Depreciation Life Of Commercial Building

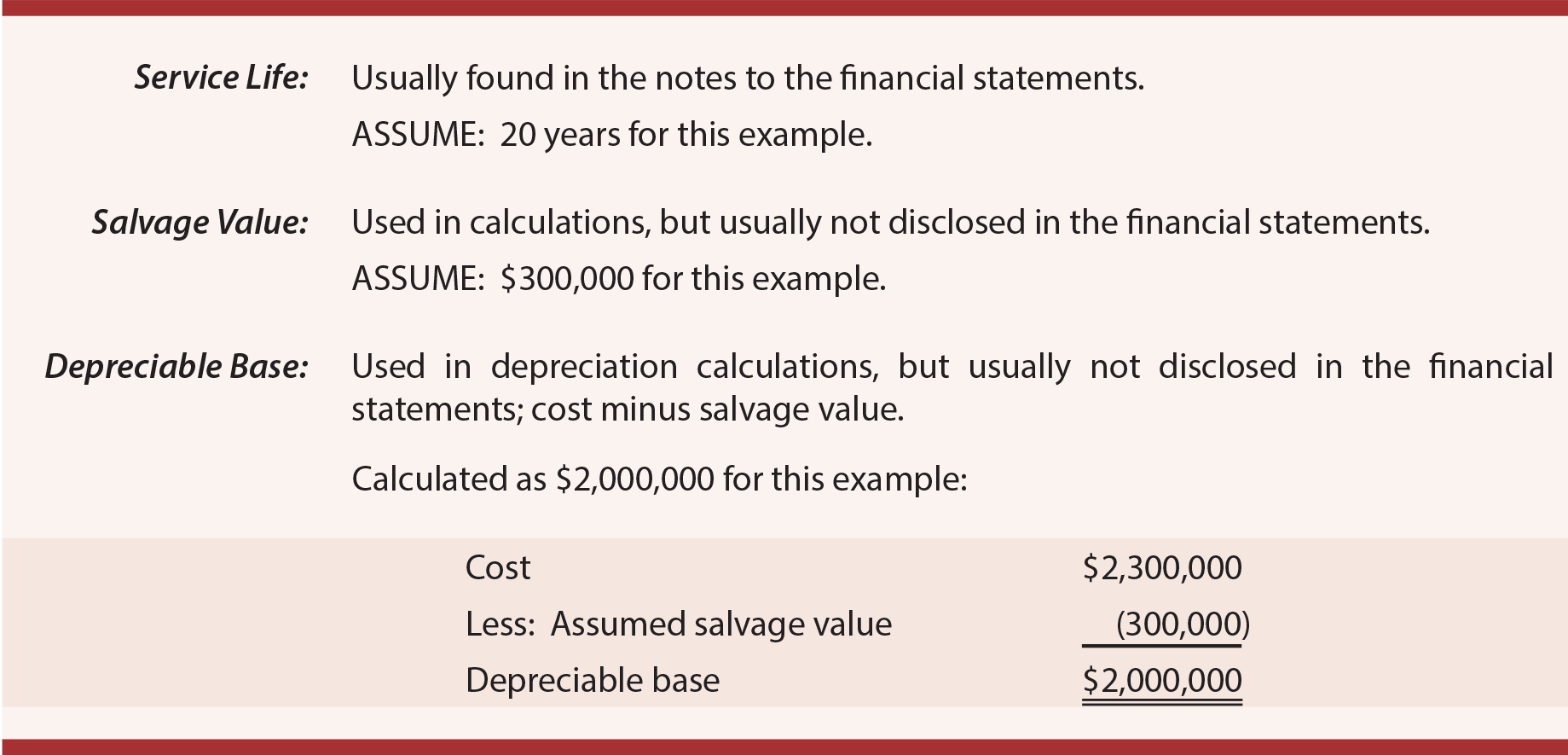

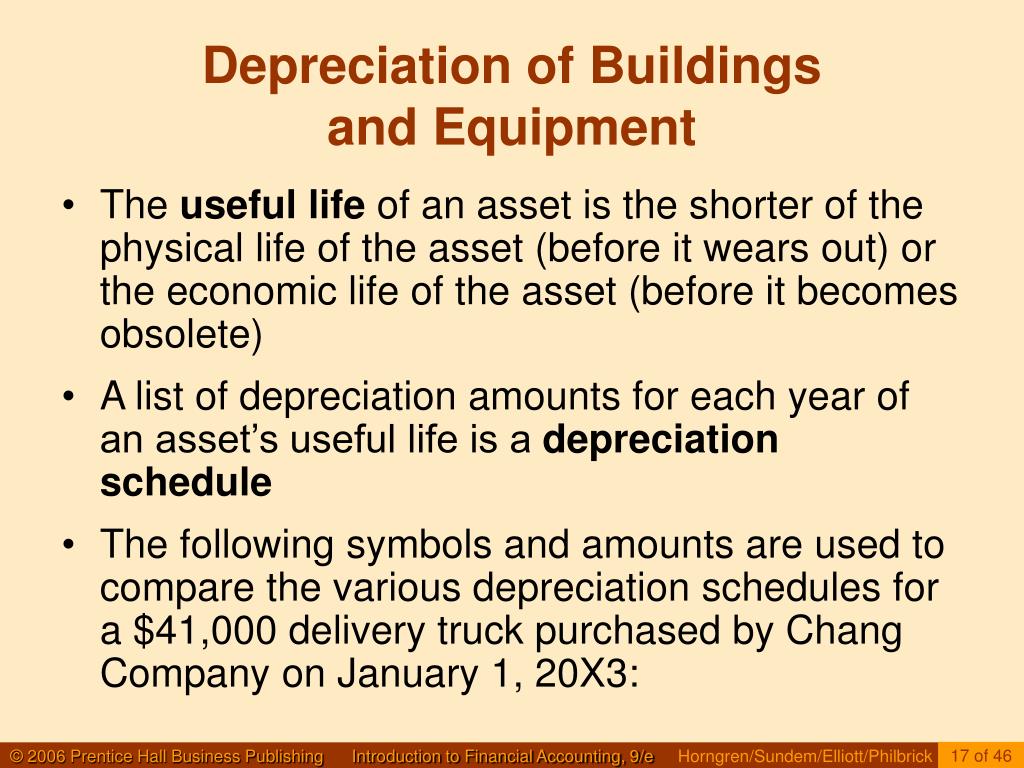

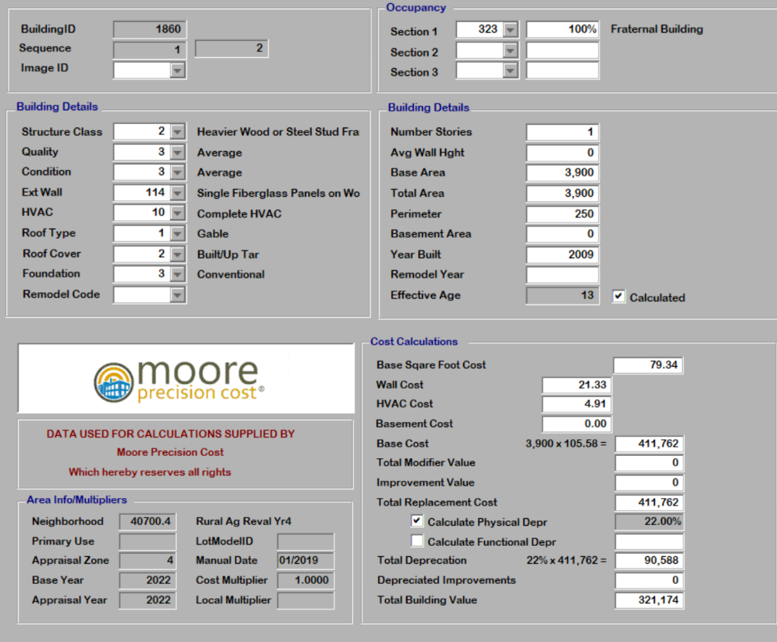

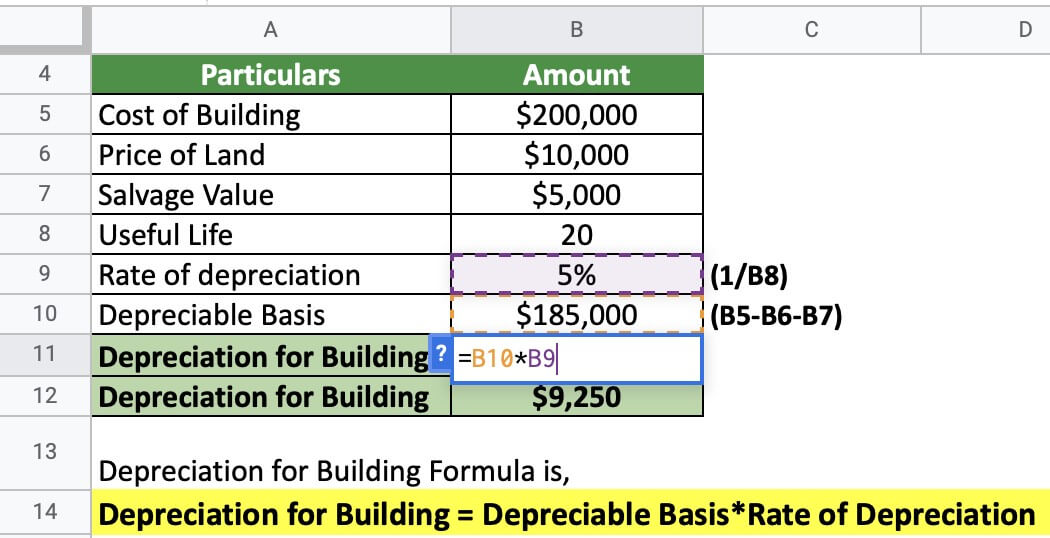

Depreciation Life Of Commercial Building - Residential buildings residential buildings typically have a depreciation rate of around 5% per year. This rate is relatively lower compared to commercial or industrial. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. The process begins by determining the asset’s. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. There are several types of capital assets that can be depreciated when you use them in your business. [3] can i depreciate the cost of land? Depreciation of a building is the. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Land can never be depreciated. [3] can i depreciate the cost of land? Depreciation of a building is the. According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years. The process begins by determining the asset’s. What is depreciation in commercial real estate? Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. In commercial real estate, depreciation refers to the gradual decline in a property’s value due to wear and tear, obsolescence, or other causes. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. Residential buildings residential buildings typically have a depreciation rate of around 5% per year. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property.. The lifespan of a roof impacts financial. Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. There are several types of capital assets that can be depreciated when you use them in your business. This rate is relatively lower compared to commercial or industrial. Understanding the depreciation life of a commercial roof is essential. Understanding depreciation in rental property. Commercial buildings are typically depreciated over 39 years, allowing owners to spread out the property's cost and reduce. There are several types of capital assets that can be depreciated when you use them in your business. [3] can i depreciate the cost of land? Understanding the depreciation life of a commercial roof is essential for. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. The lifespan of a roof impacts financial. Residential buildings residential. Ive got a client replacing the roof and hvac ducting. The lifespan of a roof impacts financial. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. The process begins by determining the asset’s. This rate is relatively lower compared to commercial or industrial. The process begins by determining the asset’s. Understanding depreciation in rental property. According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years. The lifespan of a roof impacts financial. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. This rate is relatively lower compared to commercial or industrial. What is depreciation in commercial real estate? If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of. Residential buildings residential buildings typically have a depreciation rate of around 5% per year. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. Depreciation of a building is the. The lifespan of a roof impacts financial. Ive got a client replacing. The process begins by determining the asset’s. This rate is relatively lower compared to commercial or industrial. For tax purposes in the united states, the irs assigns a useful life of 39 years to commercial properties, meaning the building's value can be deducted in equal portions (using. Understanding depreciation in rental property. If you know the equipment isn't going to. For commercial properties, which generate income over many years, depreciation allows businesses to spread out the cost of the building over its useful life, matching the expense with. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. [3] can i depreciate the cost of land? For tax. This rate is relatively lower compared to commercial or industrial. Commercial real estate depreciation is a key tax deduction that allows property owners to recover the cost of their investment over time. The lifespan of a roof impacts financial. Commercial and residential buildings can be depreciated over a certain number of years based on the type of property. The process begins by determining the asset’s. Ive got a client replacing the roof and hvac ducting. There are several types of capital assets that can be depreciated when you use them in your business. Depreciation of a building is the. Understanding the depreciation life of a commercial roof is essential for businesses to manage assets effectively and optimize tax benefits. Understanding the concept of building depreciation and its useful life is pivotal in the realm of real estate, accounting, and asset management. Residential buildings residential buildings typically have a depreciation rate of around 5% per year. Understanding depreciation in rental property. Commercial buildings and improvements are depreciated over 39 years, but there are tax breaks that allow deductions to be taken more quickly for certain real estate investments. If you know the equipment isn't going to last 39 years, do you have the option to depreciate it for a lesser amount of time? Calculating depreciation for commercial property involves a systematic approach that incorporates various factors and decisions. According to irs regulations, the standard depreciation period for new commercial construction is typically 39 years.Depreciation Concepts

Popular Depreciation Methods To Calculate Asset Value Over The Years

PPT LongLived Assets and Depreciation PowerPoint Presentation ID

Commercial Building Carpet Depreciation Life Two Birds Home

Difference between Depreciation and Obsolescence Value of Building

Commercial Building Depreciation Commercial Appraisal File 1

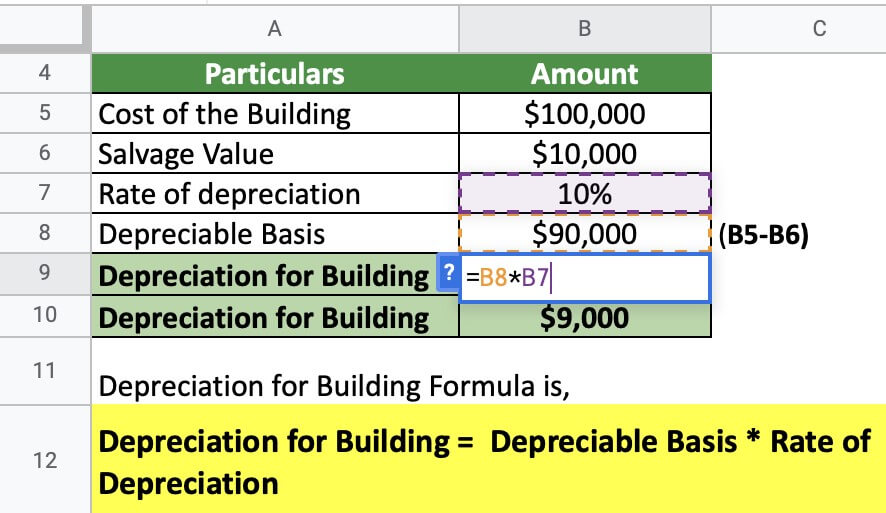

Depreciation for Building Definition, Formula, and Excel Examples

Understanding the Depreciation of a Commercial Building

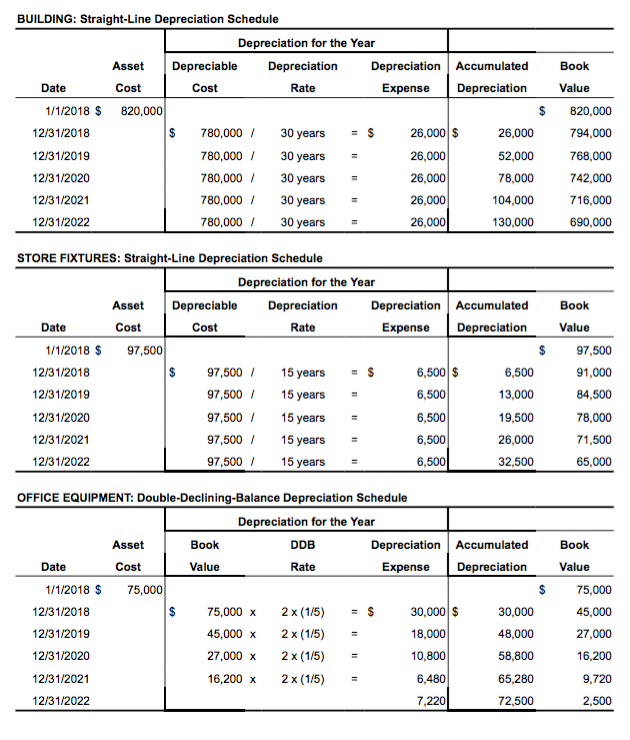

Solved BUILDING StraightLine Depreciation Schedule

Depreciation for Building Definition, Formula, and Excel Examples

In Commercial Real Estate, Depreciation Refers To The Gradual Decline In A Property’s Value Due To Wear And Tear, Obsolescence, Or Other Causes.

[3] Can I Depreciate The Cost Of Land?

What Is Depreciation In Commercial Real Estate?

For Commercial Properties, Which Generate Income Over Many Years, Depreciation Allows Businesses To Spread Out The Cost Of The Building Over Its Useful Life, Matching The Expense With.

Related Post: