How To Build A Good Etf Portfolio

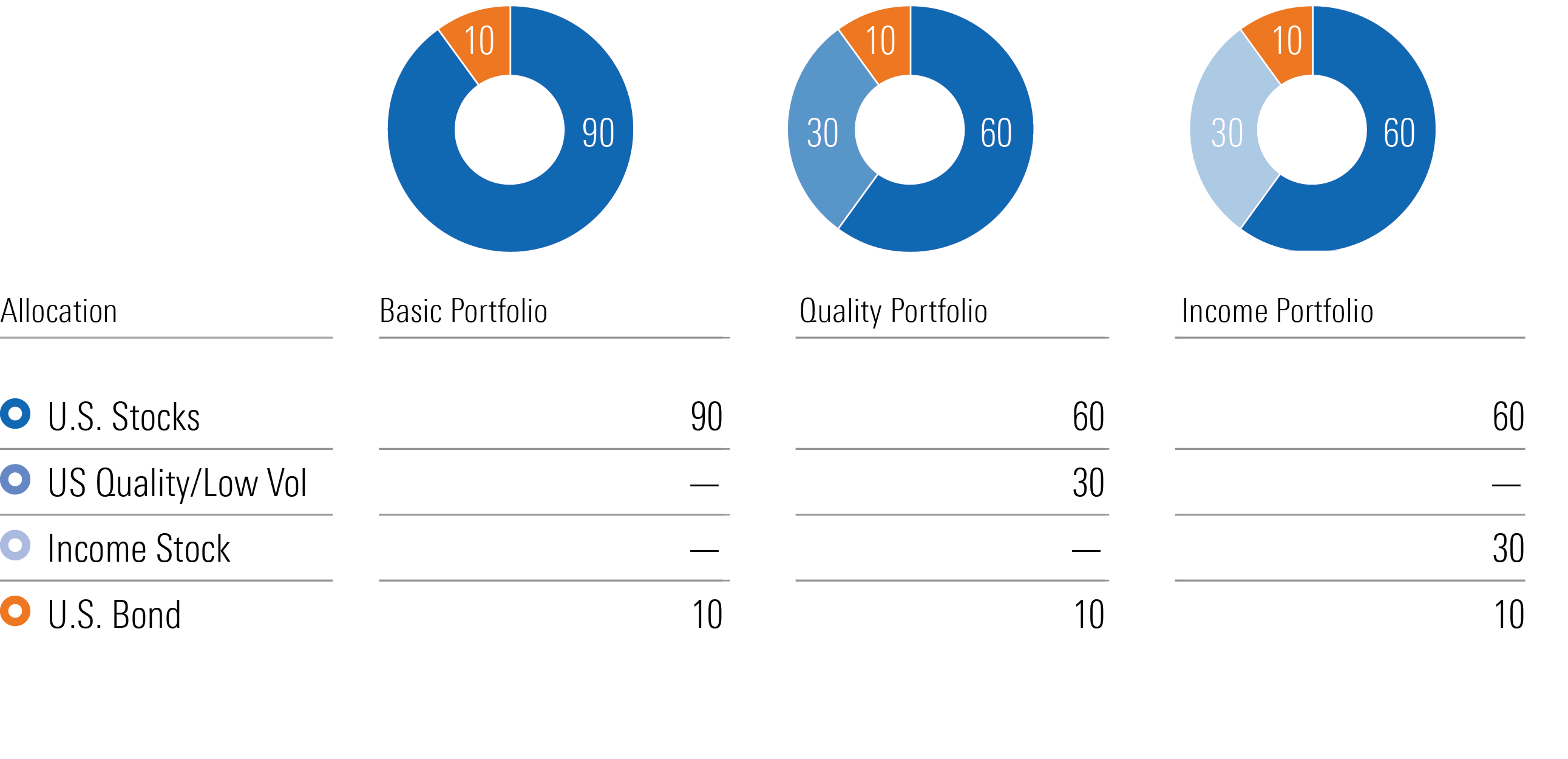

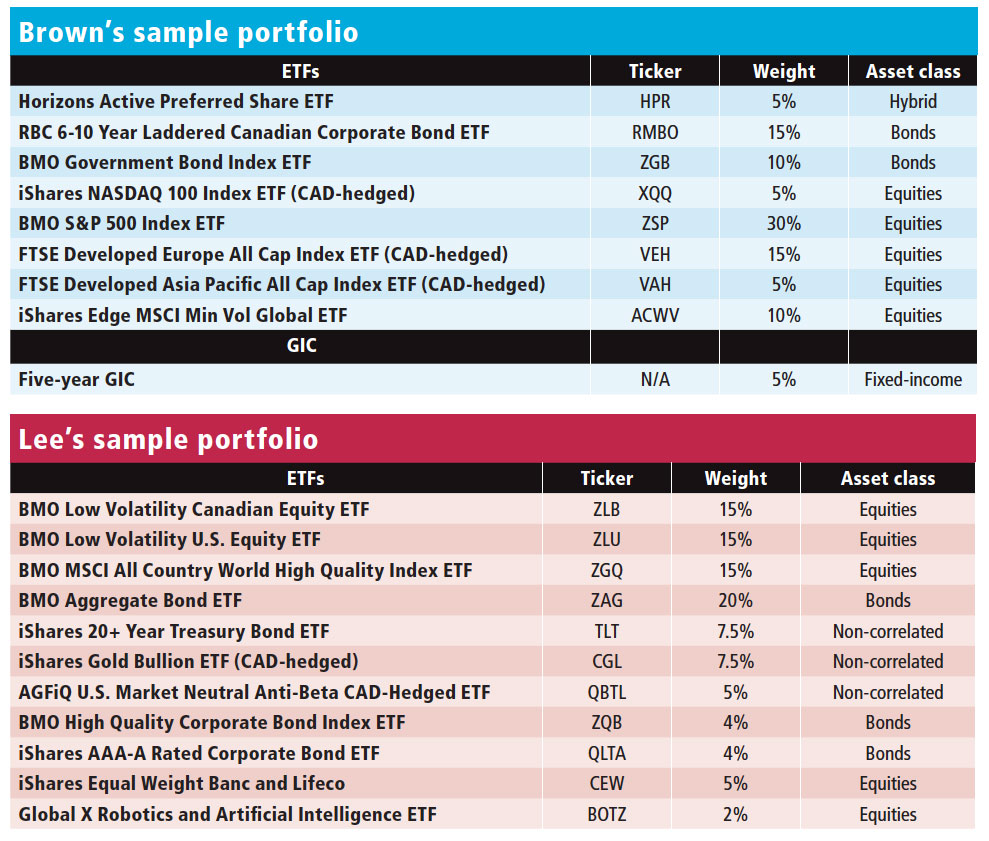

How To Build A Good Etf Portfolio - Buffered etfs can be a good option for retirees who are looking for a way to manage risk in their retirement portfolio. Start with one or two etfs for your core. Why should you focus on index etfs? Understand different types of etfs. These funds offer a buffer against market losses while. In the long run, etfs are proving to be the better asset simply because the fees are much lower, which will help you sustain your gains in the future. Some investors enjoy the art of investing. Etfs can be smart investments for almost any kind of investor, from professional money managers to beginners. In this article, we take a deep dive into how etfs work and cover the. Below, we’ll explore three popular approaches that can help. When building a diversified portfolio with etfs, investors should consider their investment objectives, risk tolerance, and overall financial goals to select the right etfs that align with. Start with one or two etfs for your core. See how bond, stock, international, sector, and environmental, social, and governance (esg) screened etfs might fit into your portfolio. Understand different types of etfs. Buffered etfs can be a good option for retirees who are looking for a way to manage risk in their retirement portfolio. These etfs may keep your portfolio stable. The basic process of building an etf portfolio is to identify an appropriate risk level for your situation, translate that risk level into a targeted investment mix, and choose specific etfs to fill in the various buckets of that investment mix. A focus on the s&p/asx 200 and the s&p 500 is a good place to start, but it’s not a bad idea to look. These funds offer a buffer against market losses while. Why should you focus on index etfs? Understand different types of etfs. Below, we’ll explore three popular approaches that can help. The key to any good portfolio is diversification: In the long run, etfs are proving to be the better asset simply because the fees are much lower, which will help you sustain your gains in the future. Buffered etfs can be a good option for retirees. A focus on the s&p/asx 200 and the s&p 500 is a good place to start, but it’s not a bad idea to look. Buffered etfs can be a good option for retirees who are looking for a way to manage risk in their retirement portfolio. Here’s how to do it. Start with one or two etfs for your core.. With their ability to diversify a portfolio and their. In this article, we take a deep dive into how etfs work and cover the. That means you can create an. Below, we’ll explore three popular approaches that can help. Etfs can be smart investments for almost any kind of investor, from professional money managers to beginners. These etfs may keep your portfolio stable. A focus on the s&p/asx 200 and the s&p 500 is a good place to start, but it’s not a bad idea to look. Creating a strong etf portfolio starts with understanding some key strategies that align with your investment goals. Some investors enjoy the art of investing. That means you can create. The key to any good portfolio is diversification: These funds offer a buffer against market losses while. In this article, we take a deep dive into how etfs work and cover the. They enjoy the intellectual challenge of crafting a portfolio. When building a diversified portfolio with etfs, investors should consider their investment objectives, risk tolerance, and overall financial goals. Investors can build a portfolio that holds one or. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. In the long run, etfs are proving to be the better asset simply because the fees are much lower, which will help you sustain your. In this article, we take a deep dive into how etfs work and cover the. Understand different types of etfs. Some investors enjoy the art of investing. These funds offer a buffer against market losses while. Start with one or two etfs for your core. Creating a strong etf portfolio starts with understanding some key strategies that align with your investment goals. They enjoy the intellectual challenge of crafting a portfolio. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. See how bond, stock, international, sector, and environmental,. If you’ve gotten this far and the thought of managing your own account feels overwhelming, a financial advisor can build and maintain a portfolio for you. That means you can create an. Etfs can be smart investments for almost any kind of investor, from professional money managers to beginners. Some investors enjoy the art of investing. Buffered etfs can be. With their ability to diversify a portfolio and their. Creating a strong etf portfolio starts with understanding some key strategies that align with your investment goals. The key to any good portfolio is diversification: In the long run, etfs are proving to be the better asset simply because the fees are much lower, which will help you sustain your gains. That means you can create an. Below, we’ll explore three popular approaches that can help. Why should you focus on index etfs? In this article, we take a deep dive into how etfs work and cover the. Here’s how to do it. The key to any good portfolio is diversification: Etfs can be smart investments for almost any kind of investor, from professional money managers to beginners. Creating a strong etf portfolio starts with understanding some key strategies that align with your investment goals. In the long run, etfs are proving to be the better asset simply because the fees are much lower, which will help you sustain your gains in the future. The basic process of building an etf portfolio is to identify an appropriate risk level for your situation, translate that risk level into a targeted investment mix, and choose specific etfs to fill in the various buckets of that investment mix. With their ability to diversify a portfolio and their. When building a diversified portfolio with etfs, investors should consider their investment objectives, risk tolerance, and overall financial goals to select the right etfs that align with. Gift 5 articles to anyone you choose each month when you subscribe. These etfs may keep your portfolio stable. Some investors enjoy the art of investing. Start with one or two etfs for your core.How to Build an ETF Portfolio

How to Build an ETF Portfolio at Questrade PWL Capital

How to Make Best ETF Portfolio in 2024 ETF Investing Strategies

How to Build an ETF Portfolio in 7 Steps

Building All ETF Diversified Portfolio WealthDesk

How to Build an ETF Portfolio A StepbyStep Investment Strategy

The New Investor’s Guide to Building an ETF Portfolio Morningstar

How to build a recessionproof ETF portfolio Investment Executive

How to Build an ETF Portfolio with 100! (Full Course on ETFs) YouTube

How to Build an ETF Portfolio for Beginners YouTube

These Funds Offer A Buffer Against Market Losses While.

Buffered Etfs Can Be A Good Option For Retirees Who Are Looking For A Way To Manage Risk In Their Retirement Portfolio.

As An Investor, It's Essential To Fully Research.

See How Bond, Stock, International, Sector, And Environmental, Social, And Governance (Esg) Screened Etfs Might Fit Into Your Portfolio.

Related Post: