Do Installment Loans Build Credit

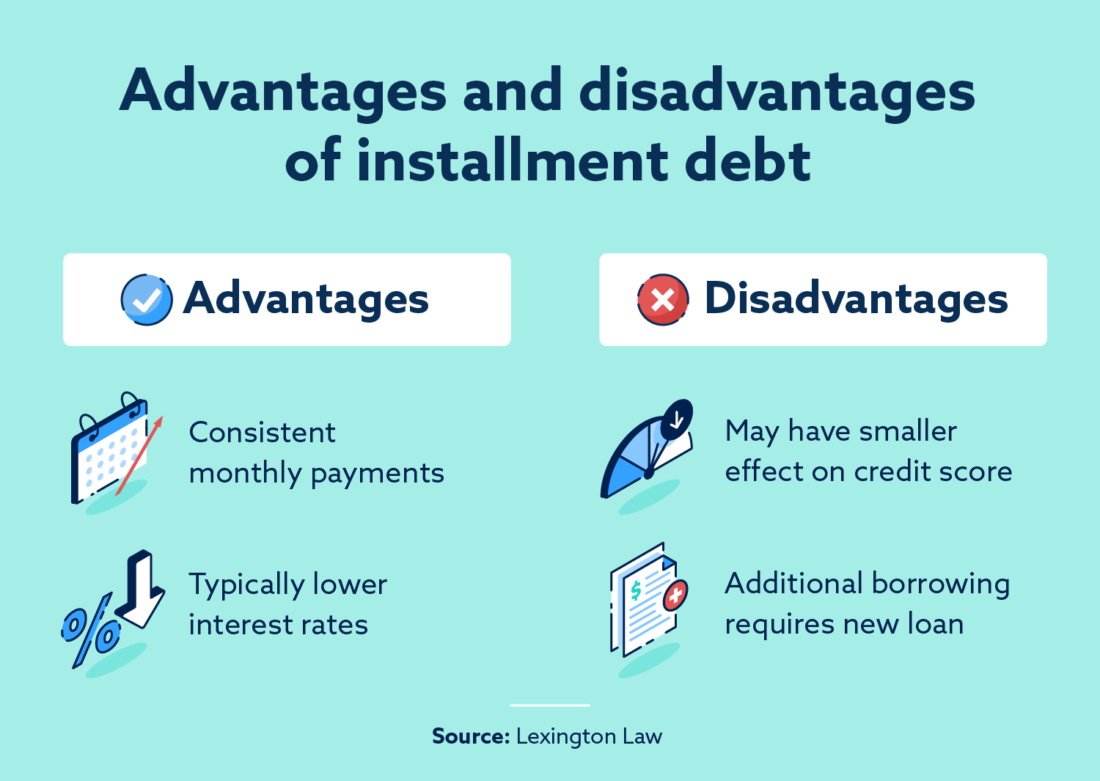

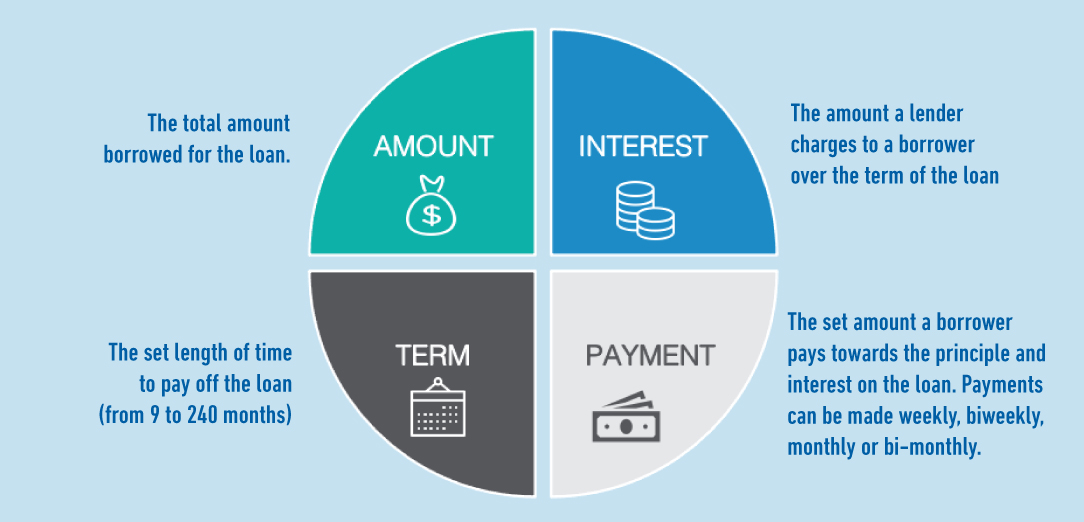

Do Installment Loans Build Credit - But certain mistakes can hurt it. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. With so many different due dates to. Find answers to these and more questions here. Installment loans can help improve your credit score over time with regular payments. An installment loan, such as a personal loan or a car loan, can be a good way to build credit if it is used responsibly. Instal and cs max are credit builder installment loans designed to help strengthen your credit profile. The interest rate for a personal installment loan will largely depend on the borrower’s creditworthiness, and borrowers with low credit scores may pay high interest rates. How loans impact your credit score. You borrow a fixed amount of money (the principal) upfront, along with interest, and repay it in equal installments (often monthly. Missing a payment can cause a dip in your score. You borrow a fixed amount of money (the principal) upfront, along with interest, and repay it in equal installments (often monthly. An installment loan, such as a personal loan or a car loan, can be a good way to build credit if it is used responsibly. Installment loans can help improve your credit score over time with regular payments. The interest rate for a personal installment loan will largely depend on the borrower’s creditworthiness, and borrowers with low credit scores may pay high interest rates. Installment loans can help improve your credit score over time with regular payments, but missing a payment can cause a dip in your score. Missing a payment can cause a dip in your score. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. If you do not need an installment loan, there are. Loans can impact your credit score in multiple ways. Getting a personal loan can be a great way to boost your credit score. Choose the best creditstrong installment loan for you based on monthly payment,. Credit history accounts for about 15% of your credit score. Installment loans resemble climbing this ladder. Installment loans can help improve your credit score over time with regular payments, but missing a payment can. With so many different due dates to. Yes, installment loans can help you build credit by improving your payment history, adding variety to your credit mix and lowering your credit utilization. Installment loans can help improve your credit score over time with regular payments, but missing a payment can cause a dip in your score. If you do not need. Installment loans can help improve your credit score over time with regular payments, but missing a payment can cause a dip in your score. An installment loan is an excellent way to build your credit while working towards ownership of a large asset, or to accelerate debt repayment though a consolidation loan. An installment loan, such as a personal loan. Loans can impact your credit score in multiple ways. In order to build good credit, you need to pay all your bills on time, not just student loans but also your credit cards, utilities and medical bills. Getting a personal loan can be a great way to boost your credit score. But certain mistakes can hurt it. How loans impact. Student loans and mortgages also can use simple interest, but it can. Installment loans can help improve your credit score over time with regular payments, but missing a payment can cause a dip in your score. Loans can impact your credit score in multiple ways. Find answers to these and more questions here. Yes, installment loans can help you build. Installment loans can help improve your credit score over time with regular payments. Installment loans resemble climbing this ladder. An installment loan, such as a personal loan or a car loan, can be a good way to build credit if it is used responsibly. Yes, installment loans can help you build credit by improving your payment history, adding variety to. Getting a personal loan can be a great way to boost your credit score. The interest rate for a personal installment loan will largely depend on the borrower’s creditworthiness, and borrowers with low credit scores may pay high interest rates. What is an installment loan? Installment loans can help improve your credit score over time with regular payments, but missing. Installment loans can help improve your credit score over time with regular payments. Installment loans resemble climbing this ladder. When should i get an installment loan? Getting a personal loan can be a great way to boost your credit score. Instal and cs max are credit builder installment loans designed to help strengthen your credit profile. Installment loans can help improve your credit score over time with regular payments. Installment loans (like rise) installment loans offer more manageable terms and predictable monthly payments, making them a better fit for those who need flexibility and time to repay. Installment loans can help improve your credit score over time with regular payments, but missing a payment can cause. Find answers to these and more questions here. Repaying the loan on time and in full each month can help. With so many different due dates to. You borrow a fixed amount of money (the principal) upfront, along with interest, and repay it in equal installments (often monthly. If you do not need an installment loan, there are. Missing a payment can cause a dip in your score. An installment loan, such as a personal loan or a car loan, can be a good way to build credit if it is used responsibly. Installment loans resemble climbing this ladder. The interest rate for a personal installment loan will largely depend on the borrower’s creditworthiness, and borrowers with low credit scores may pay high interest rates. If you do not need an installment loan, there are. Choose the best creditstrong installment loan for you based on monthly payment,. Among consumers with a credit record, 21.2 percent financed at least one purchase with a bnpl loan, up from 17.6 percent in. Installment loans can help improve your credit score over time with regular payments. Student loans and mortgages also can use simple interest, but it can. Loans can impact your credit score in multiple ways. Missing a payment can cause a dip in your score. Find answers to these and more questions here. But certain mistakes can hurt it. Instal and cs max are credit builder installment loans designed to help strengthen your credit profile. What is an installment loan? Installment loans can help improve your credit score over time with regular payments.Installment Loans vs. Revolving Credit Lexington Law

Installment Loans

Differences Between a Line of Credit vs Installment Loan MoneyKey

Credit Building Installment Loans

What Are Installment Loans? (And How They Can Help)

Installment Loans What They Are and How They Work

What are elements of installment credit? Leia aqui What are the key

How Does an Installment Loan Work?

Do Installment Loans Build Credit? Yes — Here’s How Bankrate

How Do Installment Loans Work When It Comes to Building Credit?

With So Many Different Due Dates To.

Installment Loans Can Help Improve Your Credit Score Over Time With Regular Payments, But Missing A Payment Can Cause A Dip In Your Score.

Will An Installment Loan Build My Credit?

Installment Loans Can Help Improve Your Credit Score Over Time With Regular Payments, But Missing A Payment Can Cause A Dip In Your Score.

Related Post: