Does Greenlight Build Credit

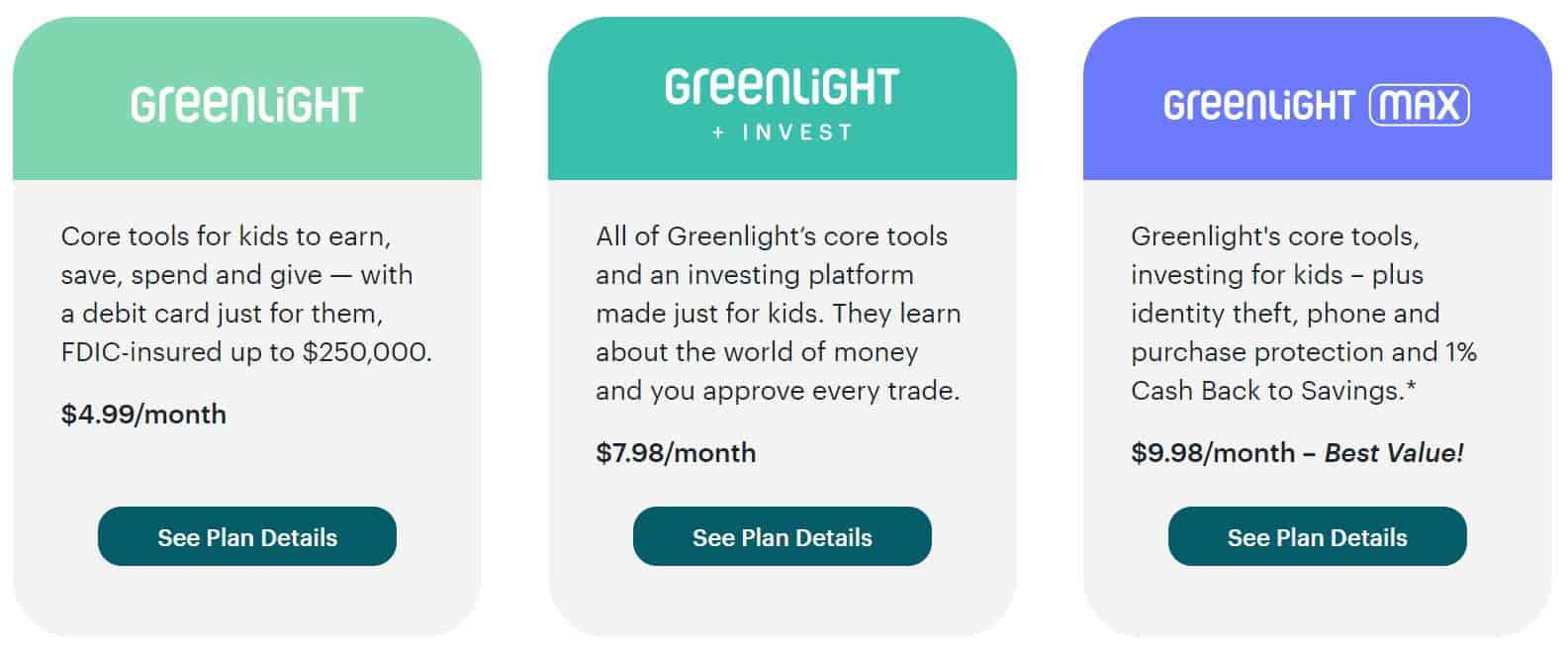

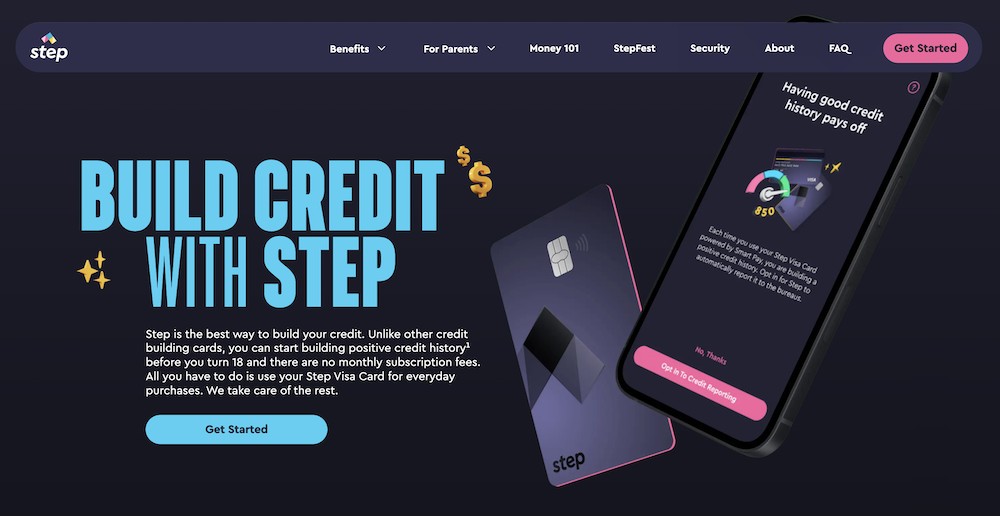

Does Greenlight Build Credit - Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Parents can now add teens as. Adults can get a world mastercard credit card that offers 3% cash back on purchases. Teens learn to manage credit responsibly by tracking their balances within the greenlight. Greenlight helps you and your family. Plus, you'll even earn some cash. They can add teenage children as authorized users to help them start building a. By choosing the right card for your needs and using it wisely, you can build a solid credit history and set yourself up for financial success. Our insights will help your family navigate the world of credit with confidence. However, today the company launched the. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Greenlight requires a monthly subscription fee and offers three paid plans. Our insights will help your family navigate the world of credit with confidence. With the greenlight family cash card, teens can now start building credit before 18. Greenlight helps you and your family. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Unlock the secrets of building and maintaining good credit from an early age. Greenlight is a banking app designed for children. Using greenlight, parents can instantly transfer funds to kids,. Plus, you'll even earn some cash. Our insights will help your family navigate the world of credit with confidence. Unlock the secrets of building and maintaining good credit from an early age. Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Teens learn to manage credit. When teens are ready to buy a car or rent an apartment, good credit unlocks better interest rates, lower monthly payments, and more. Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Adults can get a world mastercard credit card that offers 3% cash back on. Our insights will help your family navigate the world of credit with confidence. But is it safe to send your. Adults can get a world mastercard credit card that offers 3% cash back on purchases. Plus, you'll even earn some cash. Find out how to build your child’s credit so they’ll have a head start when they want to get. Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Teens learn to manage credit responsibly by tracking their balances within the greenlight. Adults can get a world mastercard credit card that offers 3% cash back on purchases. Greenlight helps you and your family. Plus, you'll even. With the greenlight family cash card, teens can now start building credit before 18. Greenlight is a banking app designed for children. However, today the company launched the. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Adults can get a world mastercard credit. However, today the company launched the. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Unlock the secrets of building and maintaining good credit from an early age. When teens are ready to buy a car or rent an apartment, good credit unlocks better. With the greenlight family cash card, teens can now start building credit before 18. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. Our insights will help your family navigate the world of credit with confidence.. But is it safe to send your. While the greenlight debit card has a lot to offer when it comes to teaching kids about finances, the costs to access the best of its benefits may not be worth it to some people. Greenlight requires a monthly subscription fee and offers three paid plans. Using greenlight, parents can instantly transfer funds. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan. Greenlight, a. Greenlight is a banking app designed for children. Based in atlanta, ga, greenlight is a financial services company specializing in debit card for kids and parents. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Parents can now add teens as. Adults can get. Teens learn to manage credit responsibly by tracking their balances within the greenlight. Greenlight helps you and your family. Designed to help teens build credit, the greenlight family cash card is a solid card that can give kids a head start on establishing credit. Using greenlight, parents can instantly transfer funds to kids,. Parents can now add teens as. They can add teenage children as authorized users to help them start building a. Greenlight financial technology has long provided financial education and debit cards to its child and teen customers since 2014; But is it safe to send your. Greenlight is a banking app designed for children. Greenlight, a fintech company that helps teach financial literacy, today announced a credit builder for teens to build credit before they turn 18. Our insights will help your family navigate the world of credit with confidence. Open bright opportunities by building credit. Based in atlanta, ga, greenlight is a financial services company specializing in debit card for kids and parents. By choosing the right card for your needs and using it wisely, you can build a solid credit history and set yourself up for financial success. Greenlight requires a monthly subscription fee and offers three paid plans. Find out how to build your child’s credit so they’ll have a head start when they want to get a credit card of their own or apply for a school or car loan.Does Greenlight build credit? Leia aqui What are the disadvantages of

Does Greenlight build credit? Leia aqui What are the disadvantages of

Greenlight’s new credit card helps teens, their parents build credit

Greenlight Card Review Read This Before Signing Up! Arrest Your Debt

Greenlight Revolutionizes Credit with IndustryFirst Credit Builder for

Does Greenlight build credit? Leia aqui What are the disadvantages of

Greenlight Family Cash Card Lets Authorized Users Build Credit

Does Greenlight affect credit score? Leia aqui What are the

Build credit knowledge with Greenlight.

Greenlight credit card with credit builder for teens

Plus, You'll Even Earn Some Cash.

Adults Can Get A World Mastercard Credit Card That Offers 3% Cash Back On Purchases.

While The Greenlight Debit Card Has A Lot To Offer When It Comes To Teaching Kids About Finances, The Costs To Access The Best Of Its Benefits May Not Be Worth It To Some People.

When Teens Are Ready To Buy A Car Or Rent An Apartment, Good Credit Unlocks Better Interest Rates, Lower Monthly Payments, And More.

Related Post: