Farm Building Depreciation Life

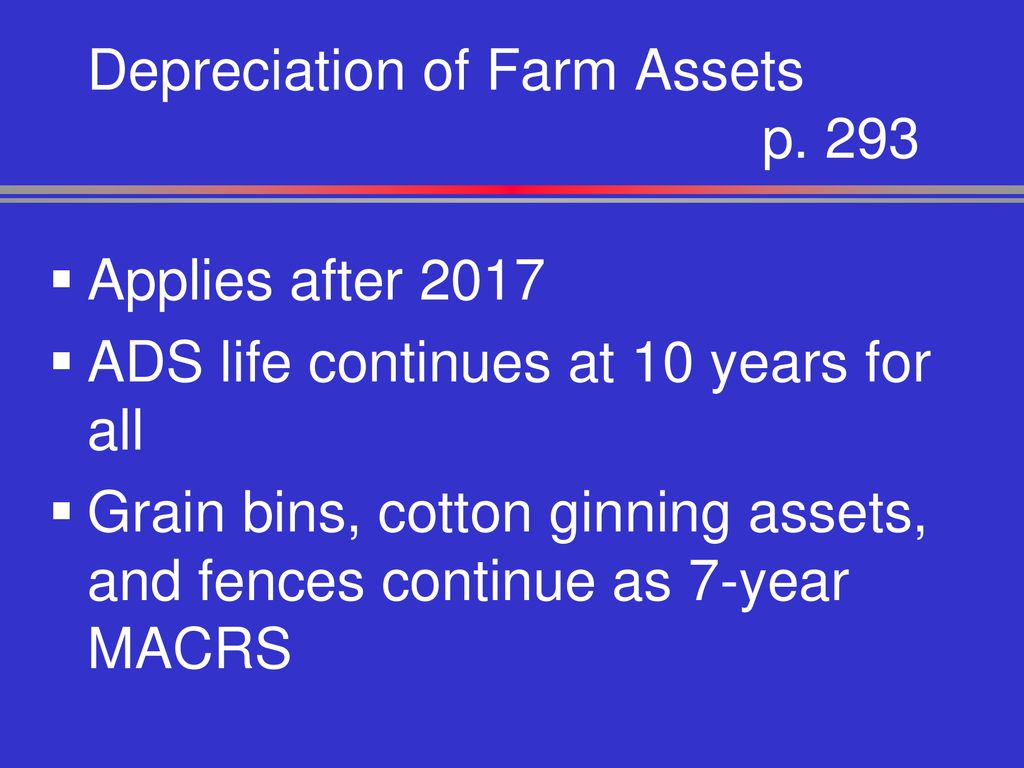

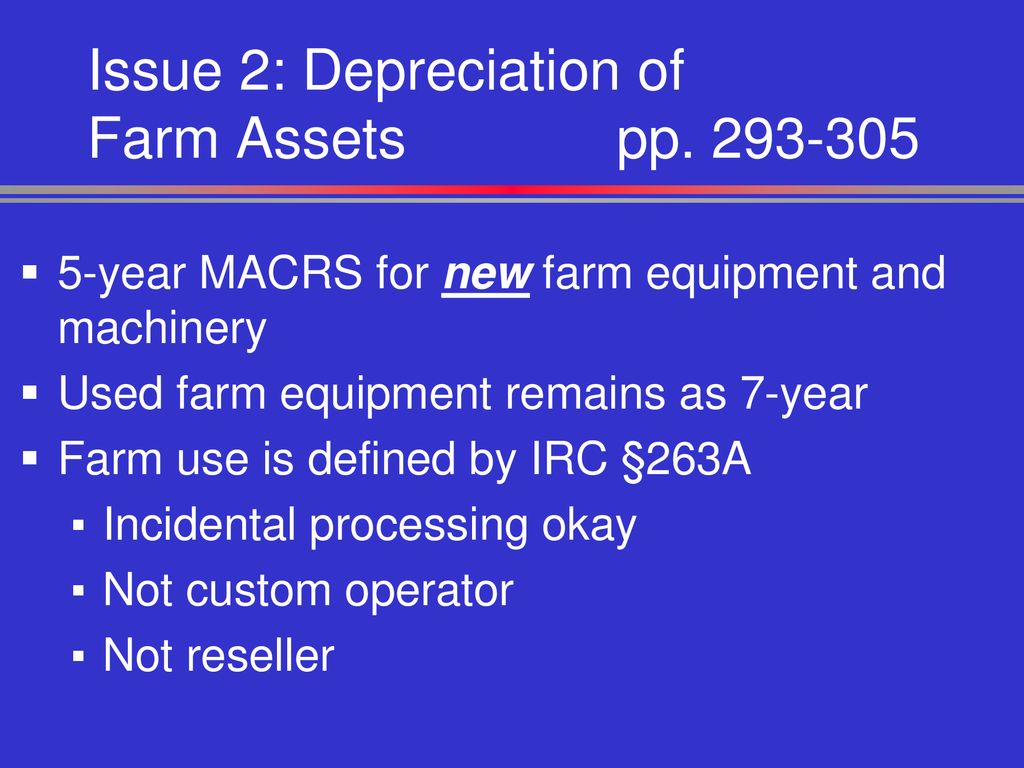

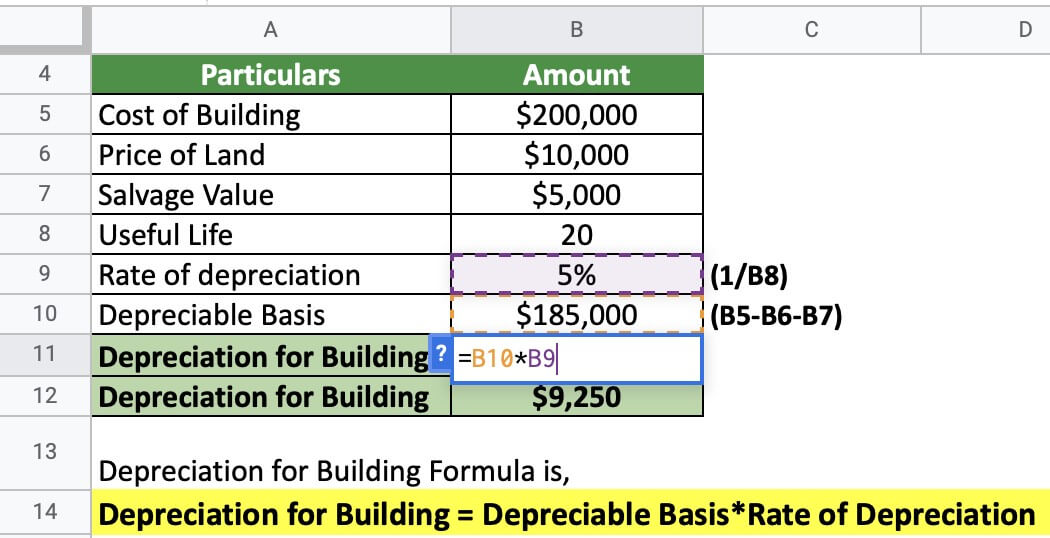

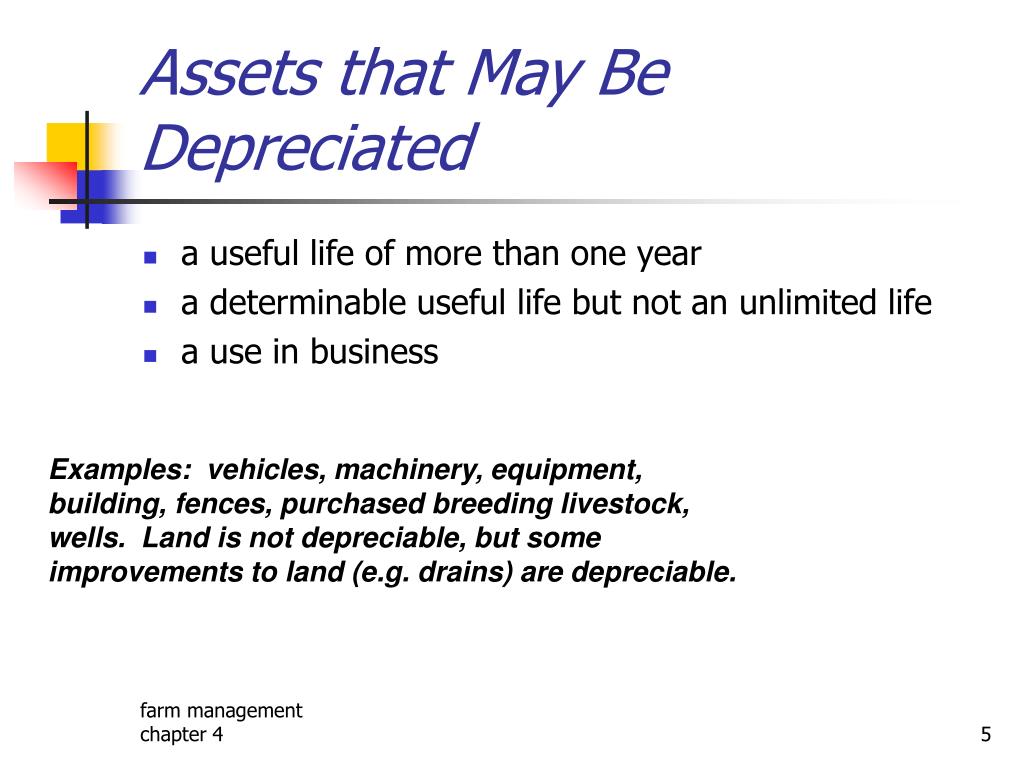

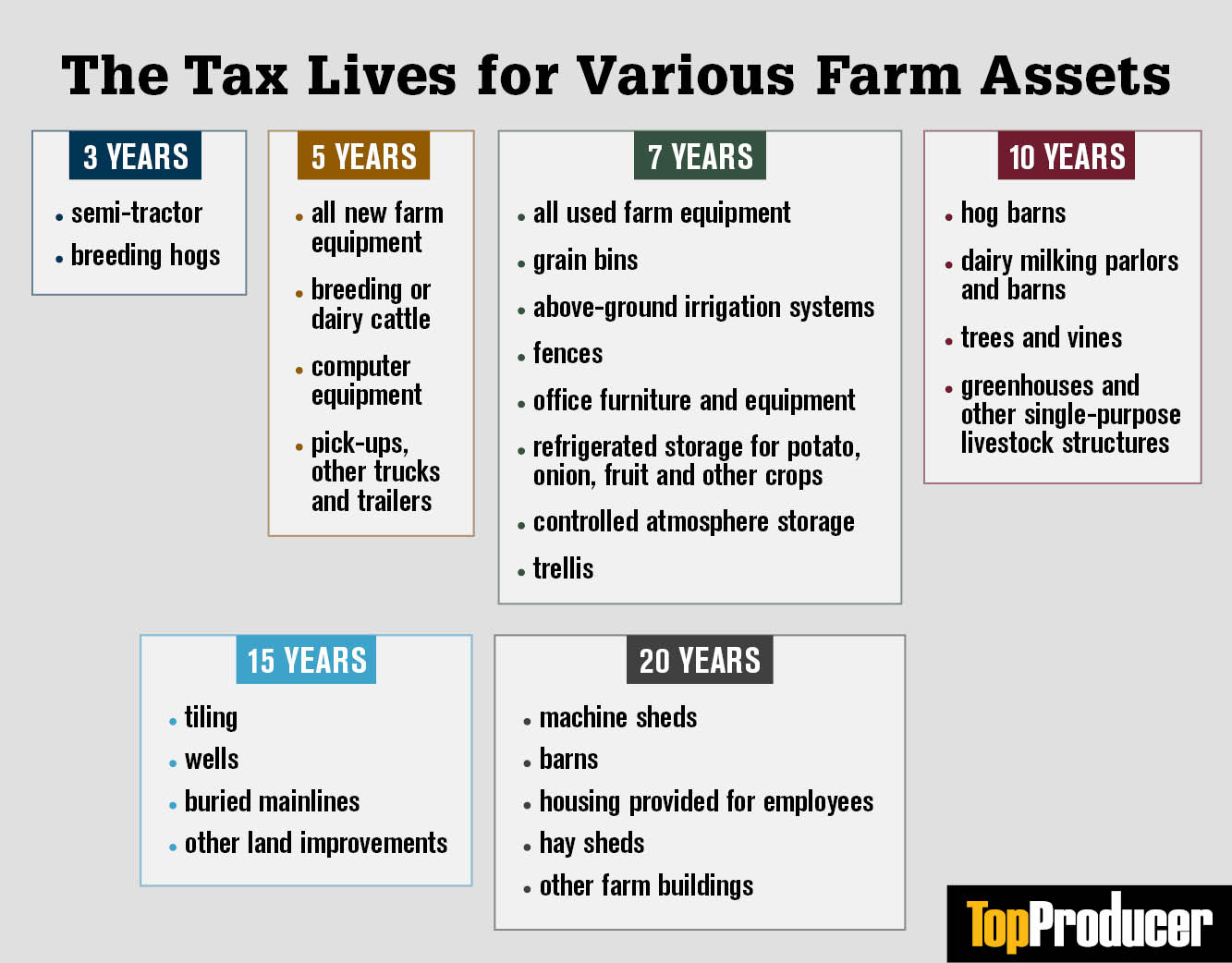

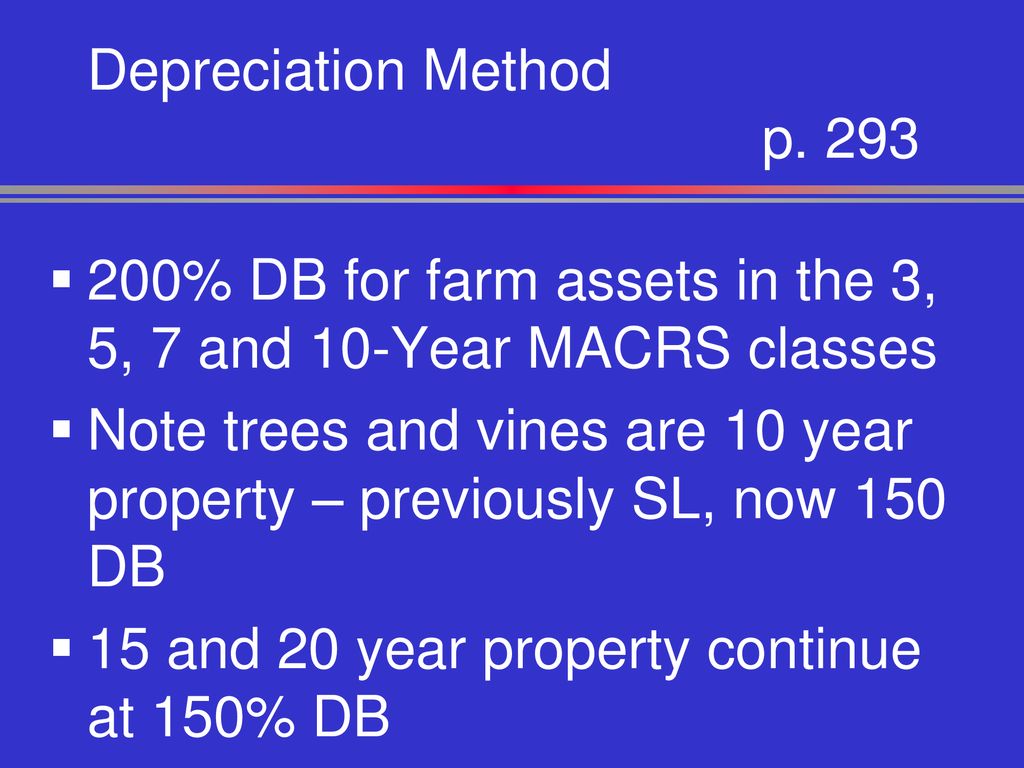

Farm Building Depreciation Life - Bonus depreciation of $240,000 (2023) +$2,250 regular. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; Beginning farmers may be inclined, and rightfully so, to protect cash and use the tax code to accomplish this goal. This chart summarizes the depreciation and section 179 limits for luxury vehicles placed in service in 2024: What do we need to know? They are not eligible for section 179. The irs sets the class life for farm assets. Farm equipment is generally depreciated over 7 years, although some may be 5. This article will delve into the concept of depreciation, its importance in agriculture, and how it affects farm equipment and buildings. Farm buildings are depreciated over a 20 year life. Using bonus depreciation [irc § 168(k)] or the “expense election” under. Depreciation is a noncash cost. 200 percent db method allowed; Bonus depreciation of $240,000 (2023) +$2,250 regular. What do we need to know? This article will delve into the concept of depreciation, its importance in agriculture, and how it affects farm equipment and buildings. ¶435 depreciation of farm property new law explained farming machinery depreciated over five years; She first used it for planting on. Amaija purchased a planter on 12/12/24 which was delivered to her farm on 12/14/24. Interest may be a cash cost if outstanding debt exists, or a noncash cost if there is no debt. Farm buildings like grain bins or horticultural structures often. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Therefore, they are eligible for 50% or 100% bonus depreciation. Farm buildings can be written off over either. For commercial properties a 39 year depreciation schedule can be used. Land improvements (drain tiles and berms, for example) can be depreciated. Bonus depreciation of $240,000 (2023) +$2,250 regular. Farm buildings can be written off over either 10 or 20 years, depending on what they’re used for. She first used it for planting on. She first used it for planting on. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. Depreciation is a noncash cost. Amaija purchased a planter on 12/12/24 which was delivered to her farm on 12/14/24. Interest may. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Allocate the purchase price between the land and the building based. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent. The irs sets the class life for farm assets. This chart summarizes the depreciation and section 179 limits for luxury vehicles placed in service in 2024: Using bonus depreciation [irc § 168(k)] or the “expense election” under. The idea is that you want to establish the time. She first used it for planting on. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. What do we need to know? The idea is that you want to establish the time. Farm equipment is generally depreciated over 7 years, although some may be. Allocate the purchase price between the land and the building based. This article will delve into the concept of depreciation, its importance in agriculture, and how it affects farm equipment and buildings. The irs sets the class life for farm assets. Ads required if farming business elects out of. Table 1 illustrates macrs gds and ads recovery periods for these. Farm buildings can be written off over either 10 or 20 years, depending on what they’re used for. 200 percent db method allowed; The variable costs are those that are incurred because of use. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Ads required if farming business elects out of. Depreciation is a noncash cost. “building improvements” are capital events that materially extend the useful life of a building or increase the value of a building by at least 25 percent of the original life period or. This chart summarizes the depreciation and section 179 limits for luxury vehicles placed in service in 2024: Considering the different depreciation methods, section. Depreciation is a noncash cost. Interest may be a cash cost if outstanding debt exists, or a noncash cost if there is no debt. Bonus depreciation of $240,000 (2023) +$2,250 regular. They are not eligible for section 179. Allocate the purchase price between the land and the building based. She first used it for planting on. Interest may be a cash cost if outstanding debt exists, or a noncash cost if there is no debt. This chart summarizes the depreciation and section 179 limits for luxury vehicles placed in service in 2024: 200 percent db method allowed; Allocate the purchase price between the land and the building based. The idea is that you want to establish the time. Considering the different depreciation methods, section 179 expense deduction, bonus depreciation, and consulting with a tax professional are all essential steps in effectively. Ads required if farming business elects out of. Farm buildings are depreciated over a 20 year life. Using bonus depreciation [irc § 168(k)] or the “expense election” under. Table 1 illustrates macrs gds and ads recovery periods for these listed agricultural assets. Beginning farmers may be inclined, and rightfully so, to protect cash and use the tax code to accomplish this goal. Depreciation is a noncash cost. This article will delve into the concept of depreciation, its importance in agriculture, and how it affects farm equipment and buildings. Typically, a residential property will be depreciated over 27.5 years. Therefore, they are eligible for 50% or 100% bonus depreciation.Agricultural and Natural Resource Issues Chapter 9 pp ppt download

Agricultural and Natural Resource Issues Chapter 9 pp ppt download

Depreciation for Building Definition, Formula, and Excel Examples

PPT Farm Management PowerPoint Presentation, free download ID805758

The Farm CPA Depreciation, Depreciation, Depreciation AgWeb

Agricultural and Natural Resource Issues Chapter 9 pp ppt download

Effects of Increase Percentage Depreciation on Crop Farm Machinery

Paul Neiffer Let’s Talk Depreciation for Farmers AgWeb

PPT LongLived Assets and Depreciation PowerPoint Presentation, free

Depreciating Farm Property with a FiveYear Recovery Period Center

Land Improvements (Drain Tiles And Berms, For Example) Can Be Depreciated.

Amaija Purchased A Planter On 12/12/24 Which Was Delivered To Her Farm On 12/14/24.

What Do We Need To Know?

¶435 Depreciation Of Farm Property New Law Explained Farming Machinery Depreciated Over Five Years;

Related Post: