What Credit Score Do You Need To Build A House

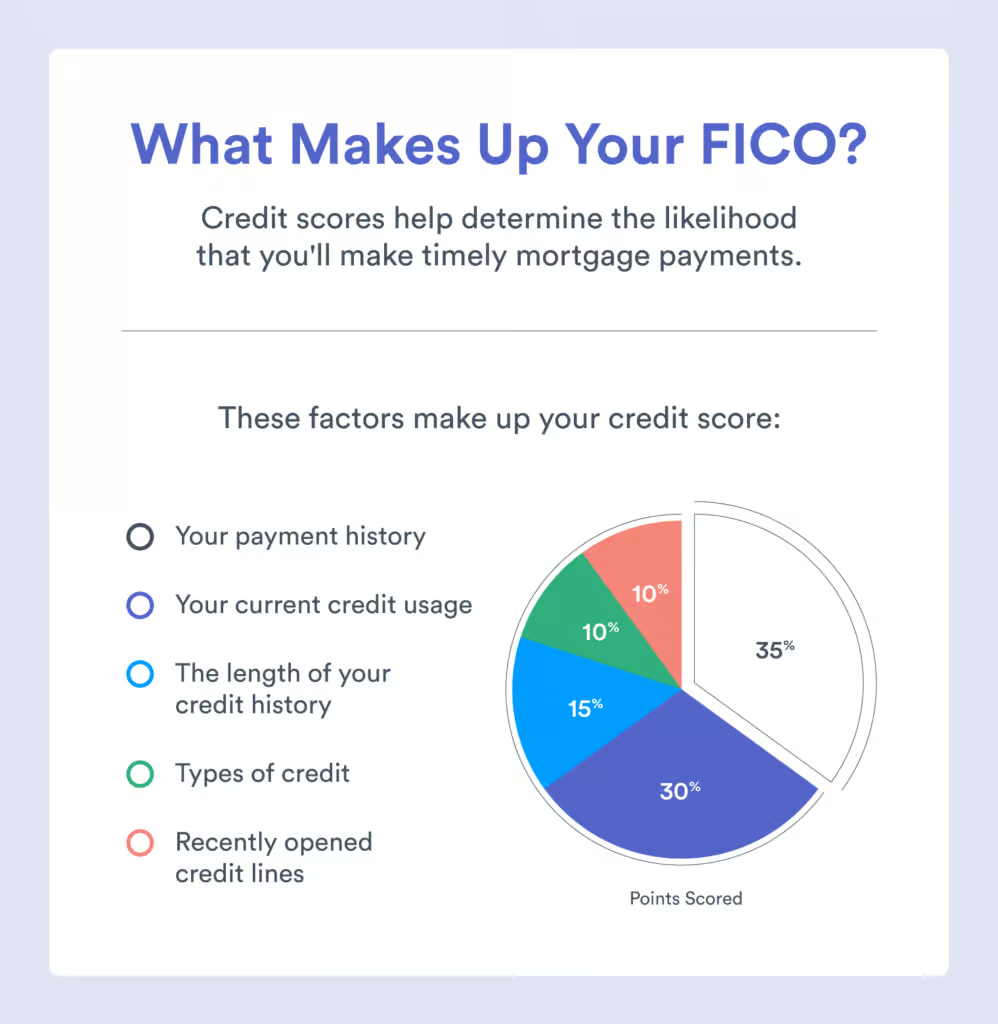

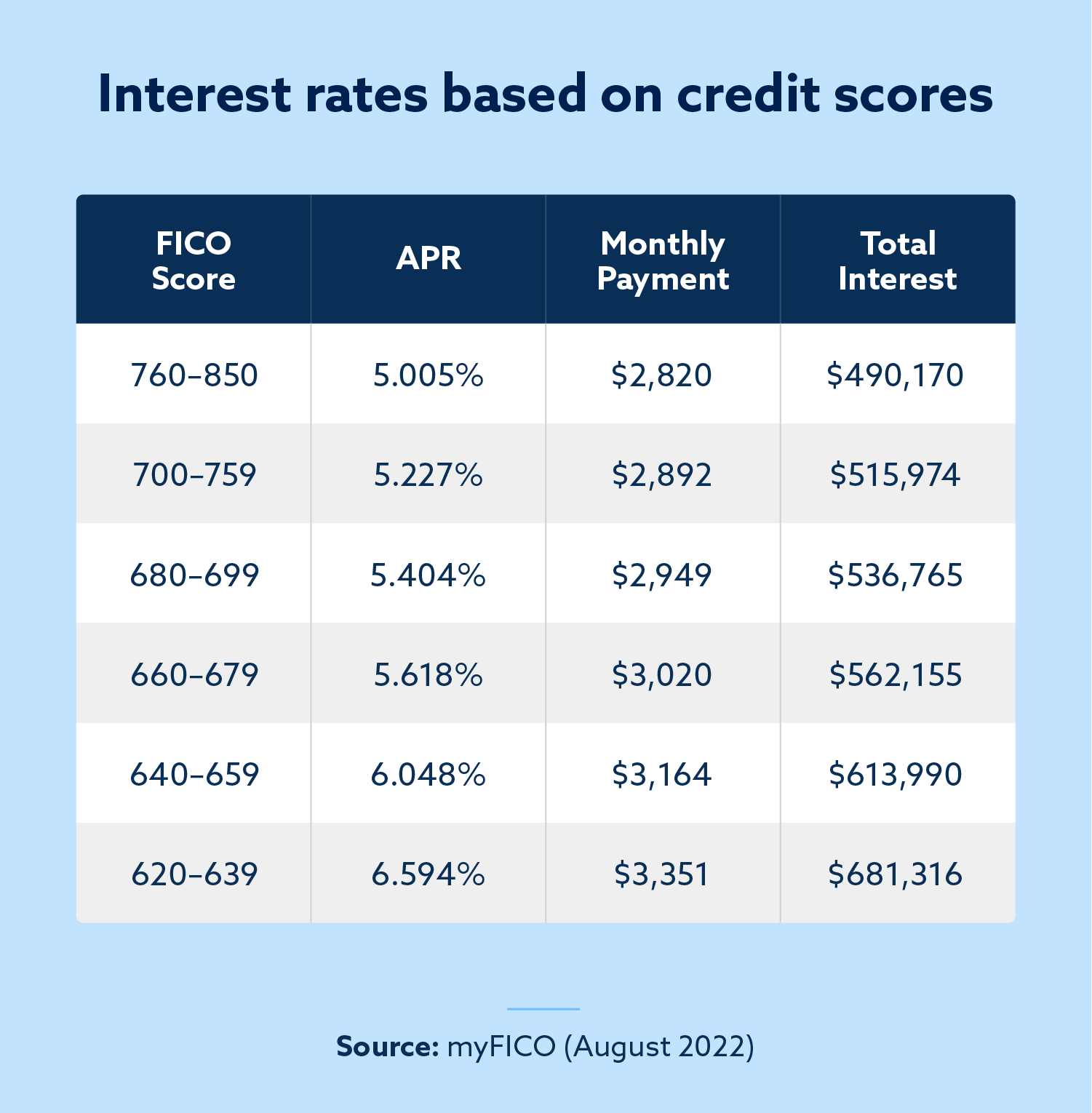

What Credit Score Do You Need To Build A House - To win approval for a construction loan, you may need: Its estimated market value and its. Here is everything you need to rent out your home confidently, efficiently, and with peace of mind. The first thing you want to do is make sure you qualify for an fha construction loan. To qualify for a construction loan, most lenders require a minimum credit score of 620 or higher. To reduce their risk, lenders require borrowers to have a credit score of 680 or higher to qualify for a. Anything higher than that is considered. To get a construction loan, you need to meet certain criteria. What credit score is needed to buy a house? West virginia has the most affordable housing, where homebuyers need to earn around $64,000 per year to afford the median house. As mentioned above, the credit score you need to buy a house will vary depending on the loan type you apply for. Most mortgages, including conventional loans, require a credit score of 620 or higher. Credit score is one of the most important factors in buying a house, as lenders use it to gauge how likely you are to repay a home loan. What credit score do you need to get a mortgage? What credit score is needed to buy a house? What credit score do you need for a construction loan? This official evaluation of the home determines two things: To reduce their risk, lenders require borrowers to have a credit score of 680 or higher to qualify for a. Before deciding whether renting out your house is right. It’s possible to get an fha loan with a credit score as low as 500, but many lenders. What credit score do you need to get a mortgage? Generally speaking, you’ll likely need a score of at least 620 — what’s classified as a “fair” rating — to qualify with most lenders. As mentioned above, the credit score you need to buy a house will vary depending on the loan type you apply for. A favorable credit score. You should aim for a credit score of at least 680 or higher if you need a construction loan. With a solid history of good credit and a promising. As mentioned above, the credit score you need to buy a house will vary depending on the loan type you apply for. Its estimated market value and its. With a federal. A favorable credit score to buy a house is typically in the high 600s and 700s. To win approval for a construction loan, you may need: Do you need good credit to build a house? You should aim for a credit score of at least 680 or higher if you need a construction loan. Your initial credit score when building. Borrowers usually need to have a minimum fico® score of 500 and pay a 10% down. With a solid history of good credit and a promising. Anything higher than that is considered. With a federal housing administration (fha). Most mortgages, including conventional loans, require a credit score of 620 or higher. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. Foundation and framing give you the bones and base of a home, so you want to make sure they’re done absolutely right. Your initial credit score when building credit will. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. In general, necessary credit scores will range from 500 to 700. To get a construction loan, you need to meet certain criteria. What credit score do you need to get. Credit score is one of the most important factors in buying a house, as lenders use it to gauge how likely you are to repay a home loan. If you are building a home you should aim for a minimum 680 credit score. In general, necessary credit scores will range from 500 to 700. West virginia has the most affordable. Most mortgages, including conventional loans, require a credit score of 620 or higher. You should aim for a credit score of at least 680 or higher if you need a construction loan. To get a construction loan, you need to meet certain criteria. What credit score do you need to get a mortgage? Before deciding whether renting out your house. Foundation and framing give you the bones and base of a home, so you want to make sure they’re done absolutely right. Here is everything you need to rent out your home confidently, efficiently, and with peace of mind. But, in practice, you usually need at least a 640 score. What credit score do you need for a construction loan?. The first thing you want to do is make sure you qualify for an fha construction loan. The credit score you'll need to get a home equity loan can vary depending on the lender, but generally speaking, experts say you'll need a score in at least the good or fair. You should aim for a credit score of at least. To win approval for a construction loan, you may need: With a solid history of good credit and a promising. With a federal housing administration (fha). Before deciding whether renting out your house is right. Buyers in the city need an average of £510 a month to meet mortgage payments for a one or two bedroom home, which cost an average of £119,350, it said. In general, necessary credit scores will range from 500 to 700. On average, the nahb reports that framing a house. Credit score is one of the most important factors in buying a house, as lenders use it to gauge how likely you are to repay a home loan. The first thing you want to do is make sure you qualify for an fha construction loan. A favorable credit score to buy a house is typically in the high 600s and 700s. West virginia has the most affordable housing, where homebuyers need to earn around $64,000 per year to afford the median house. Fha construction loans need a minimum credit score of 580. When you use an fha loan to buy a house, it first has to pass an fha appraisal. It’s possible to get an fha loan with a credit score as low as 500, but many lenders. The credit score you'll need to get a home equity loan can vary depending on the lender, but generally speaking, experts say you'll need a score in at least the good or fair. Here is everything you need to rent out your home confidently, efficiently, and with peace of mind.What Credit Score Do You Need to Buy a House?

How to Check Your Credit At Truworths Searche

What Credit Score Do Mortgage Lenders Use? Lexington Law

What credit score do I need to buy a house? ️ 2022

What is a Good Credit Score to Buy a House in 2019 Homes for Heroes

What Credit Score Do I Need To Buy A House? First Time Home Buyer

What Should My Credit Score be to Buy a House? YouTube

How to build a credit history kobo building

Credit Score Needed to Buy a House YouTube

What Credit Score Do You Need To Buy A House? Burlington Real Estate

But, In Practice, You Usually Need At Least A 640 Score.

What Credit Score Do You Need For A Construction Loan?

To Qualify For A Construction Loan, Most Lenders Require A Minimum Credit Score Of 620 Or Higher.

This Official Evaluation Of The Home Determines Two Things:

Related Post: