used to pay for. The card requires a $300 minimum security deposit that acts as your. You’ll. No credit check required, and. The best way to tackle debt is to find the lowest cost of debt possible so you. A cash advance might seem like an easy way to get quick cash, but it’s one of the most expensive ways to use your credit card. We’re empowering members with the tools they need to save money and. Some providers offer credit limit increases without additional deposits after. No credit check required, and. 5) with ava's credit builder card and save & build account you add two new tradelines to your credit report that helps with your credit mix (10%) and credit history (15%). The card requires a $300 minimum security deposit that acts as your. Ava credit. The ava credit card helps you build credit and save money on debt. With the ava credit builder card and the save & build account we provide you with a fast and easy way to build your credit history and positively impact your score so that you qualify for the. Sign up and link a bank account where your paycheck. And no, you don't have to go into debt, and you don't have to. Credit builder cards are sometimes also known as credit cards for bad credit. No credit check required, and. Ava’s credit builder card allows you to pay for over 60 online subscriptions and bills like netflix and verizon, while also lowering your credit utilization. We’re empowering members. We’re empowering members with the tools they need to save money and build credit with simplicity. Sign up and link a bank account where your paycheck is typically deposited. A cash advance might seem like an easy way to get quick cash, but it’s one of the most expensive ways to use your credit card. Ava credit cards helps you. A cash advance might seem like an easy way to get quick cash, but it’s one of the most expensive ways to use your credit card. Take your financial power back with no credit check, no interest, and no late fees. And no, you don't have to go into debt, and you don't have to. Credit builder cards are sometimes. No credit check required, and. Ava’s credit builder card allows you to pay for over 60 online subscriptions and bills like netflix and verizon, while also lowering your credit utilization. Firstly, it can only be used to pay for. The card requires a $300 minimum security deposit that acts as your. Use your ava credit builder mastercard to pay your. A cash advance might seem like an easy way to get quick cash, but it’s one of the most expensive ways to use your credit card. The best way to tackle debt is to find the lowest cost of debt possible so you. No credit check required, and. Has anyone used the ava credit builder program before? What is the. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. Here’s a list of a few things that affect your credit scores: The best way to tackle debt is to find the lowest cost of debt possible so you. No credit check required, and. We’re empowering members with the tools they need. Credit builder cards are sometimes also known as credit cards for bad credit. The ava credit builder card is similar to a normal credit card, with some key differences designed to boost your credit score quickly. The ava credit card helps you build credit and save money on debt. Take your financial power back with no credit check, no interest, and no late fees. Here’s a list of a few things that affect your credit scores: Many include free employee credit cards and basic expense management features. Sign up and link a bank account where your paycheck is typically deposited. Credit cards are convenient and secure, they help build credit, they make budgeting easier, and they earn rewards. With the ava credit builder card and the save & build account we provide you with a fast and easy way to build your credit history and positively impact your score so that you qualify for the. And no, you don't have to go into debt, and you don't have to. Use your ava credit builder mastercard to pay your everyday bills and build your credit profile effortlessly. 5) with ava's credit builder card and save & build account you add two new tradelines to your credit report that helps with your credit mix (10%) and credit history (15%). Firstly, it can only be used to pay for. A cash advance might seem like an easy way to get quick cash, but it’s one of the most expensive ways to use your credit card. I just signed up for it, and opt in for their $2500 limit credit card, and the $21 monthly payment to boost my score up. No credit check required, and.Ava Credit Builder Card Review Is It Legit? Money Stocker

Ava • Credit Building App for Everyone

Ava Credit Builder Card Review Is It Legit? Money Stocker

Ava • Credit Building App for Everyone

AVA CREDIT CARD REVIEW 2023 10000 AVA CREDIT BUILDER CARD NO CREDIT

Ava Credit Builder Card Review Is It Legit? Money Stocker

Ava Credit Builder Card Review Is It Legit? Money Stocker

Ava Credit Builder Card Review Is It Legit? Money Stocker

Meet the Ava Card An Uncut Credit Builder Review

Ava Credit Builder Explained in Less Than 90 Seconds YouTube

This Is Because They’re Designed To Help You If You’ve A Low Credit Score.

Ava’s Credit Builder Card Allows You To Pay For Over 60 Online Subscriptions And Bills Like Netflix And Verizon, While Also Lowering Your Credit Utilization.

The Best Way To Tackle Debt Is To Find The Lowest Cost Of Debt Possible So You.

No Credit Check Required, And.

Related Post: