Payment Reporting Builds Credit Prbc

Payment Reporting Builds Credit Prbc - What do you do when one of the individuals in this situation wants a mortgage? Additionally, we have partnered with microbilt and their unique credit reporting product called payment reporting builds credit (prbc). Credit bureaus (equifax, experian, transunion and innovis) in that it is an fcra (fair credit reporting act) compliant national data repository. Bnpl credit is a type of deferred payment option that generally allows the consumer to split a purchase into smaller installments, typically four or fewer, often with a. It helps you to save money. But specialty reports are often tailored. Consumer reporting agency, prbc, helps you build a consumer credit profile and score, which may assist you to obtain future financial products and services from a lender or financial institution;. This credit reporting option has no minimum. Prbc, which stands for payment reporting builds credit, is the industry’s oldest, largest and leading alternative credit score. For a fee of about $30, you can start building your own credit report through prbc; Additionally, we have partnered with microbilt and their unique credit reporting product called payment reporting builds credit (prbc). It allows individuals to enrol without charge and file their own data on payment of various bills to build up a positive credit file. This credit reporting option has no minimum. Prbc, which stands for payment reporting builds credit, is the industry’s oldest, largest and leading alternative credit score. Specialty consumer reports are similar to traditional credit reports (from experian, equifax and transunion), which contain your credit payment history. Credit bureaus (equifax, experian, transunion and innovis) in that it is an fcra (fair credit reporting act) compliant national data repository. Consumer reporting agency, prbc, helps you build a consumer credit profile and score, which may assist you to obtain future financial products and services from a lender or financial institution;. What do you do when one of the individuals in this situation wants a mortgage? Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. With all of this in mind, prbc has developed a credit scoring model that takes into account not just how people have handled their debts, but also how well they've been able to. Since the prbc, which now stands for payment reporting builds credit, is another credit reporting agency, they don't actually report any information to the. It allows individuals to enrol without charge and file their own data on payment of various bills to build up a positive credit file. If you're interested in joining the ranks of those who prefer a. Bnpl credit is a type of deferred payment option that generally allows the consumer to split a purchase into smaller installments, typically four or fewer, often with a. It allows individuals to enrol without charge and file their own data on payment of various bills to build up a positive credit file. With all of this in mind, prbc has. Bnpl credit is a type of deferred payment option that generally allows the consumer to split a purchase into smaller installments, typically four or fewer, often with a. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. You could tell. Specialty consumer reports are similar to traditional credit reports (from experian, equifax and transunion), which contain your credit payment history. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Prbc, which stands for payment reporting builds credit, is the industry’s. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Bnpl credit. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. It helps you to save money. For a fee of about $30, you can start building your own credit report through prbc; Connect, formerly prbc, is a consumer credit reporting agency,. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Since the. For a fee of about $30, you can start building your own credit report through prbc; What do you do when one of the individuals in this situation wants a mortgage? Prbc is the only credit bureau that enables you to build your credit by having your positive bill payment history reported on your behalf. Connect, formerly prbc, is a. Additionally, we have partnered with microbilt and their unique credit reporting product called payment reporting builds credit (prbc). It helps you to save money. With all of this in mind, prbc has developed a credit scoring model that takes into account not just how people have handled their debts, but also how well they've been able to. But specialty reports. Credit bureaus (equifax, experian, transunion and innovis) in that it is an fcra (fair credit reporting act) compliant national data repository. With all of this in mind, prbc has developed a credit scoring model that takes into account not just how people have handled their debts, but also how well they've been able to. Connect, formerly prbc, is a consumer. If you're interested in joining the ranks of those who prefer a more holistic approach to lending, prbc (payment reporting builds credit) can help. What do you do when one of the individuals in this situation wants a mortgage? This credit reporting option has no minimum. You could tell them to come back when they build their credit, or you could call payment. Additionally, we have partnered with microbilt and their unique credit reporting product called payment reporting builds credit (prbc). It is similar to the other four u.s. Connect, formerly prbc, is a consumer credit reporting agency, more commonly referred to as a credit bureau in the united states. Prbc is the only credit bureau that enables you to build your credit by having your positive bill payment history reported on your behalf. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. Prbc enables consumers and business owners to build their own prbc bill payment history and bill payment scoresm (bpssm) based on their past three years of payments by giving. With all of this in mind, prbc has developed a credit scoring model that takes into account not just how people have handled their debts, but also how well they've been able to. It allows individuals to enrol without charge and file their own data on payment of various bills to build up a positive credit file. But specialty reports are often tailored. Consumer reporting agency, prbc, helps you build a consumer credit profile and score, which may assist you to obtain future financial products and services from a lender or financial institution;. Bnpl credit is a type of deferred payment option that generally allows the consumer to split a purchase into smaller installments, typically four or fewer, often with a. Since the prbc, which now stands for payment reporting builds credit, is another credit reporting agency, they don't actually report any information to the.Build Your Own Credit Report CreditorWatch

What can I pay monthly to build credit? Leia aqui What monthly bills

PRBC Business Credit Building Companies Build Information Center

What is PRBC

Build Your Credit by Reporting Past Rent Payments

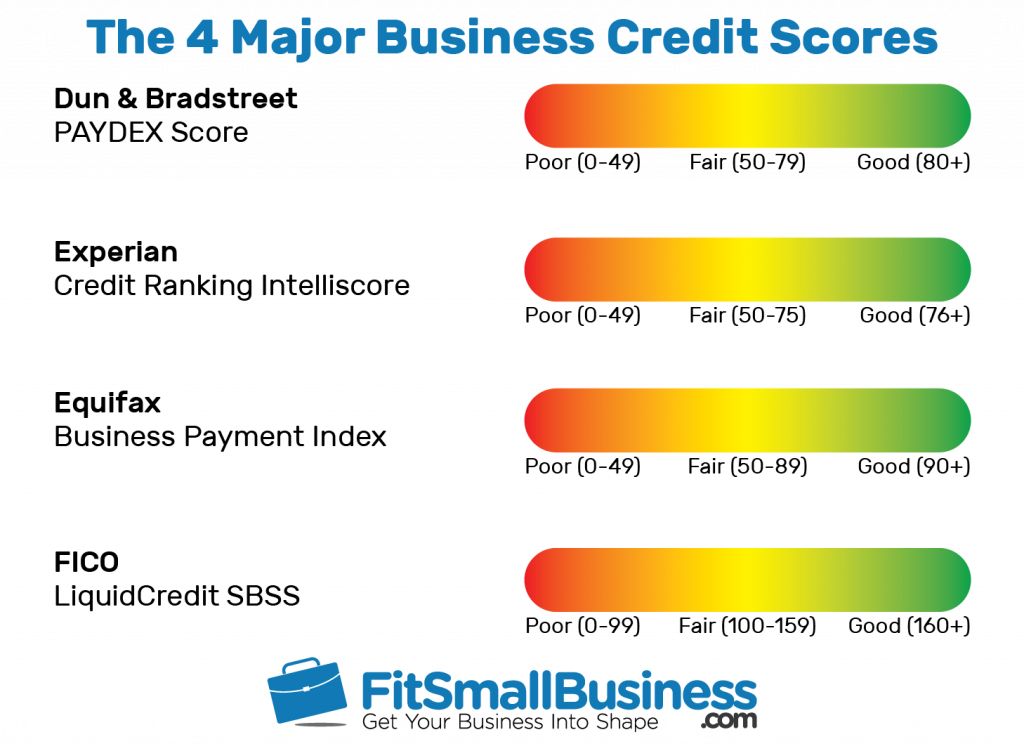

How to Build Business Credit in 7 Steps

5 Fastest Ways to Build New Credit

Report Rent Payments to Credit Bureau with TenantCloud

Does Paying Rent Build Credit? [2023 Guide]

How to Report Payment to Credit Bureau? Credello

Credit Bureaus (Equifax, Experian, Transunion And Innovis) In That It Is An Fcra (Fair Credit Reporting Act) Compliant National Data Repository.

For A Fee Of About $30, You Can Start Building Your Own Credit Report Through Prbc;

Prbc, Which Stands For Payment Reporting Builds Credit, Is The Industry’s Oldest, Largest And Leading Alternative Credit Score.

Specialty Consumer Reports Are Similar To Traditional Credit Reports (From Experian, Equifax And Transunion), Which Contain Your Credit Payment History.

Related Post:

![Does Paying Rent Build Credit? [2023 Guide]](https://res.cloudinary.com/apartmentlist/image/fetch/f_auto,q_auto,t_renter_life_article/https://images.ctfassets.net/jeox55pd4d8n/5tMPWtcXGinWWVVhMLwQDG/7067863e820c172ffd880eb1ccd2c873/Why_Report_Rental_Payments_.png)