Credit One Credit Builder Average Limit

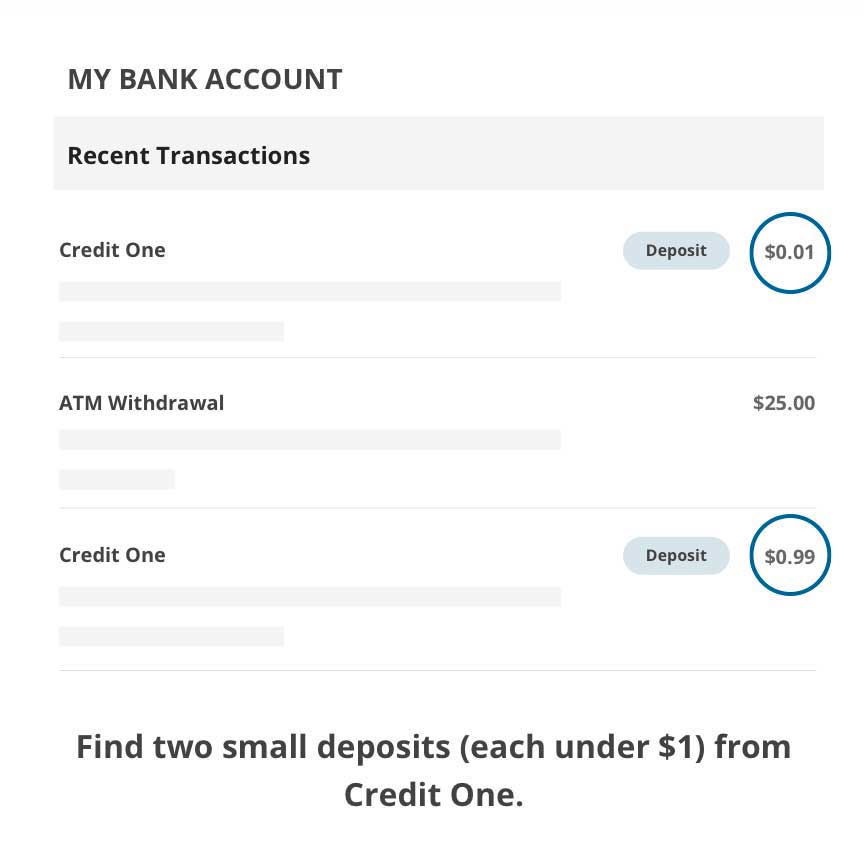

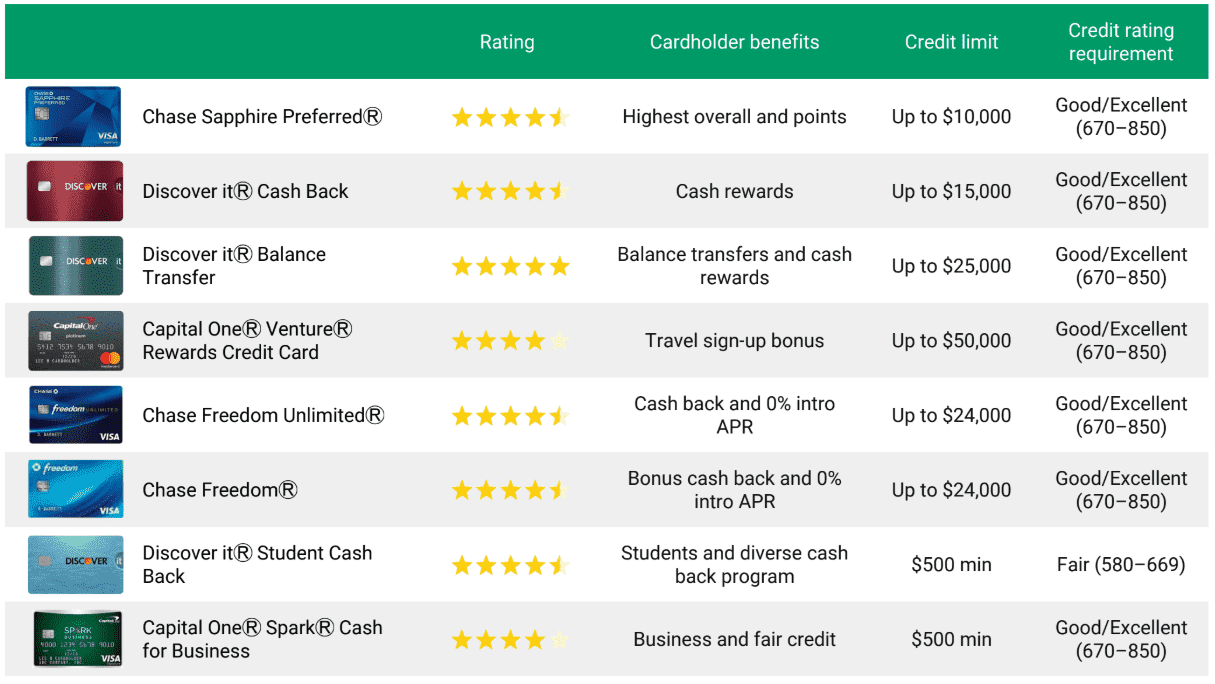

Credit One Credit Builder Average Limit - Interested in the credit one bank platinum visa? They will not work with you at all on any missed payments, unemployment, financial hardship. The starting credit limit for credit one credit cards is $300 to $500. The average credit limit for members who have matched. Factors influencing credit limits, including credit history, income, and overall financial health, play a pivotal role in determining the highest credit limit available for credit. What is the max credit limit for credit one? The starting credit limit for credit one credit cards is $300 to $500. Keep in mind that the starting credit limit you get on the. Credit one credit card applicants with the highest credit scores and the most income have the best. Capital one on the other hand will work with you. What is the max credit limit for credit one? You will be able to build credit and track your score in the one app. Here’s the average credit limit of members who matched their credit one bank® platinum x5 visa® or similar cards. Interested in the credit one bank platinum visa? If you intend to use credit one bank unsecured visa as your family's everyday. Credit one credit card applicants with the highest credit scores and the most income have the best. The average credit card limit is around $13,000, according to the most recent data from transunion, one of the three major credit bureaus. Read reviews and see cardholder data, including average credit limits and credit scores. The starting credit limit for credit one credit cards is $300 to $500. You can choose how much you’d. This card's maximum credit limit is $1,500. Credit one customers can get a higher credit limit in one of three ways — waiting for it to happen automatically, calling the card issuer or requesting an increase online. The average credit card limit is around $13,000, according to the most recent data from transunion, one of the three major credit bureaus.. Capital one on the other hand will work with you. The starting credit limit for credit one credit cards is $300 to $500. They will not work with you at all on any missed payments, unemployment, financial hardship. You will be able to build credit and track your score in the one app. The average credit limit for members who. If you care at all about having a good credit score, financial experts recommend you use less than 30% of your revolving credit — which includes credit cards and other lines of. Factors influencing credit limits, including credit history, income, and overall financial health, play a pivotal role in determining the highest credit limit available for credit. Credit one is. This card's maximum credit limit is $1,500. The average credit card limit is around $13,000, according to the most recent data from transunion, one of the three major credit bureaus. They will not work with you at all on any missed payments, unemployment, financial hardship. The starting credit limit for credit one credit cards is $300 to $500. Credit one. Factors influencing credit limits, including credit history, income, and overall financial health, play a pivotal role in determining the highest credit limit available for credit. What is the max credit limit for credit one? They will not work with you at all on any missed payments, unemployment, financial hardship. Interested in the credit one bank platinum visa? Credit one credit. You will be able to build credit and track your score in the one app. They will not work with you at all on any missed payments, unemployment, financial hardship. Read reviews and see cardholder data, including average credit limits and credit scores. Capital one on the other hand will work with you. Credit one credit card applicants with the. If you care at all about having a good credit score, financial experts recommend you use less than 30% of your revolving credit — which includes credit cards and other lines of. Credit one is fine unless you miss a payment. This card's maximum credit limit is $1,500. You will be able to build credit and track your score in. If you intend to use credit one bank unsecured visa as your family's everyday. The starting credit limit for credit one credit cards is $300 to $500. The average credit card limit is around $13,000, according to the most recent data from transunion, one of the three major credit bureaus. Credit one customers can get a higher credit limit in. Keep in mind that the starting credit limit you get on the. This card's maximum credit limit is $1,500. The starting credit limit for credit one credit cards is $300 to $500. Credit one is fine unless you miss a payment. Interested in the credit one bank platinum visa? Credit one credit card applicants with the highest credit scores and the most income have the best. The average credit limit for members who have matched. You can choose how much you’d. Factors influencing credit limits, including credit history, income, and overall financial health, play a pivotal role in determining the highest credit limit available for credit. The average credit. What is the max credit limit for credit one? You can choose how much you’d. Credit one is fine unless you miss a payment. The starting credit limit for credit one credit cards is $300 to $500. Credit one credit card applicants with the highest credit scores and the most income have the best. If you care at all about having a good credit score, financial experts recommend you use less than 30% of your revolving credit — which includes credit cards and other lines of. The average credit card limit is around $13,000, according to the most recent data from transunion, one of the three major credit bureaus. This card's maximum credit limit is $1,500. Credit one credit card applicants with the highest credit scores and the most income have the best. Factors influencing credit limits, including credit history, income, and overall financial health, play a pivotal role in determining the highest credit limit available for credit. The average credit limit for members who have matched. Here’s the average credit limit of members who matched their credit one bank® platinum x5 visa® or similar cards. Interested in the credit one bank platinum visa? Credit one customers can get a higher credit limit in one of three ways — waiting for it to happen automatically, calling the card issuer or requesting an increase online. Capital one on the other hand will work with you. You will be able to build credit and track your score in the one app.Can I increase my Self credit card limit? Leia aqui What is the

Empowering Your Teen with Early Credit Building for Government

What is the credit limit for Credit One Bank? Leia aqui Does Credit

What is the Credit One limit? Leia aqui How often does Credit One

What is the max credit limit with credit one? Leia aqui What is Credit

What is the credit limit for Credit One Bank? Leia aqui Does Credit

How often does Credit One raise limit? Leia aqui Will credit one

Can I increase my Self credit card limit? Leia aqui What is the

How often does Credit One raise limit? Leia aqui Will credit one

CREDIT BUILDER CREDIT CARD Credit One Credit Cards. Auto Credit limit

If You Intend To Use Credit One Bank Unsecured Visa As Your Family's Everyday.

Keep In Mind That The Starting Credit Limit You Get On The.

Read Reviews And See Cardholder Data, Including Average Credit Limits And Credit Scores.

They Will Not Work With You At All On Any Missed Payments, Unemployment, Financial Hardship.

Related Post:

:max_bytes(150000):strip_icc()/6-benefits-to-increasing-your-credit-limit.aspx-Final-3e39f0c2ff2849e99e00473e4027810e.png)